Estimating the Long-Term Effects of Novel Treatments

Paper and Code

Mar 15, 2021

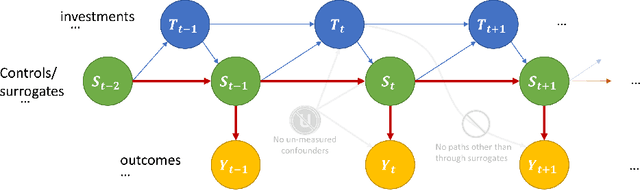

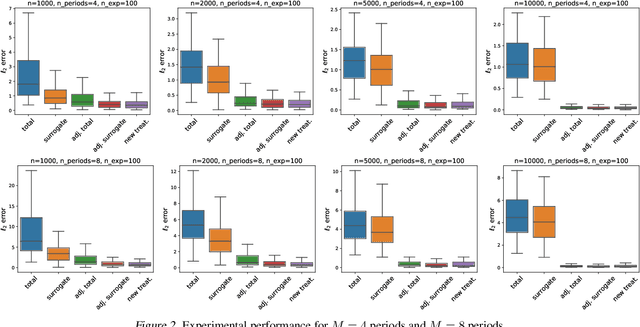

Policy makers typically face the problem of wanting to estimate the long-term effects of novel treatments, while only having historical data of older treatment options. We assume access to a long-term dataset where only past treatments were administered and a short-term dataset where novel treatments have been administered. We propose a surrogate based approach where we assume that the long-term effect is channeled through a multitude of available short-term proxies. Our work combines three major recent techniques in the causal machine learning literature: surrogate indices, dynamic treatment effect estimation and double machine learning, in a unified pipeline. We show that our method is consistent and provides root-n asymptotically normal estimates under a Markovian assumption on the data and the observational policy. We use a data-set from a major corporation that includes customer investments over a three year period to create a semi-synthetic data distribution where the major qualitative properties of the real dataset are preserved. We evaluate the performance of our method and discuss practical challenges of deploying our formal methodology and how to address them.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge