Axel Brando

CID: Measuring Feature Importance Through Counterfactual Distributions

Nov 19, 2025Abstract:Assessing the importance of individual features in Machine Learning is critical to understand the model's decision-making process. While numerous methods exist, the lack of a definitive ground truth for comparison highlights the need for alternative, well-founded measures. This paper introduces a novel post-hoc local feature importance method called Counterfactual Importance Distribution (CID). We generate two sets of positive and negative counterfactuals, model their distributions using Kernel Density Estimation, and rank features based on a distributional dissimilarity measure. This measure, grounded in a rigorous mathematical framework, satisfies key properties required to function as a valid metric. We showcase the effectiveness of our method by comparing with well-established local feature importance explainers. Our method not only offers complementary perspectives to existing approaches, but also improves performance on faithfulness metrics (both for comprehensiveness and sufficiency), resulting in more faithful explanations of the system. These results highlight its potential as a valuable tool for model analysis.

Seeing the Unseen: How EMoE Unveils Bias in Text-to-Image Diffusion Models

May 19, 2025Abstract:Estimating uncertainty in text-to-image diffusion models is challenging because of their large parameter counts (often exceeding 100 million) and operation in complex, high-dimensional spaces with virtually infinite input possibilities. In this paper, we propose Epistemic Mixture of Experts (EMoE), a novel framework for efficiently estimating epistemic uncertainty in diffusion models. EMoE leverages pre-trained networks without requiring additional training, enabling direct uncertainty estimation from a prompt. We leverage a latent space within the diffusion process that captures epistemic uncertainty better than existing methods. Experimental results on the COCO dataset demonstrate EMoE's effectiveness, showing a strong correlation between uncertainty and image quality. Additionally, EMoE identifies under-sampled languages and regions with higher uncertainty, revealing hidden biases in the training set. This capability demonstrates the relevance of EMoE as a tool for addressing fairness and accountability in AI-generated content.

Object detection in adverse weather conditions for autonomous vehicles using Instruct Pix2Pix

May 13, 2025Abstract:Enhancing the robustness of object detection systems under adverse weather conditions is crucial for the advancement of autonomous driving technology. This study presents a novel approach leveraging the diffusion model Instruct Pix2Pix to develop prompting methodologies that generate realistic datasets with weather-based augmentations aiming to mitigate the impact of adverse weather on the perception capabilities of state-of-the-art object detection models, including Faster R-CNN and YOLOv10. Experiments were conducted in two environments, in the CARLA simulator where an initial evaluation of the proposed data augmentation was provided, and then on the real-world image data sets BDD100K and ACDC demonstrating the effectiveness of the approach in real environments. The key contributions of this work are twofold: (1) identifying and quantifying the performance gap in object detection models under challenging weather conditions, and (2) demonstrating how tailored data augmentation strategies can significantly enhance the robustness of these models. This research establishes a solid foundation for improving the reliability of perception systems in demanding environmental scenarios, and provides a pathway for future advancements in autonomous driving.

* 8 pages, 5 figures. Accepted at the International Joint Conference on Neural Networks (IJCNN) 2025 (to appear)

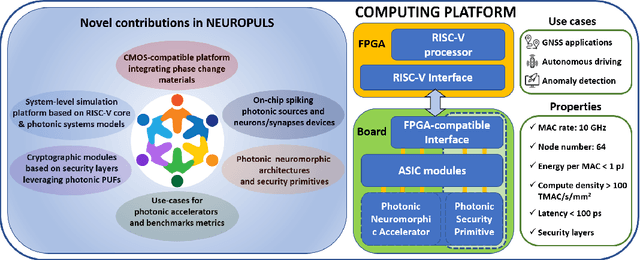

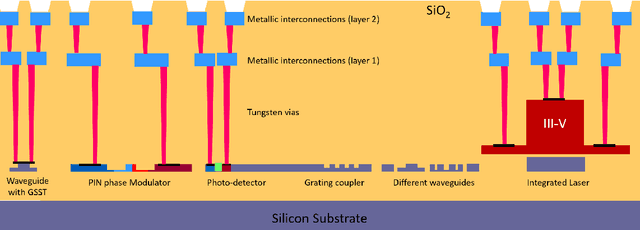

NEUROPULS: NEUROmorphic energy-efficient secure accelerators based on Phase change materials aUgmented siLicon photonicS

May 04, 2023

Abstract:This special session paper introduces the Horizon Europe NEUROPULS project, which targets the development of secure and energy-efficient RISC-V interfaced neuromorphic accelerators using augmented silicon photonics technology. Our approach aims to develop an augmented silicon photonics platform, an FPGA-powered RISC-V-connected computing platform, and a complete simulation platform to demonstrate the neuromorphic accelerator capabilities. In particular, their main advantages and limitations will be addressed concerning the underpinning technology for each platform. Then, we will discuss three targeted use cases for edge-computing applications: Global National Satellite System (GNSS) anti-jamming, autonomous driving, and anomaly detection in edge devices. Finally, we will address the reliability and security aspects of the stand-alone accelerator implementation and the project use cases.

Retrospective Uncertainties for Deep Models using Vine Copulas

Feb 24, 2023Abstract:Despite the major progress of deep models as learning machines, uncertainty estimation remains a major challenge. Existing solutions rely on modified loss functions or architectural changes. We propose to compensate for the lack of built-in uncertainty estimates by supplementing any network, retrospectively, with a subsequent vine copula model, in an overall compound we call Vine-Copula Neural Network (VCNN). Through synthetic and real-data experiments, we show that VCNNs could be task (regression/classification) and architecture (recurrent, fully connected) agnostic while providing reliable and better-calibrated uncertainty estimates, comparable to state-of-the-art built-in uncertainty solutions.

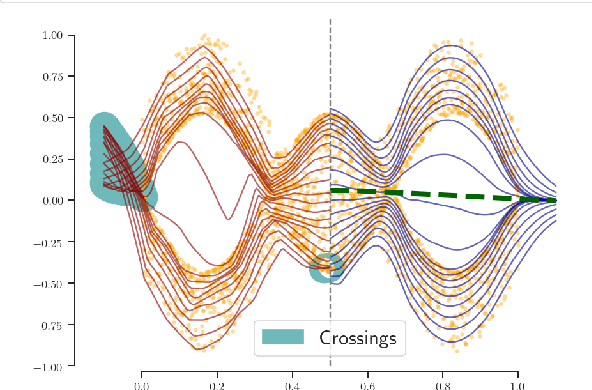

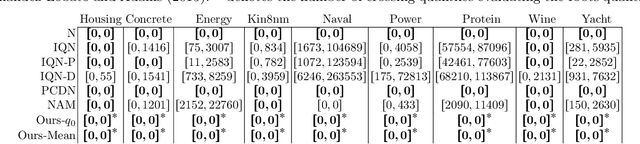

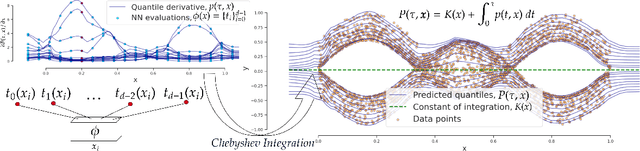

Deep Non-Crossing Quantiles through the Partial Derivative

Jan 30, 2022

Abstract:Quantile Regression (QR) provides a way to approximate a single conditional quantile. To have a more informative description of the conditional distribution, QR can be merged with deep learning techniques to simultaneously estimate multiple quantiles. However, the minimisation of the QR-loss function does not guarantee non-crossing quantiles, which affects the validity of such predictions and introduces a critical issue in certain scenarios. In this article, we propose a generic deep learning algorithm for predicting an arbitrary number of quantiles that ensures the quantile monotonicity constraint up to the machine precision and maintains its modelling performance with respect to alternative models. The presented method is evaluated over several real-world datasets obtaining state-of-the-art results as well as showing that it scales to large-size data sets.

Modelling heterogeneous distributions with an Uncountable Mixture of Asymmetric Laplacians

Oct 29, 2019

Abstract:In regression tasks, aleatoric uncertainty is commonly addressed by considering a parametric distribution of the output variable, which is based on strong assumptions such as symmetry, unimodality or by supposing a restricted shape. These assumptions are too limited in scenarios where complex shapes, strong skews or multiple modes are present. In this paper, we propose a generic deep learning framework that learns an Uncountable Mixture of Asymmetric Laplacians (UMAL), which will allow us to estimate heterogeneous distributions of the output variable and shows its connections to quantile regression. Despite having a fixed number of parameters, the model can be interpreted as an infinite mixture of components, which yields a flexible approximation for heterogeneous distributions. Apart from synthetic cases, we apply this model to room price forecasting and to predict financial operations in personal bank accounts. We demonstrate that UMAL produces proper distributions, which allows us to extract richer insights and to sharpen decision-making.

Uncertainty Modelling in Deep Networks: Forecasting Short and Noisy Series

Jul 24, 2018

Abstract:Deep Learning is a consolidated, state-of-the-art Machine Learning tool to fit a function when provided with large data sets of examples. However, in regression tasks, the straightforward application of Deep Learning models provides a point estimate of the target. In addition, the model does not take into account the uncertainty of a prediction. This represents a great limitation for tasks where communicating an erroneous prediction carries a risk. In this paper we tackle a real-world problem of forecasting impending financial expenses and incomings of customers, while displaying predictable monetary amounts on a mobile app. In this context, we investigate if we would obtain an advantage by applying Deep Learning models with a Heteroscedastic model of the variance of a network's output. Experimentally, we achieve a higher accuracy than non-trivial baselines. More importantly, we introduce a mechanism to discard low-confidence predictions, which means that they will not be visible to users. This should help enhance the user experience of our product.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge