Ali Hirsa

Simulating financial time series using attention

Jul 01, 2022

Abstract:Financial time series simulation is a central topic since it extends the limited real data for training and evaluation of trading strategies. It is also challenging because of the complex statistical properties of the real financial data. We introduce two generative adversarial networks (GANs), which utilize the convolutional networks with attention and the transformers, for financial time series simulation. The GANs learn the statistical properties in a data-driven manner and the attention mechanism helps to replicate the long-range dependencies. The proposed GANs are tested on the S&P 500 index and option data, examined by scores based on the stylized facts and are compared with the pure convolutional GAN, i.e. QuantGAN. The attention-based GANs not only reproduce the stylized facts, but also smooth the autocorrelation of returns.

Supervised Neural Networks for Illiquid Alternative Asset Cash Flow Forecasting

Aug 05, 2021

Abstract:Institutional investors have been increasing the allocation of the illiquid alternative assets such as private equity funds in their portfolios, yet there exists a very limited literature on cash flow forecasting of illiquid alternative assets. The net cash flow of private equity funds typically follow a J-curve pattern, however the timing and the size of the contributions and distributions depend on the investment opportunities. In this paper, we develop a benchmark model and present two novel approaches (direct vs. indirect) to predict the cash flows of private equity funds. We introduce a sliding window approach to apply on our cash flow data because different vintage year funds contain different lengths of cash flow information. We then pass the data to an LSTM/ GRU model to predict the future cash flows either directly or indirectly (based on the benchmark model). We further integrate macroeconomic indicators into our data, which allows us to consider the impact of market environment on cash flows and to apply stress testing. Our results indicate that the direct model is easier to implement compared to the benchmark model and the indirect model, but still the predicted cash flows align better with the actual cash flows. We also show that macroeconomic variables improve the performance of the direct model whereas the impact is not obvious on the indirect model.

Two-Stage Sector Rotation Methodology Using Machine Learning and Deep Learning Techniques

Aug 05, 2021

Abstract:Market indicators such as CPI and GDP have been widely used over decades to identify the stage of business cycles and also investment attractiveness of sectors given market conditions. In this paper, we propose a two-stage methodology that consists of predicting ETF prices for each sector using market indicators and ranking sectors based on their predicted rate of returns. We initially start with choosing sector specific macroeconomic indicators and implement Recursive Feature Elimination algorithm to select the most important features for each sector. Using our prediction tool, we implement different Recurrent Neural Networks models to predict the future ETF prices for each sector. We then rank the sectors based on their predicted rate of returns. We select the best performing model by evaluating the annualized return, annualized Sharpe ratio, and Calmar ratio of the portfolios that includes the top four ranked sectors chosen by the model. We also test the robustness of the model performance with respect to lookback windows and look ahead windows. Our empirical results show that our methodology beats the equally weighted portfolio performance even in the long run. We also find that Echo State Networks exhibits an outstanding performance compared to other models yet it is faster to implement compared to other RNN models.

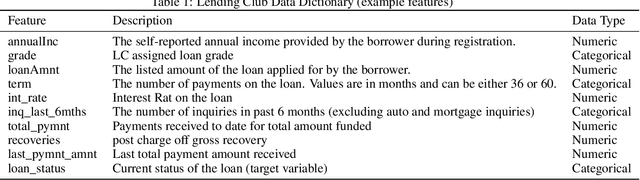

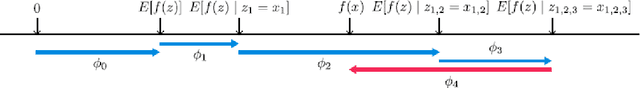

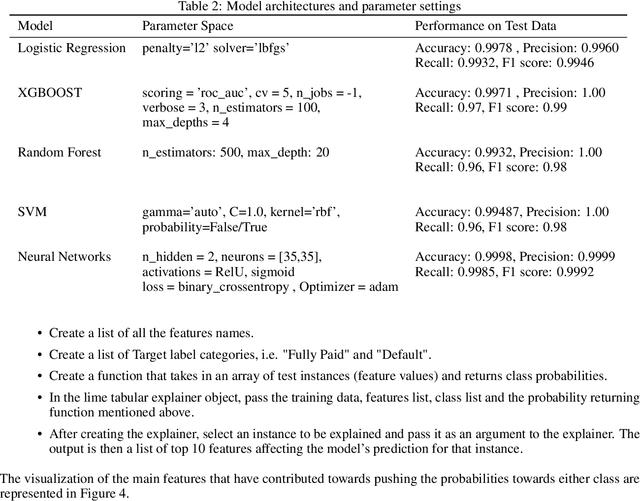

Explainable AI in Credit Risk Management

Mar 01, 2021

Abstract:Artificial Intelligence (AI) has created the single biggest technology revolution the world has ever seen. For the finance sector, it provides great opportunities to enhance customer experience, democratize financial services, ensure consumer protection and significantly improve risk management. While it is easier than ever to run state-of-the-art machine learning models, designing and implementing systems that support real-world finance applications have been challenging. In large part because they lack transparency and explainability which are important factors in establishing reliable technology and the research on this topic with a specific focus on applications in credit risk management. In this paper, we implement two advanced post-hoc model agnostic explainability techniques called Local Interpretable Model Agnostic Explanations (LIME) and SHapley Additive exPlanations (SHAP) to machine learning (ML)-based credit scoring models applied to the open-access data set offered by the US-based P2P Lending Platform, Lending Club. Specifically, we use LIME to explain instances locally and SHAP to get both local and global explanations. We discuss the results in detail and present multiple comparison scenarios by using various kernels available for explaining graphs generated using SHAP values. We also discuss the practical challenges associated with the implementation of these state-of-art eXplainabale AI (XAI) methods and document them for future reference. We have made an effort to document every technical aspect of this research, while at the same time providing a general summary of the conclusions.

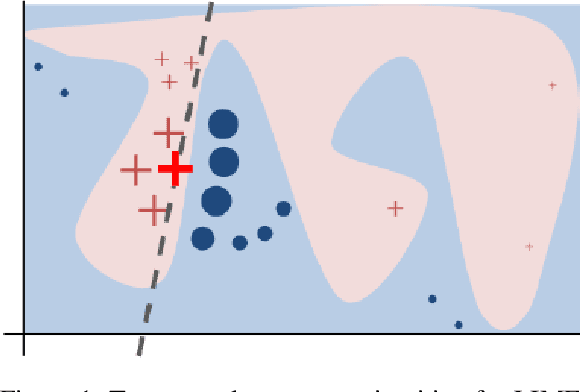

Regularized Generative Adversarial Network

Feb 09, 2021

Abstract:We propose a framework for generating samples from a probability distribution that differs from the probability distribution of the training set. We use an adversarial process that simultaneously trains three networks, a generator and two discriminators. We refer to this new model as regularized generative adversarial network (RegGAN). We evaluate RegGAN on a synthetic dataset composed of gray scale images and we further show that it can be used to learn some pre-specified notions in topology (basic topology properties). The work is motivated by practical problems encountered while using generative methods in the art world.

Supervised Deep Neural Networks (DNNs) for Pricing/Calibration of Vanilla/Exotic Options Under Various Different Processes

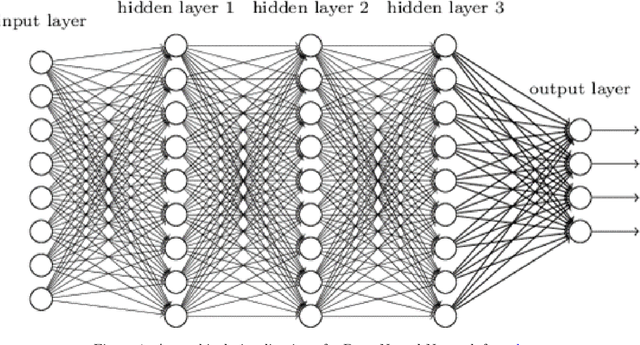

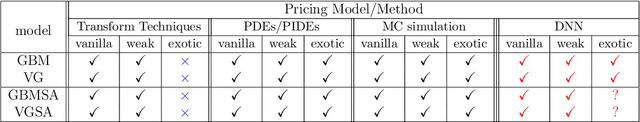

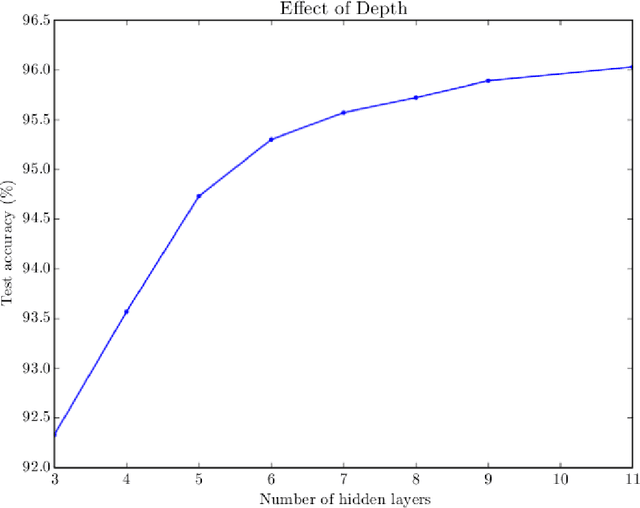

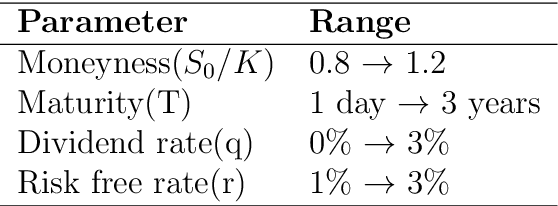

Feb 15, 2019

Abstract:We apply supervised deep neural networks (DNNs) for pricing and calibration of both vanilla and exotic options under both diffusion and pure jump processes with and without stochastic volatility. We train our neural network models under different number of layers, neurons per layer, and various different activation functions in order to find which combinations work better empirically. For training, we consider various different loss functions and optimization routines. We demonstrate that deep neural networks exponentially expedite option pricing compared to commonly used option pricing methods which consequently make calibration and parameter estimation super fast.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge