Frédéric Oblé

Transfer Learning for Credit Card Fraud Detection: A Journey from Research to Production

Jul 20, 2021

Abstract:The dark face of digital commerce generalization is the increase of fraud attempts. To prevent any type of attacks, state of the art fraud detection systems are now embedding Machine Learning (ML) modules. The conception of such modules is only communicated at the level of research and papers mostly focus on results for isolated benchmark datasets and metrics. But research is only a part of the journey, preceded by the right formulation of the business problem and collection of data, and followed by a practical integration. In this paper, we give a wider vision of the process, on a case study of transfer learning for fraud detection, from business to research, and back to business.

Master your Metrics with Calibration

Sep 06, 2019

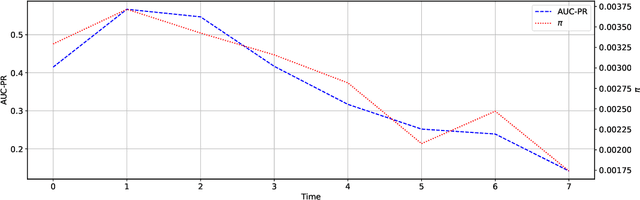

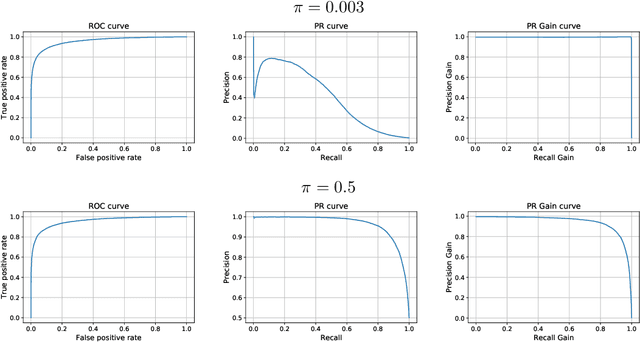

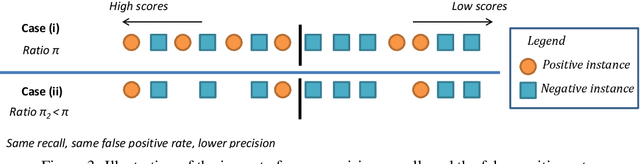

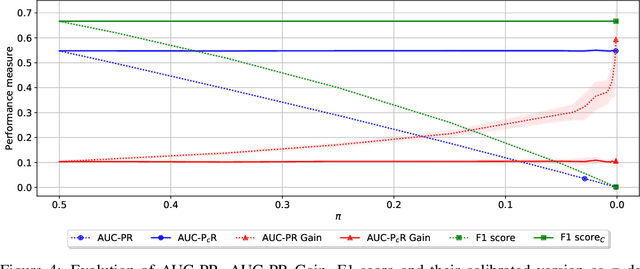

Abstract:Machine learning models deployed in real-world applications are often evaluated with precision-based metrics such as F1-score or AUC-PR (Area Under the Curve of Precision Recall). Heavily dependent on the class prior, such metrics may sometimes lead to wrong conclusions about the performance. For example, when dealing with non-stationary data streams, they do not allow the user to discern the reasons why a model performance varies across different periods. In this paper, we propose a way to calibrate the metrics so that they are no longer tied to the class prior. It corresponds to a readjustment, based on probabilities, to the value that the metric would have if the class prior was equal to a reference prior (user parameter). We conduct a large number of experiments on balanced and imbalanced data to assess the behavior of calibrated metrics and show that they improve interpretability and provide a better control over what is really measured. We describe specific real-world use-cases where calibration is beneficial such as, for instance, model monitoring in production, reporting, or fairness evaluation.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge