Anqi Cheng

GAM-Depth: Self-Supervised Indoor Depth Estimation Leveraging a Gradient-Aware Mask and Semantic Constraints

Feb 22, 2024

Abstract:Self-supervised depth estimation has evolved into an image reconstruction task that minimizes a photometric loss. While recent methods have made strides in indoor depth estimation, they often produce inconsistent depth estimation in textureless areas and unsatisfactory depth discrepancies at object boundaries. To address these issues, in this work, we propose GAM-Depth, developed upon two novel components: gradient-aware mask and semantic constraints. The gradient-aware mask enables adaptive and robust supervision for both key areas and textureless regions by allocating weights based on gradient magnitudes.The incorporation of semantic constraints for indoor self-supervised depth estimation improves depth discrepancies at object boundaries, leveraging a co-optimization network and proxy semantic labels derived from a pretrained segmentation model. Experimental studies on three indoor datasets, including NYUv2, ScanNet, and InteriorNet, show that GAM-Depth outperforms existing methods and achieves state-of-the-art performance, signifying a meaningful step forward in indoor depth estimation. Our code will be available at https://github.com/AnqiCheng1234/GAM-Depth.

FDB: Fraud Dataset Benchmark

Aug 31, 2022

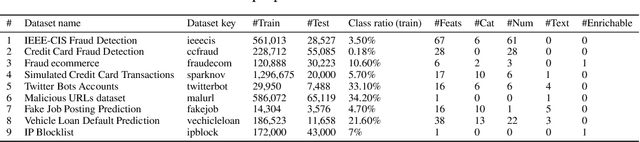

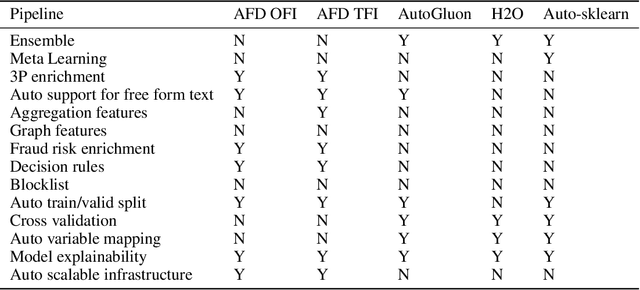

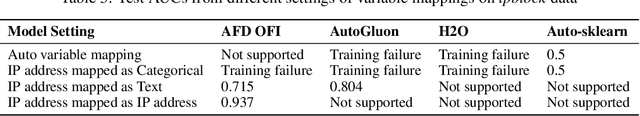

Abstract:Standardized datasets and benchmarks have spurred innovations in computer vision, natural language processing, multi-modal and tabular settings. We note that, as compared to other well researched fields fraud detection has numerous differences. The differences include a high class imbalance, diverse feature types, frequently changing fraud patterns, and adversarial nature of the problem. Due to these differences, the modeling approaches that are designed for other classification tasks may not work well for the fraud detection. We introduce Fraud Dataset Benchmark (FDB), a compilation of publicly available datasets catered to fraud detection. FDB comprises variety of fraud related tasks, ranging from identifying fraudulent card-not-present transactions, detecting bot attacks, classifying malicious URLs, predicting risk of loan to content moderation. The Python based library from FDB provides consistent API for data loading with standardized training and testing splits. For reference, we also provide baseline evaluations of different modeling approaches on FDB. Considering the increasing popularity of Automated Machine Learning (AutoML) for various research and business problems, we used AutoML frameworks for our baseline evaluations. For fraud prevention, the organizations that operate with limited resources and lack ML expertise often hire a team of investigators, use blocklists and manual rules, all of which are inefficient and do not scale well. Such organizations can benefit from AutoML solutions that are easy to deploy in production and pass the bar of fraud prevention requirements. We hope that FDB helps in the development of customized fraud detection techniques catered to different fraud modus operandi (MOs) as well as in the improvement of AutoML systems that can work well for all datasets in the benchmark.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge