Electricity Consumption Forecasting for Out-of-distribution Time-of-Use Tariffs

Paper and Code

Feb 11, 2022

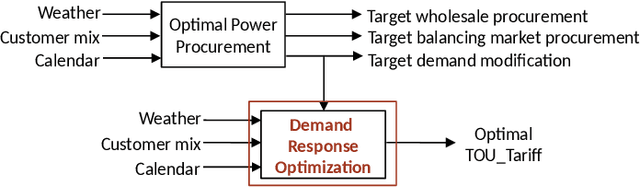

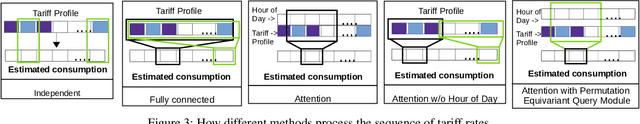

In electricity markets, retailers or brokers want to maximize profits by allocating tariff profiles to end consumers. One of the objectives of such demand response management is to incentivize the consumers to adjust their consumption so that the overall electricity procurement in the wholesale markets is minimized, e.g. it is desirable that consumers consume less during peak hours when cost of procurement for brokers from wholesale markets are high. We consider a greedy solution to maximize the overall profit for brokers by optimal tariff profile allocation. This in-turn requires forecasting electricity consumption for each user for all tariff profiles. This forecasting problem is challenging compared to standard forecasting problems due to following reasons: i. the number of possible combinations of hourly tariffs is high and retailers may not have considered all combinations in the past resulting in a biased set of tariff profiles tried in the past, ii. the profiles allocated in the past to each user is typically based on certain policy. These reasons violate the standard i.i.d. assumptions, as there is a need to evaluate new tariff profiles on existing customers and historical data is biased by the policies used in the past for tariff allocation. In this work, we consider several scenarios for forecasting and optimization under these conditions. We leverage the underlying structure of how consumers respond to variable tariff rates by comparing tariffs across hours and shifting loads, and propose suitable inductive biases in the design of deep neural network based architectures for forecasting under such scenarios. More specifically, we leverage attention mechanisms and permutation equivariant networks that allow desirable processing of tariff profiles to learn tariff representations that are insensitive to the biases in the data and still representative of the task.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge