Baptiste Barreau

Rolling Forward: Enhancing LightGCN with Causal Graph Convolution for Credit Bond Recommendation

Mar 18, 2025

Abstract:Graph Neural Networks have significantly advanced research in recommender systems over the past few years. These methods typically capture global interests using aggregated past interactions and rely on static embeddings of users and items over extended periods of time. While effective in some domains, these methods fall short in many real-world scenarios, especially in finance, where user interests and item popularity evolve rapidly over time. To address these challenges, we introduce a novel extension to Light Graph Convolutional Network (LightGCN) designed to learn temporal node embeddings that capture dynamic interests. Our approach employs causal convolution to maintain a forward-looking model architecture. By preserving the chronological order of user-item interactions and introducing a dynamic update mechanism for embeddings through a sliding window, the proposed model generates well-timed and contextually relevant recommendations. Extensive experiments on a real-world dataset from BNP Paribas demonstrate that our approach significantly enhances the performance of LightGCN while maintaining the simplicity and efficiency of its architecture. Our findings provide new insights into designing graph-based recommender systems in time-sensitive applications, particularly for financial product recommendations.

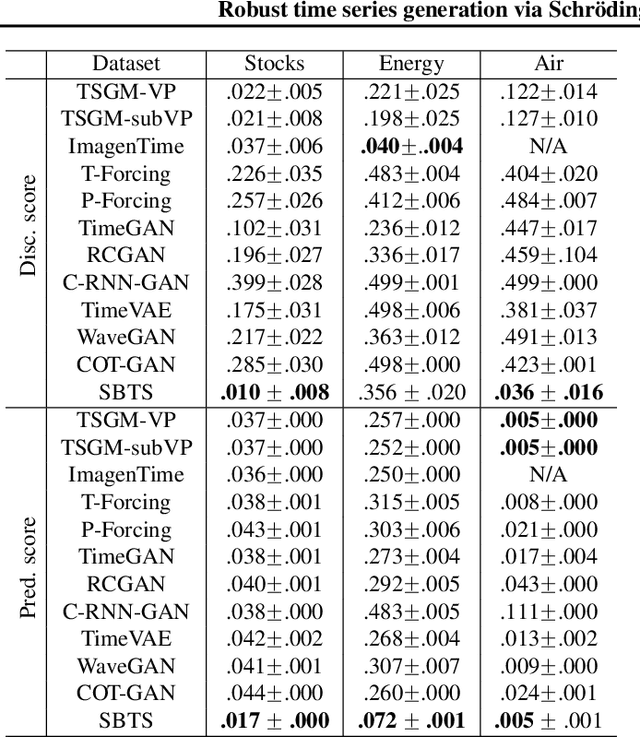

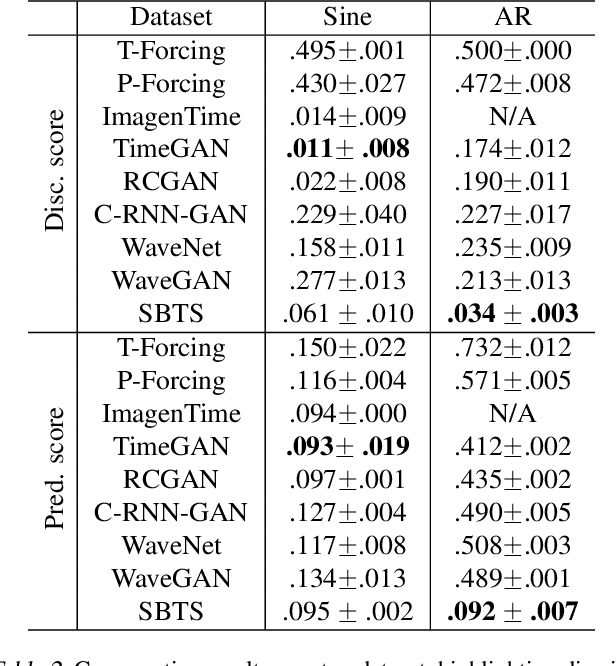

Robust time series generation via Schrödinger Bridge: a comprehensive evaluation

Mar 04, 2025

Abstract:We investigate the generative capabilities of the Schr\"odinger Bridge (SB) approach for time series. The SB framework formulates time series synthesis as an entropic optimal interpolation transport problem between a reference probability measure on path space and a target joint distribution. This results in a stochastic differential equation over a finite horizon that accurately captures the temporal dynamics of the target time series. While the SB approach has been largely explored in fields like image generation, there is a scarcity of studies for its application to time series. In this work, we bridge this gap by conducting a comprehensive evaluation of the SB method's robustness and generative performance. We benchmark it against state-of-the-art (SOTA) time series generation methods across diverse datasets, assessing its strengths, limitations, and capacity to model complex temporal dependencies. Our results offer valuable insights into the SB framework's potential as a versatile and robust tool for time series generation.

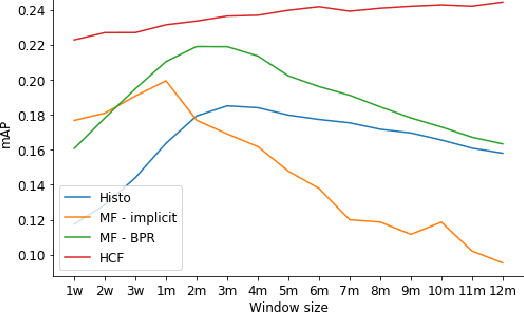

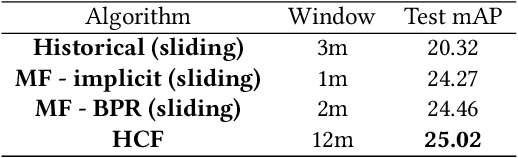

Adaptive Collaborative Filtering with Personalized Time Decay Functions for Financial Product Recommendation

Aug 01, 2023Abstract:Classical recommender systems often assume that historical data are stationary and fail to account for the dynamic nature of user preferences, limiting their ability to provide reliable recommendations in time-sensitive settings. This assumption is particularly problematic in finance, where financial products exhibit continuous changes in valuations, leading to frequent shifts in client interests. These evolving interests, summarized in the past client-product interactions, see their utility fade over time with a degree that might differ from one client to another. To address this challenge, we propose a time-dependent collaborative filtering algorithm that can adaptively discount distant client-product interactions using personalized decay functions. Our approach is designed to handle the non-stationarity of financial data and produce reliable recommendations by modeling the dynamic collaborative signals between clients and products. We evaluate our method using a proprietary dataset from BNP Paribas and demonstrate significant improvements over state-of-the-art benchmarks from relevant literature. Our findings emphasize the importance of incorporating time explicitly in the model to enhance the accuracy of financial product recommendation.

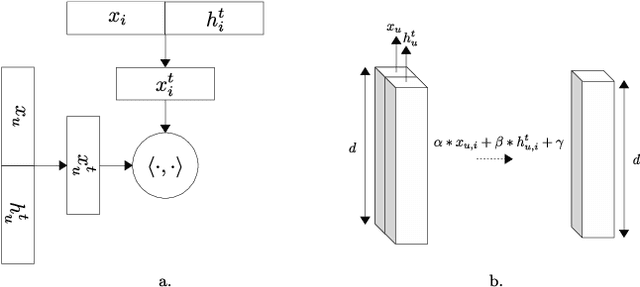

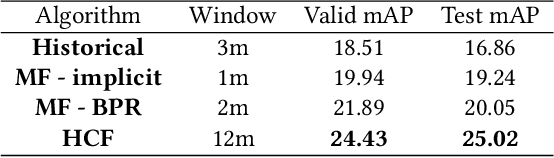

History-Augmented Collaborative Filtering for Financial Recommendations

Feb 26, 2021

Abstract:In many businesses, and particularly in finance, the behavior of a client might drastically change over time. It is consequently crucial for recommender systems used in such environments to be able to adapt to these changes. In this study, we propose a novel collaborative filtering algorithm that captures the temporal context of a user-item interaction through the users' and items' recent interaction histories to provide dynamic recommendations. The algorithm, designed with issues specific to the financial world in mind, uses a custom neural network architecture that tackles the non-stationarity of users' and items' behaviors. The performance and properties of the algorithm are monitored in a series of experiments on a G10 bond request for quotation proprietary database from BNP Paribas Corporate and Institutional Banking.

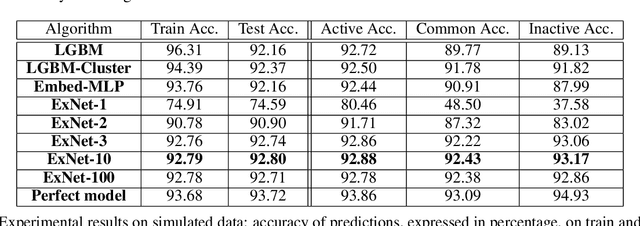

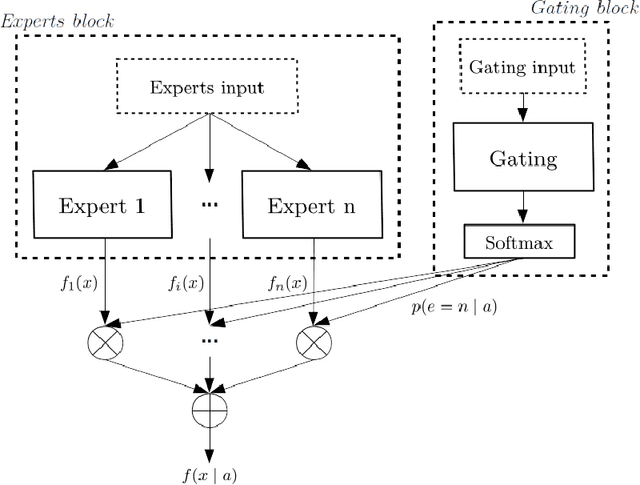

Deep Prediction of Investor Interest: a Supervised Clustering Approach

Sep 11, 2019

Abstract:We propose a novel deep learning architecture suitable for the prediction of investor interest for a given asset in a given timeframe. This architecture performs both investor clustering and modelling at the same time. We first verify its superior performance on a simulated scenario inspired by real data and then apply it to a large proprietary database from BNP Paribas Corporate and Institutional Banking.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge