Fanglan Zheng

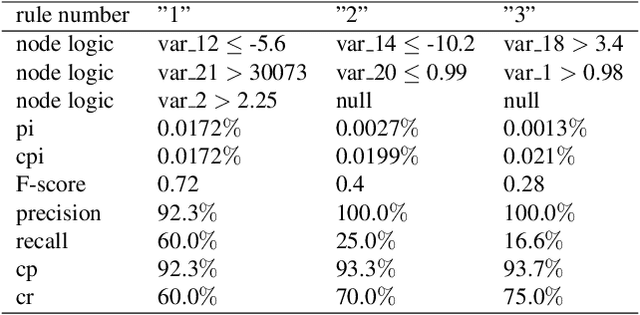

Causal Inference Based Single-branch Ensemble Trees For Uplift Modeling

Feb 03, 2023

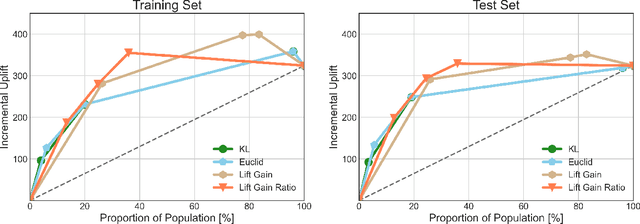

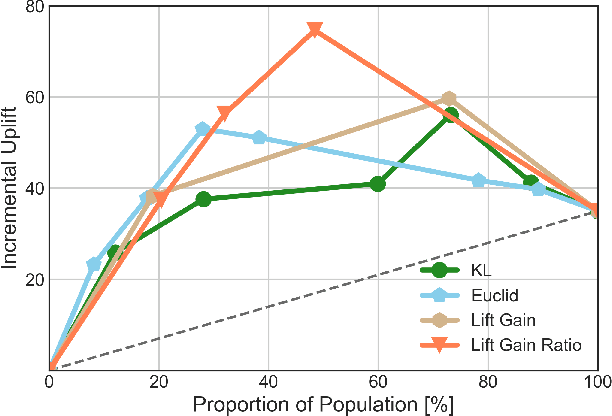

Abstract:In this manuscript (ms), we propose causal inference based single-branch ensemble trees for uplift modeling, namely CIET. Different from standard classification methods for predictive probability modeling, CIET aims to achieve the change in the predictive probability of outcome caused by an action or a treatment. According to our CIET, two partition criteria are specifically designed to maximize the difference in outcome distribution between the treatment and control groups. Next, a novel single-branch tree is built by taking a top-down node partition approach, and the remaining samples are censored since they are not covered by the upper node partition logic. Repeating the tree-building process on the censored data, single-branch ensemble trees with a set of inference rules are thus formed. Moreover, CIET is experimentally demonstrated to outperform previous approaches for uplift modeling in terms of both area under uplift curve (AUUC) and Qini coefficient significantly. At present, CIET has already been applied to online personal loans in a national financial holdings group in China. CIET will also be of use to analysts applying machine learning techniques to causal inference in broader business domains such as web advertising, medicine and economics.

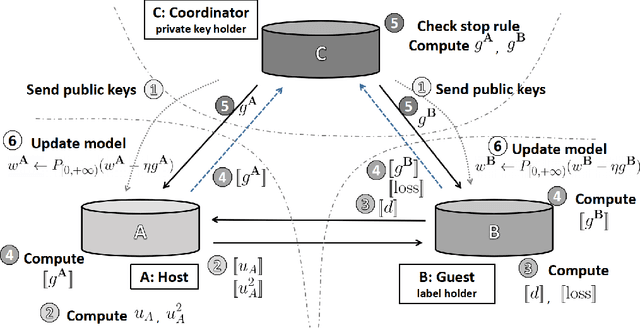

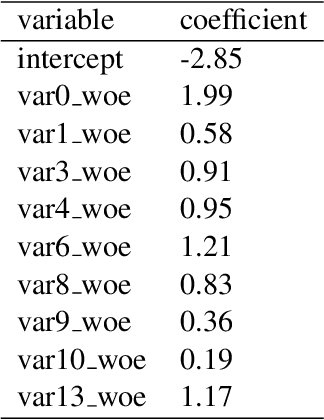

A Vertical Federated Learning Method for Interpretable Scorecard and Its Application in Credit Scoring

Sep 14, 2020

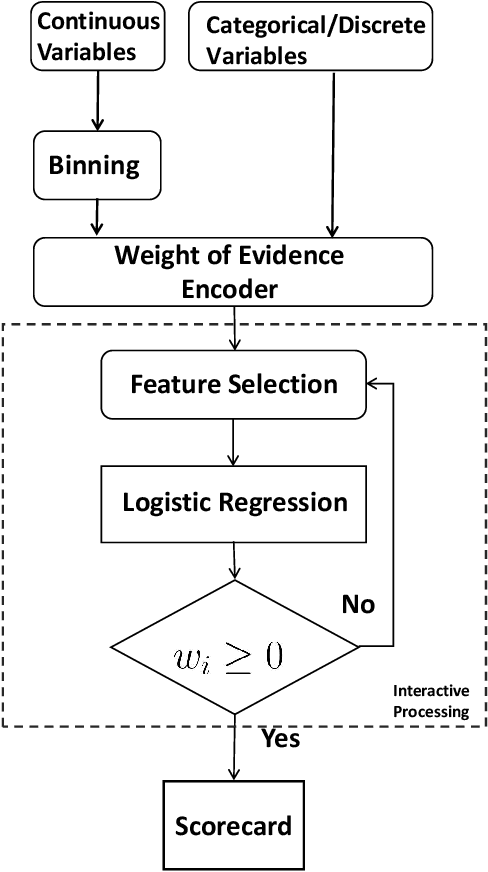

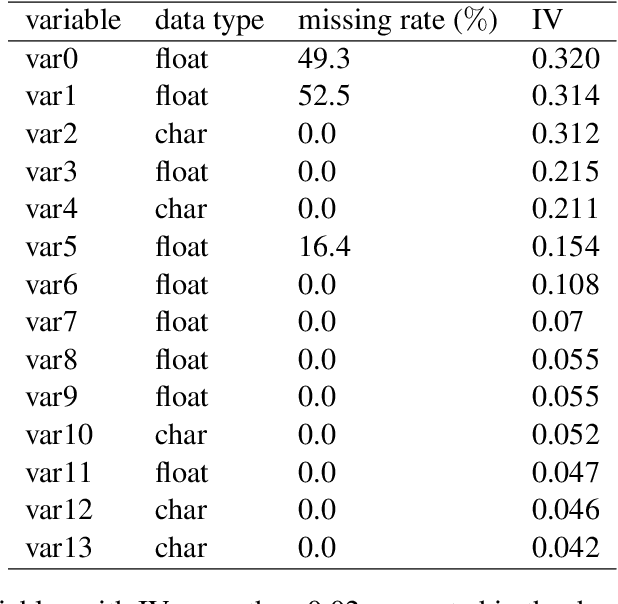

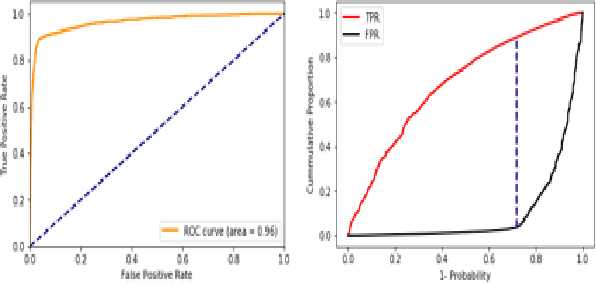

Abstract:With the success of big data and artificial intelligence in many fields, the applications of big data driven models are expected in financial risk management especially credit scoring and rating. Under the premise of data privacy protection, we propose a projected gradient-based method in the vertical federated learning framework for the traditional scorecard, which is based on logistic regression with bounded constraints, namely FL-LRBC. The latter enables multiple agencies to jointly train an optimized scorecard model in a single training session. It leads to the formation of the model with positive coefficients, while the time-consuming parameter-tuning process can be avoided. Moreover, the performance in terms of both AUC and the Kolmogorov-Smirnov (KS) statistics is significantly improved due to data enrichment using FL-LRBC. At present, FL-LRBC has already been applied to credit business in a China nation-wide financial holdings group.

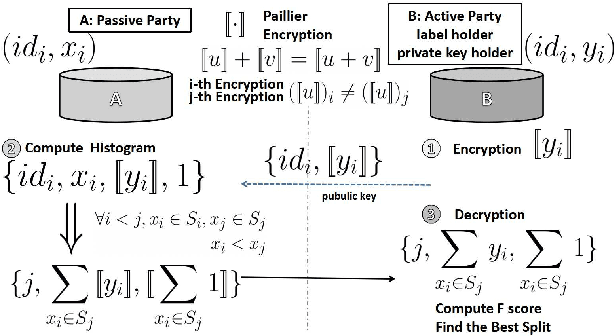

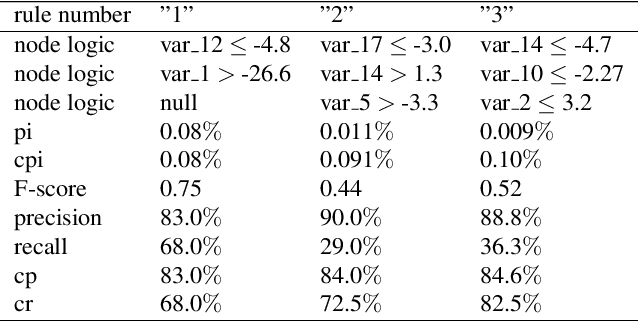

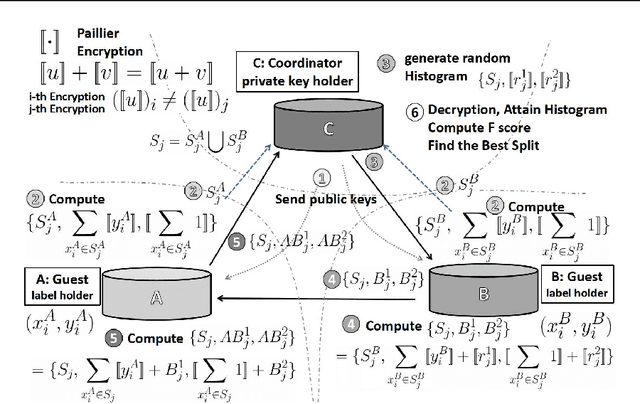

A Federated F-score Based Ensemble Model for Automatic Rule Extraction

Jul 17, 2020

Abstract:In this manuscript, we propose a federated F-score based ensemble tree model for automatic rule extraction, namely Fed-FEARE. Under the premise of data privacy protection, Fed-FEARE enables multiple agencies to jointly extract set of rules both vertically and horizontally. Compared with that without federated learning, measures in evaluating model performance are highly improved. At present, Fed-FEARE has already been applied to multiple business, including anti-fraud and precision marketing, in a China nation-wide financial holdings group.

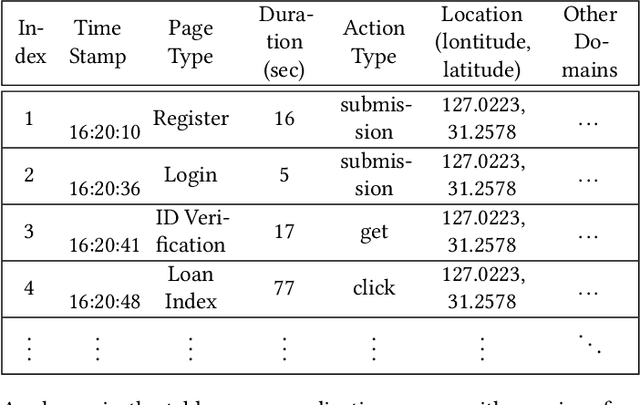

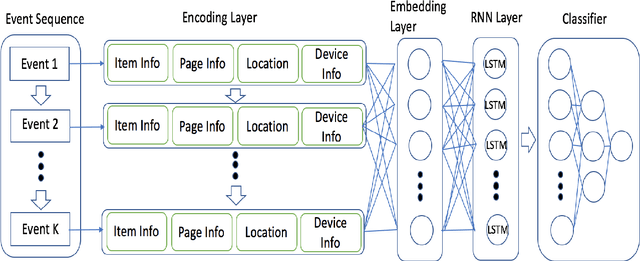

Sequential Behavioral Data Processing Using Deep Learning and the Markov Transition Field in Online Fraud Detection

Aug 16, 2018

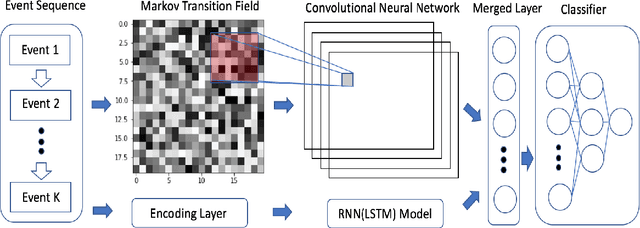

Abstract:Due to the popularity of the Internet and smart mobile devices, more and more financial transactions and activities have been digitalized. Compared to traditional financial fraud detection strategies using credit-related features, customers are generating a large amount of unstructured behavioral data every second. In this paper, we propose an Recurrent Neural Netword (RNN) based deep-learning structure integrated with Markov Transition Field (MTF) for predicting online fraud behaviors using customer's interactions with websites or smart-phone apps as a series of states. In practice, we tested and proved that the proposed network structure for processing sequential behavioral data could significantly boost fraud predictive ability comparing with the multilayer perceptron network and distance based classifier with Dynamic Time Warping(DTW) as distance metric.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge