Jose A. Rodríguez-Serrano

Deep Non-Crossing Quantiles through the Partial Derivative

Jan 30, 2022

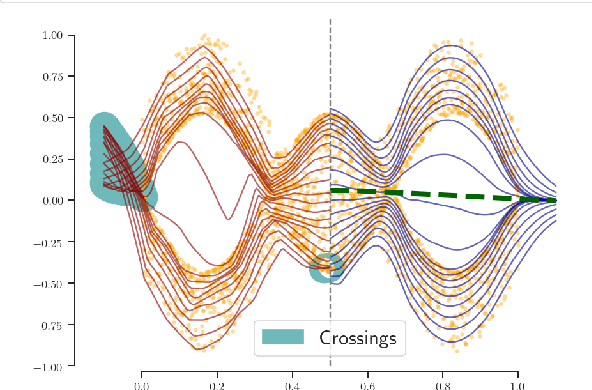

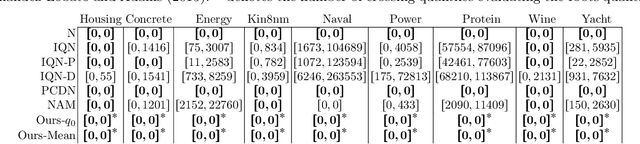

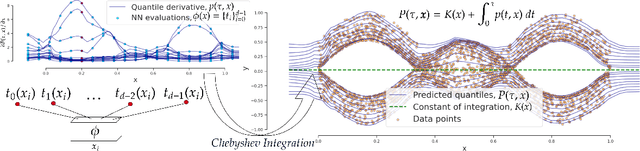

Abstract:Quantile Regression (QR) provides a way to approximate a single conditional quantile. To have a more informative description of the conditional distribution, QR can be merged with deep learning techniques to simultaneously estimate multiple quantiles. However, the minimisation of the QR-loss function does not guarantee non-crossing quantiles, which affects the validity of such predictions and introduces a critical issue in certain scenarios. In this article, we propose a generic deep learning algorithm for predicting an arbitrary number of quantiles that ensures the quantile monotonicity constraint up to the machine precision and maintains its modelling performance with respect to alternative models. The presented method is evaluated over several real-world datasets obtaining state-of-the-art results as well as showing that it scales to large-size data sets.

Modelling heterogeneous distributions with an Uncountable Mixture of Asymmetric Laplacians

Oct 29, 2019

Abstract:In regression tasks, aleatoric uncertainty is commonly addressed by considering a parametric distribution of the output variable, which is based on strong assumptions such as symmetry, unimodality or by supposing a restricted shape. These assumptions are too limited in scenarios where complex shapes, strong skews or multiple modes are present. In this paper, we propose a generic deep learning framework that learns an Uncountable Mixture of Asymmetric Laplacians (UMAL), which will allow us to estimate heterogeneous distributions of the output variable and shows its connections to quantile regression. Despite having a fixed number of parameters, the model can be interpreted as an infinite mixture of components, which yields a flexible approximation for heterogeneous distributions. Apart from synthetic cases, we apply this model to room price forecasting and to predict financial operations in personal bank accounts. We demonstrate that UMAL produces proper distributions, which allows us to extract richer insights and to sharpen decision-making.

Uncertainty Modelling in Deep Networks: Forecasting Short and Noisy Series

Jul 24, 2018

Abstract:Deep Learning is a consolidated, state-of-the-art Machine Learning tool to fit a function when provided with large data sets of examples. However, in regression tasks, the straightforward application of Deep Learning models provides a point estimate of the target. In addition, the model does not take into account the uncertainty of a prediction. This represents a great limitation for tasks where communicating an erroneous prediction carries a risk. In this paper we tackle a real-world problem of forecasting impending financial expenses and incomings of customers, while displaying predictable monetary amounts on a mobile app. In this context, we investigate if we would obtain an advantage by applying Deep Learning models with a Heteroscedastic model of the variance of a network's output. Experimentally, we achieve a higher accuracy than non-trivial baselines. More importantly, we introduce a mechanism to discard low-confidence predictions, which means that they will not be visible to users. This should help enhance the user experience of our product.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge