Anil Bhatia

Learning to Liquidate Forex: Optimal Stopping via Adaptive Top-K Regression

Feb 25, 2022

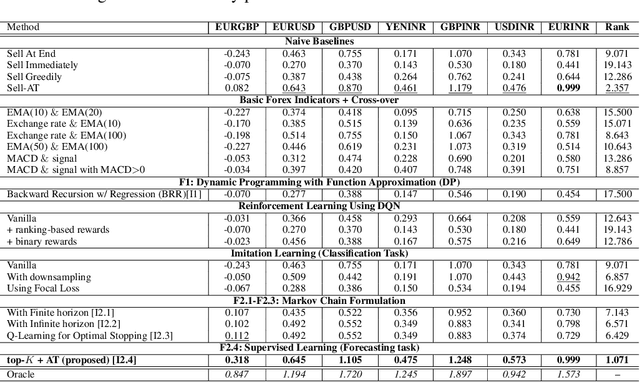

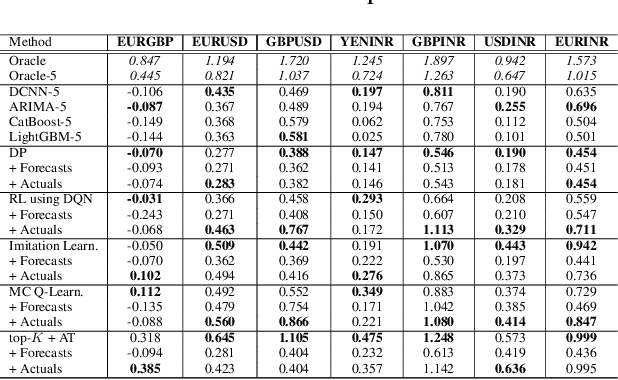

Abstract:We consider learning a trading agent acting on behalf of the treasury of a firm earning revenue in a foreign currency (FC) and incurring expenses in the home currency (HC). The goal of the agent is to maximize the expected HC at the end of the trading episode by deciding to hold or sell the FC at each time step in the trading episode. We pose this as an optimization problem, and consider a broad spectrum of approaches with the learning component ranging from supervised to imitation to reinforcement learning. We observe that most of the approaches considered struggle to improve upon simple heuristic baselines. We identify two key aspects of the problem that render standard solutions ineffective - i) while good forecasts of future FX rates can be highly effective in guiding good decisions, forecasting FX rates is difficult, and erroneous estimates tend to degrade the performance of trading agents instead of improving it, ii) the inherent non-stationary nature of FX rates renders a fixed decision-threshold highly ineffective. To address these problems, we propose a novel supervised learning approach that learns to forecast the top-K future FX rates instead of forecasting all the future FX rates, and bases the hold-versus-sell decision on the forecasts (e.g. hold if future FX rate is higher than current FX rate, sell otherwise). Furthermore, to handle the non-stationarity in the FX rates data which poses challenges to the i.i.d. assumption in supervised learning methods, we propose to adaptively learn decision-thresholds based on recent historical episodes. Through extensive empirical evaluation, we show that our approach is the only approach which is able to consistently improve upon a simple heuristic baseline. Further experiments show the inefficacy of state-of-the-art statistical and deep-learning-based forecasting methods as they degrade the performance of the trading agent.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge