Giulia Livieri

Statistical Guarantees for Reasoning Probes on Looped Boolean Circuits

Feb 03, 2026Abstract:We study the statistical behaviour of reasoning probes in a stylized model of looped reasoning, given by Boolean circuits whose computational graph is a perfect $ν$-ary tree ($ν\ge 2$) and whose output is appended to the input and fed back iteratively for subsequent computation rounds. A reasoning probe has access to a sampled subset of internal computation nodes, possibly without covering the entire graph, and seeks to infer which $ν$-ary Boolean gate is executed at each queried node, representing uncertainty via a probability distribution over a fixed collection of $\mathtt{m}$ admissible $ν$-ary gates. This partial observability induces a generalization problem, which we analyze in a realizable, transductive setting. We show that, when the reasoning probe is parameterized by a graph convolutional network (GCN)-based hypothesis class and queries $N$ nodes, the worst-case generalization error attains the optimal rate $\mathcal{O}(\sqrt{\log(2/δ)}/\sqrt{N})$ with probability at least $1-δ$, for $δ\in (0,1)$. Our analysis combines snowflake metric embedding techniques with tools from statistical optimal transport. A key insight is that this optimal rate is achievable independently of graph size, owing to the existence of a low-distortion one-dimensional snowflake embedding of the induced graph metric. As a consequence, our results provide a sharp characterization of how structural properties of the computational graph govern the statistical efficiency of reasoning under partial access.

Learning from one graph: transductive learning guarantees via the geometry of small random worlds

Sep 08, 2025Abstract:Since their introduction by Kipf and Welling in $2017$, a primary use of graph convolutional networks is transductive node classification, where missing labels are inferred within a single observed graph and its feature matrix. Despite the widespread use of the network model, the statistical foundations of transductive learning remain limited, as standard inference frameworks typically rely on multiple independent samples rather than a single graph. In this work, we address these gaps by developing new concentration-of-measure tools that leverage the geometric regularities of large graphs via low-dimensional metric embeddings. The emergent regularities are captured using a random graph model; however, the methods remain applicable to deterministic graphs once observed. We establish two principal learning results. The first concerns arbitrary deterministic $k$-vertex graphs, and the second addresses random graphs that share key geometric properties with an Erd\H{o}s-R\'{e}nyi graph $\mathbf{G}=\mathbf{G}(k,p)$ in the regime $p \in \mathcal{O}((\log (k)/k)^{1/2})$. The first result serves as the basis for and illuminates the second. We then extend these results to the graph convolutional network setting, where additional challenges arise. Lastly, our learning guarantees remain informative even with a few labelled nodes $N$ and achieve the optimal nonparametric rate $\mathcal{O}(N^{-1/2})$ as $N$ grows.

Low-dimensional approximations of the conditional law of Volterra processes: a non-positive curvature approach

May 30, 2024Abstract:Predicting the conditional evolution of Volterra processes with stochastic volatility is a crucial challenge in mathematical finance. While deep neural network models offer promise in approximating the conditional law of such processes, their effectiveness is hindered by the curse of dimensionality caused by the infinite dimensionality and non-smooth nature of these problems. To address this, we propose a two-step solution. Firstly, we develop a stable dimension reduction technique, projecting the law of a reasonably broad class of Volterra process onto a low-dimensional statistical manifold of non-positive sectional curvature. Next, we introduce a sequentially deep learning model tailored to the manifold's geometry, which we show can approximate the projected conditional law of the Volterra process. Our model leverages an auxiliary hypernetwork to dynamically update its internal parameters, allowing it to encode non-stationary dynamics of the Volterra process, and it can be interpreted as a gating mechanism in a mixture of expert models where each expert is specialized at a specific point in time. Our hypernetwork further allows us to achieve approximation rates that would seemingly only be possible with very large networks.

Designing Universal Causal Deep Learning Models: The Case of Infinite-Dimensional Dynamical Systems from Stochastic Analysis

Oct 24, 2022

Abstract:Deep learning (DL) is becoming indispensable to contemporary stochastic analysis and finance; nevertheless, it is still unclear how to design a principled DL framework for approximating infinite-dimensional causal operators. This paper proposes a "geometry-aware" solution to this open problem by introducing a DL model-design framework that takes a suitable infinite-dimensional linear metric spaces as inputs and returns a universal sequential DL models adapted to these linear geometries: we call these models Causal Neural Operators (CNO). Our main result states that the models produced by our framework can uniformly approximate on compact sets and across arbitrarily finite-time horizons H\"older or smooth trace class operators which causally map sequences between given linear metric spaces. Consequentially, we deduce that a single CNO can efficiently approximate the solution operator to a broad range of SDEs, thus allowing us to simultaneously approximate predictions from families of SDE models, which is vital to computational robust finance. We deduce that the CNO can approximate the solution operator to most stochastic filtering problems, implying that a single CNO can simultaneously filter a family of partially observed stochastic volatility models.

One-Shot Learning of Stochastic Differential Equations with Computational Graph Completion

Sep 24, 2022

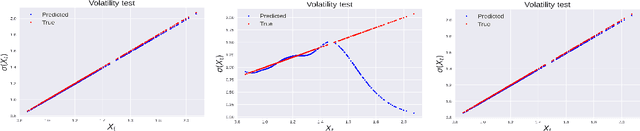

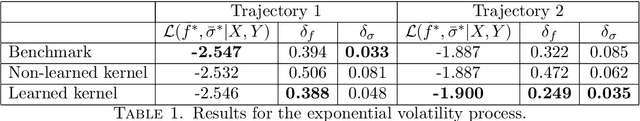

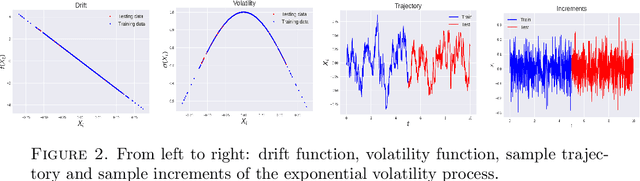

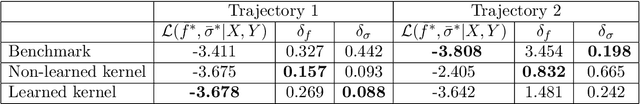

Abstract:We consider the problem of learning Stochastic Differential Equations of the form $dX_t = f(X_t)dt+\sigma(X_t)dW_t $ from one sample trajectory. This problem is more challenging than learning deterministic dynamical systems because one sample trajectory only provides indirect information on the unknown functions $f$, $\sigma$, and stochastic process $dW_t$ representing the drift, the diffusion, and the stochastic forcing terms, respectively. We propose a simple kernel-based solution to this problem that can be decomposed as follows: (1) Represent the time-increment map $X_t \rightarrow X_{t+dt}$ as a Computational Graph in which $f$, $\sigma$ and $dW_t$ appear as unknown functions and random variables. (2) Complete the graph (approximate unknown functions and random variables) via Maximum a Posteriori Estimation (given the data) with Gaussian Process (GP) priors on the unknown functions. (3) Learn the covariance functions (kernels) of the GP priors from data with randomized cross-validation. Numerical experiments illustrate the efficacy, robustness, and scope of our method.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge