Enrico Gerding

Mechanism Design for Efficient Online and Offline Allocation of Electric Vehicles to Charging Stations

Jul 19, 2020

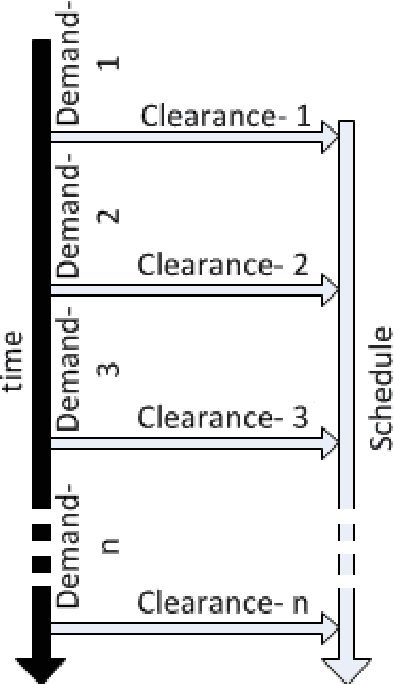

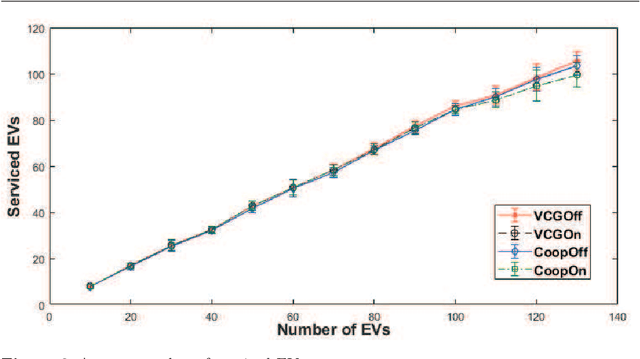

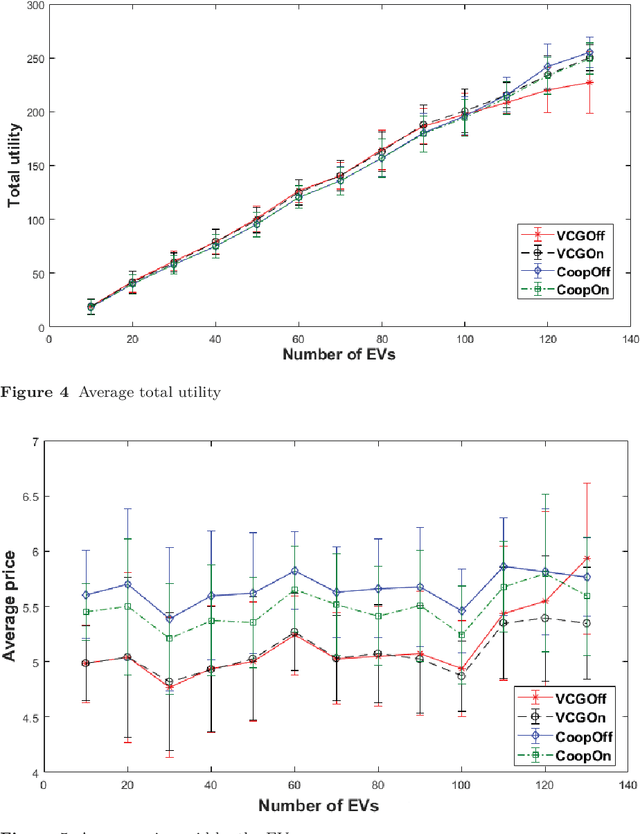

Abstract:We study the problem of allocating Electric Vehicles (EVs) to charging stations and scheduling their charging. We develop offline and online solutions that treat EV users as self-interested agents that aim to maximise their profit and minimise the impact on their schedule. We formulate the problem of the optimal EV to charging station allocation as a Mixed Integer Programming (MIP) one and we propose two pricing mechanisms: A fixed-price one, and another that is based on the well known Vickrey-Clark-Groves (VCG) mechanism. Later, we develop online solutions that incrementally call the MIP-based algorithm. We empirically evaluate our mechanisms and we observe that both scale well. Moreover, the VCG mechanism services on average $1.5\%$ more EVs than the fixed-price one. In addition, when the stations get congested, VCG leads to higher prices for the EVs and higher profit for the stations, but lower utility for the EVs. However, we theoretically prove that the VCG mechanism guarantees truthful reporting of the EVs' preferences. In contrast, the fixed-price one is vulnerable to agents' strategic behaviour as non-truthful EVs can charge in place of truthful ones. Finally, we observe that the online algorithms are on average at $98\%$ of the optimal in EV satisfaction.

Long short-term memory networks and laglasso for bond yield forecasting: Peeping inside the black box

May 05, 2020

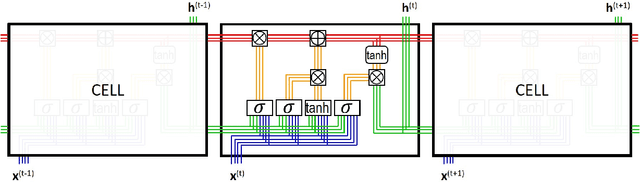

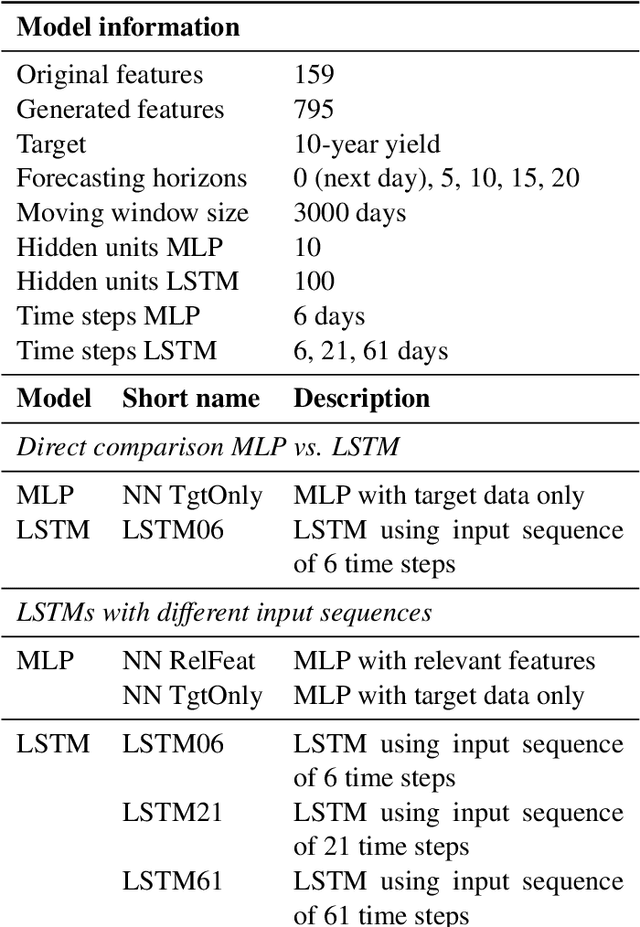

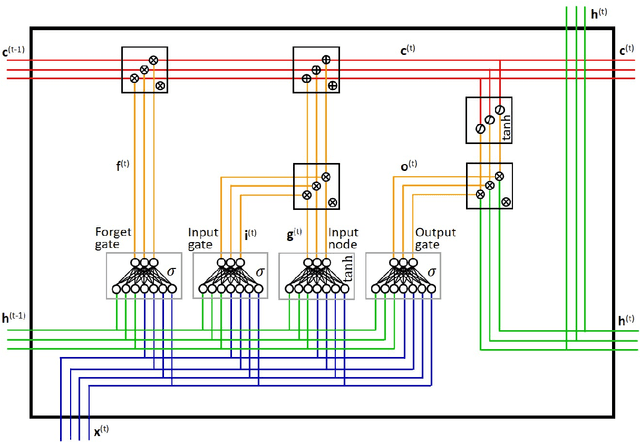

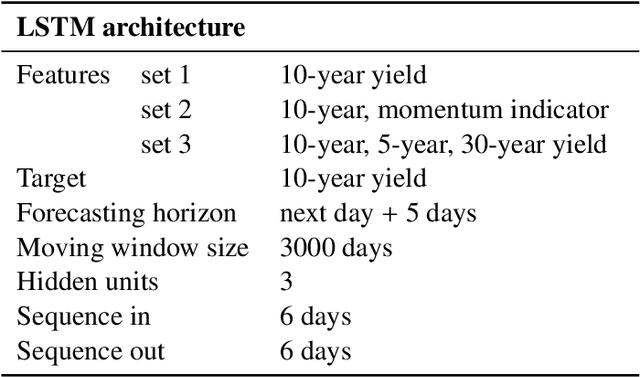

Abstract:Modern decision-making in fixed income asset management benefits from intelligent systems, which involve the use of state-of-the-art machine learning models and appropriate methodologies. We conduct the first study of bond yield forecasting using long short-term memory (LSTM) networks, validating its potential and identifying its memory advantage. Specifically, we model the 10-year bond yield using univariate LSTMs with three input sequences and five forecasting horizons. We compare those with multilayer perceptrons (MLP), univariate and with the most relevant features. To demystify the notion of black box associated with LSTMs, we conduct the first internal study of the model. To this end, we calculate the LSTM signals through time, at selected locations in the memory cell, using sequence-to-sequence architectures, uni and multivariate. We then proceed to explain the states' signals using exogenous information, for what we develop the LSTM-LagLasso methodology. The results show that the univariate LSTM model with additional memory is capable of achieving similar results as the multivariate MLP using macroeconomic and market information. Furthermore, shorter forecasting horizons require smaller input sequences and vice-versa. The most remarkable property found consistently in the LSTM signals, is the activation/deactivation of units through time, and the specialisation of units by yield range or feature. Those signals are complex but can be explained by exogenous variables. Additionally, some of the relevant features identified via LSTM-LagLasso are not commonly used in forecasting models. In conclusion, our work validates the potential of LSTMs and methodologies for bonds, providing additional tools for financial practitioners.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge