History-Augmented Collaborative Filtering for Financial Recommendations

Paper and Code

Feb 26, 2021

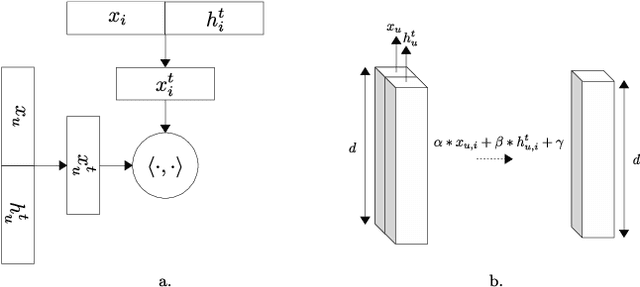

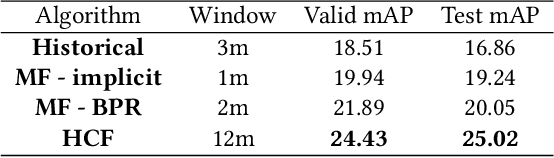

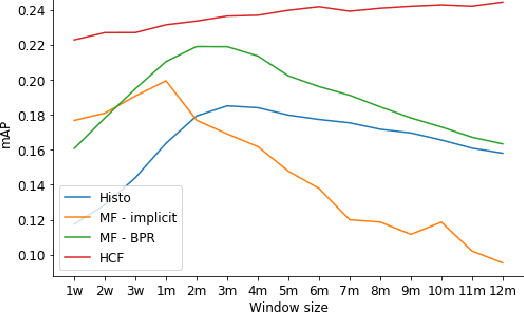

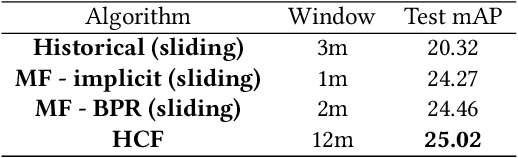

In many businesses, and particularly in finance, the behavior of a client might drastically change over time. It is consequently crucial for recommender systems used in such environments to be able to adapt to these changes. In this study, we propose a novel collaborative filtering algorithm that captures the temporal context of a user-item interaction through the users' and items' recent interaction histories to provide dynamic recommendations. The algorithm, designed with issues specific to the financial world in mind, uses a custom neural network architecture that tackles the non-stationarity of users' and items' behaviors. The performance and properties of the algorithm are monitored in a series of experiments on a G10 bond request for quotation proprietary database from BNP Paribas Corporate and Institutional Banking.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge