Daniel Poh

Transfer Ranking in Finance: Applications to Cross-Sectional Momentum with Data Scarcity

Aug 24, 2022

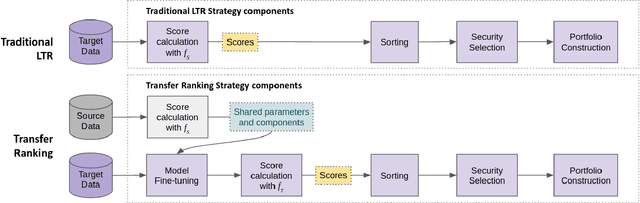

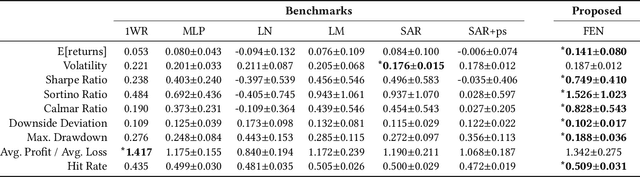

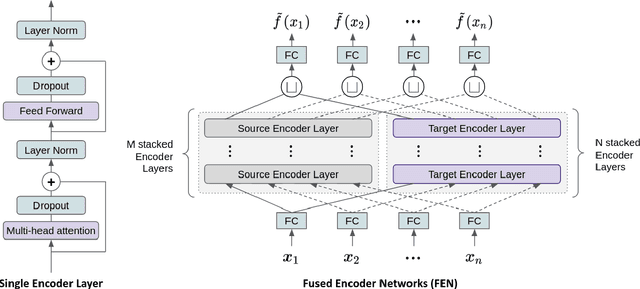

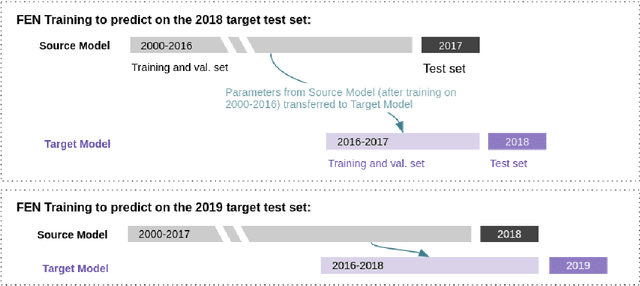

Abstract:Cross-sectional strategies are a classical and popular trading style, with recent high performing variants incorporating sophisticated neural architectures. While these strategies have been applied successfully to data-rich settings involving mature assets with long histories, deploying them on instruments with limited samples generally produce over-fitted models with degraded performance. In this paper, we introduce Fused Encoder Networks -- a novel and hybrid parameter-sharing transfer ranking model. The model fuses information extracted using an encoder-attention module operated on a source dataset with a similar but separate module focused on a smaller target dataset of interest. This mitigates the issue of models with poor generalisability that are a consequence of training on scarce target data. Additionally, the self-attention mechanism enables interactions among instruments to be accounted for, not just at the loss level during model training, but also at inference time. Focusing on momentum applied to the top ten cryptocurrencies by market capitalisation as a demonstrative use-case, the Fused Encoder Networks outperforms the reference benchmarks on most performance measures, delivering a three-fold boost in the Sharpe ratio over classical momentum as well as an improvement of approximately 50% against the best benchmark model without transaction costs. It continues outperforming baselines even after accounting for the high transaction costs associated with trading cryptocurrencies.

Enhancing Cross-Sectional Currency Strategies by Ranking Refinement with Transformer-based Architectures

May 20, 2021

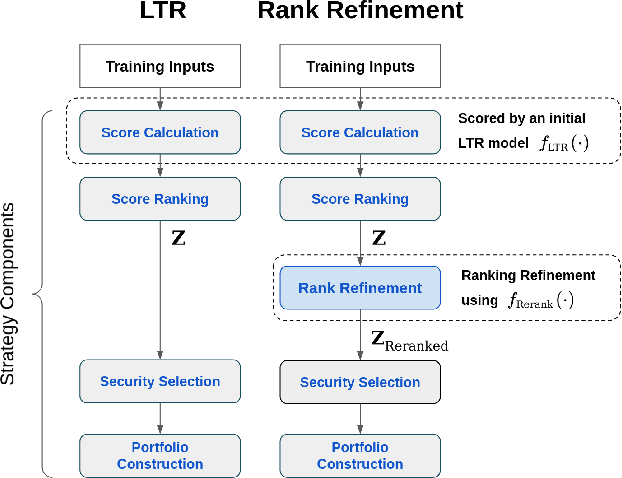

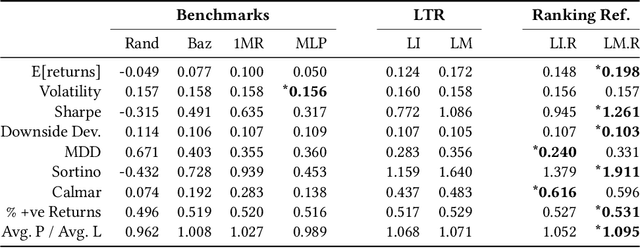

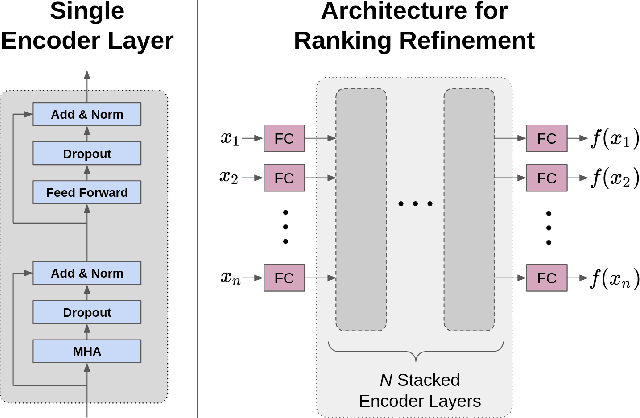

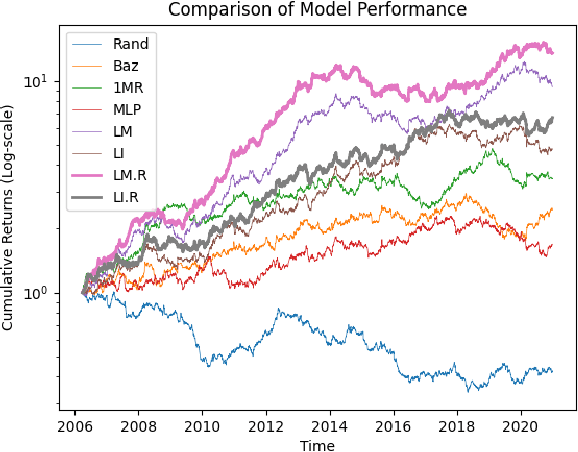

Abstract:The performance of a cross-sectional currency strategy depends crucially on accurately ranking instruments prior to portfolio construction. While this ranking step is traditionally performed using heuristics, or by sorting outputs produced by pointwise regression or classification models, Learning to Rank algorithms have recently presented themselves as competitive and viable alternatives. Despite improving ranking accuracy on average however, these techniques do not account for the possibility that assets positioned at the extreme ends of the ranked list -- which are ultimately used to construct the long/short portfolios -- can assume different distributions in the input space, and thus lead to sub-optimal strategy performance. Drawing from research in Information Retrieval that demonstrates the utility of contextual information embedded within top-ranked documents to learn the query's characteristics to improve ranking, we propose an analogous approach: exploiting the features of both out- and under-performing instruments to learn a model for refining the original ranked list. Under a re-ranking framework, we adapt the Transformer architecture to encode the features of extreme assets for refining our selection of long/short instruments obtained with an initial retrieval. Backtesting on a set of 31 currencies, our proposed methodology significantly boosts Sharpe ratios -- by approximately 20% over the original LTR algorithms and double that of traditional baselines.

Building Cross-Sectional Systematic Strategies By Learning to Rank

Dec 13, 2020Abstract:The success of a cross-sectional systematic strategy depends critically on accurately ranking assets prior to portfolio construction. Contemporary techniques perform this ranking step either with simple heuristics or by sorting outputs from standard regression or classification models, which have been demonstrated to be sub-optimal for ranking in other domains (e.g. information retrieval). To address this deficiency, we propose a framework to enhance cross-sectional portfolios by incorporating learning-to-rank algorithms, which lead to improvements of ranking accuracy by learning pairwise and listwise structures across instruments. Using cross-sectional momentum as a demonstrative case study, we show that the use of modern machine learning ranking algorithms can substantially improve the trading performance of cross-sectional strategies -- providing approximately threefold boosting of Sharpe Ratios compared to traditional approaches.

A Machine Learning approach to Risk Minimisation in Electricity Markets with Coregionalized Sparse Gaussian Processes

Apr 03, 2019

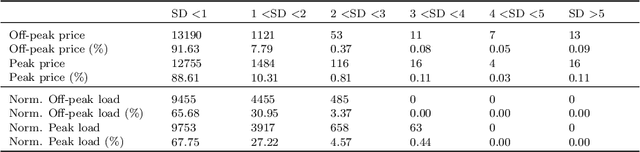

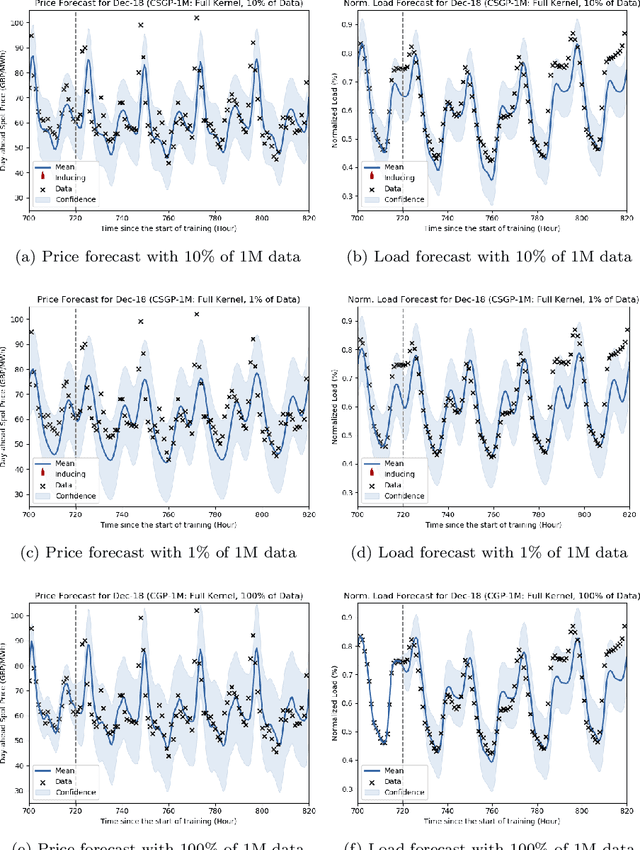

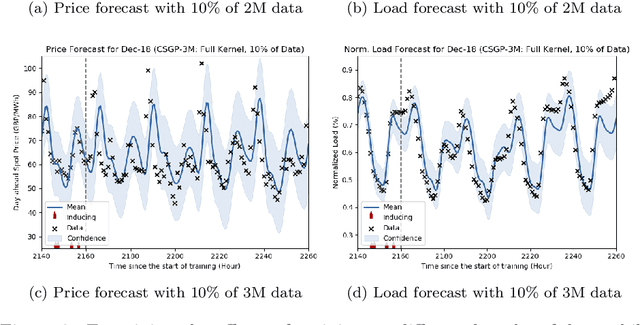

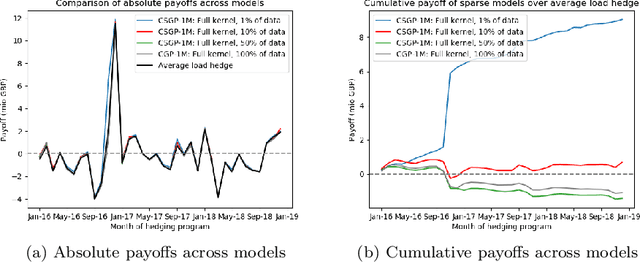

Abstract:The non-storability of electricity makes it unique among commodity assets, and it is an important driver of its price behaviour in secondary financial markets. The instantaneous and continuous matching of power supply with demand is a key factor explaining its volatility. During periods of high demand, costlier generation capabilities are utilised since electricity cannot be stored and this has the impact of driving prices up very quickly. Furthermore, the non-storability also complicates physical hedging. Owing to these, the problem of joint price-quantity risk in electricity markets is a commonly studied theme. We propose using Gaussian Processes (GPs) to tackle this problem since GPs provide a versatile and elegant non-parametric approach for regression and time-series modelling. However, GPs scale poorly with the amount of training data due to a cubic complexity. These considerations suggest that knowledge transfer between price and load is vital for effective hedging, and that a computationally efficient method is required. To this end, we use the coregionalized (or multi-task) sparse GPs which addresses the aforementioned issues. To gauge the performance of our model, we use an average-load strategy as comparator. The latter is a robust approach commonly used by industry. If the spot and load are uncorrelated and Gaussian, then hedging with the expected load will result in the minimum variance position. Our main contributions are twofold. Firstly, in developing a coregionalized sparse GP-based approach for hedging. Secondly, in demonstrating that our model-based strategy outperforms the comparator, and can thus be employed for effective hedging in electricity markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge