Enhancing Cross-Sectional Currency Strategies by Ranking Refinement with Transformer-based Architectures

Paper and Code

May 20, 2021

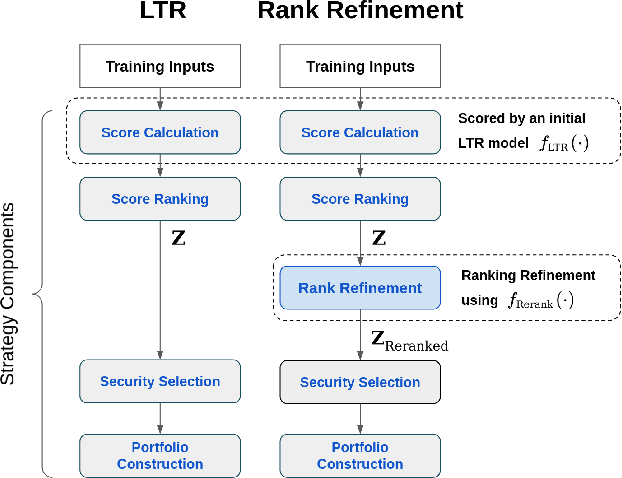

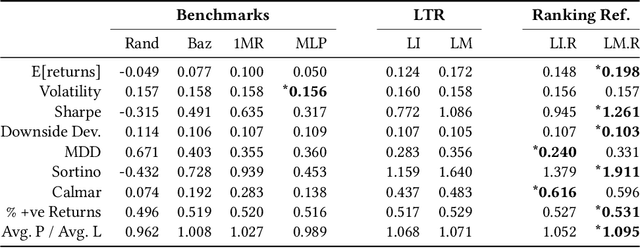

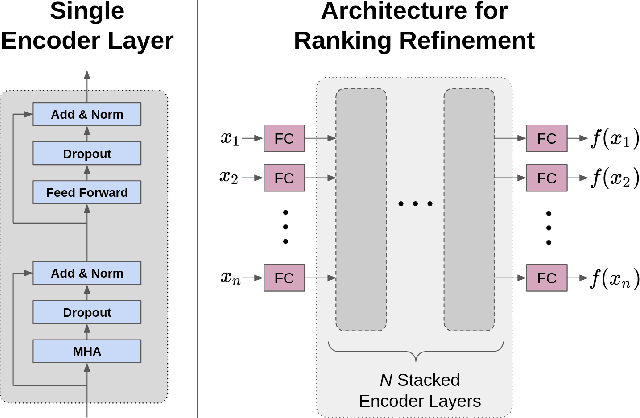

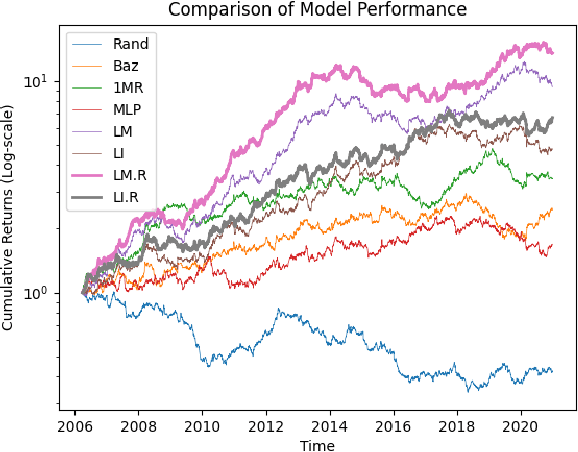

The performance of a cross-sectional currency strategy depends crucially on accurately ranking instruments prior to portfolio construction. While this ranking step is traditionally performed using heuristics, or by sorting outputs produced by pointwise regression or classification models, Learning to Rank algorithms have recently presented themselves as competitive and viable alternatives. Despite improving ranking accuracy on average however, these techniques do not account for the possibility that assets positioned at the extreme ends of the ranked list -- which are ultimately used to construct the long/short portfolios -- can assume different distributions in the input space, and thus lead to sub-optimal strategy performance. Drawing from research in Information Retrieval that demonstrates the utility of contextual information embedded within top-ranked documents to learn the query's characteristics to improve ranking, we propose an analogous approach: exploiting the features of both out- and under-performing instruments to learn a model for refining the original ranked list. Under a re-ranking framework, we adapt the Transformer architecture to encode the features of extreme assets for refining our selection of long/short instruments obtained with an initial retrieval. Backtesting on a set of 31 currencies, our proposed methodology significantly boosts Sharpe ratios -- by approximately 20% over the original LTR algorithms and double that of traditional baselines.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge