Zahra Ahani

Advanced Machine Learning Techniques for Social Support Detection on Social Media

Jan 06, 2025

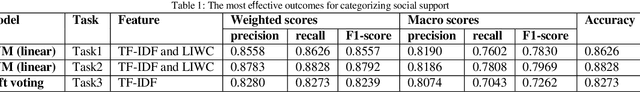

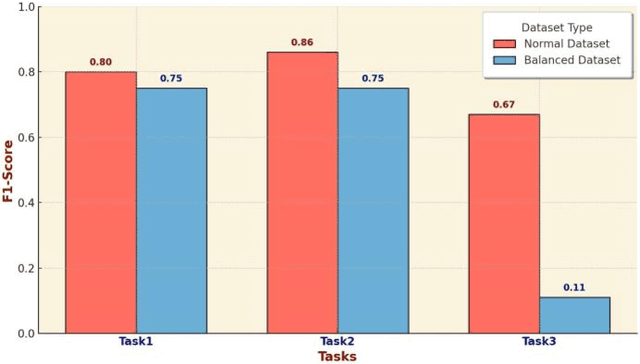

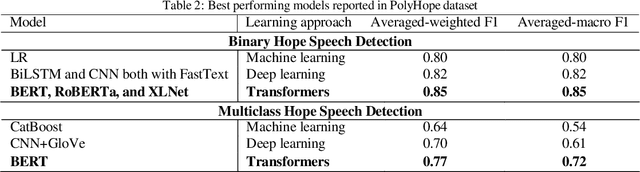

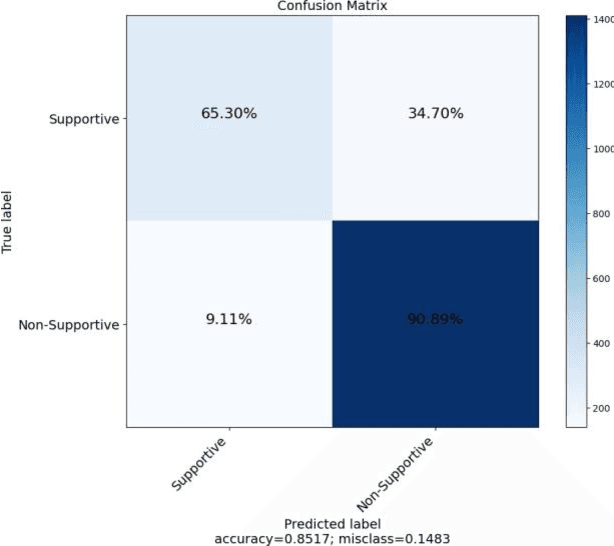

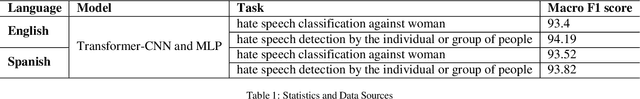

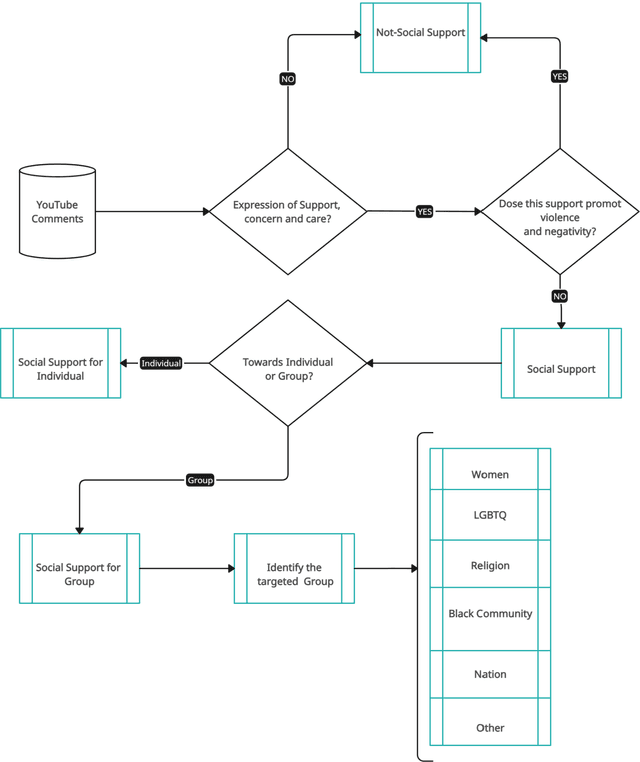

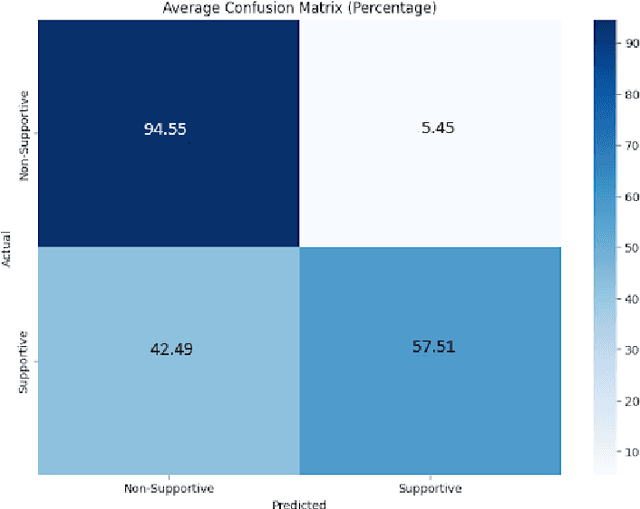

Abstract:The widespread use of social media highlights the need to understand its impact, particularly the role of online social support. This study uses a dataset focused on online social support, which includes binary and multiclass classifications of social support content on social media. The classification of social support is divided into three tasks. The first task focuses on distinguishing between supportive and non-supportive. The second task aims to identify whether the support is directed toward an individual or a group. The third task categorizes the specific type of social support, grouping it into categories such as Nation, LGBTQ, Black people, Women, Religion, and Other (if it does not fit into the previously mentioned categories). To address data imbalances in these tasks, we employed K-means clustering for balancing the dataset and compared the results with the original unbalanced data. Using advanced machine learning techniques, including transformers and zero-shot learning approaches with GPT3, GPT4, and GPT4-o, we predict social support levels in various contexts. The effectiveness of the dataset is evaluated using baseline models across different learning approaches, with transformer-based methods demonstrating superior performance. Additionally, we achieved a 0.4\% increase in the macro F1 score for the second task and a 0.7\% increase for the third task, compared to previous work utilizing traditional machine learning with psycholinguistic and unigram-based TF-IDF values.

Social Support Detection from Social Media Texts

Nov 04, 2024

Abstract:Social support, conveyed through a multitude of interactions and platforms such as social media, plays a pivotal role in fostering a sense of belonging, aiding resilience in the face of challenges, and enhancing overall well-being. This paper introduces Social Support Detection (SSD) as a Natural language processing (NLP) task aimed at identifying supportive interactions within online communities. The study presents the task of Social Support Detection (SSD) in three subtasks: two binary classification tasks and one multiclass task, with labels detailed in the dataset section. We conducted experiments on a dataset comprising 10,000 YouTube comments. Traditional machine learning models were employed, utilizing various feature combinations that encompass linguistic, psycholinguistic, emotional, and sentiment information. Additionally, we experimented with neural network-based models using various word embeddings to enhance the performance of our models across these subtasks.The results reveal a prevalence of group-oriented support in online dialogues, reflecting broader societal patterns. The findings demonstrate the effectiveness of integrating psycholinguistic, emotional, and sentiment features with n-grams in detecting social support and distinguishing whether it is directed toward an individual or a group. The best results for different subtasks across all experiments range from 0.72 to 0.82.

Exploring Sentiment Dynamics and Predictive Behaviors in Cryptocurrency Discussions by Few-Shot Learning with Large Language Models

Sep 04, 2024

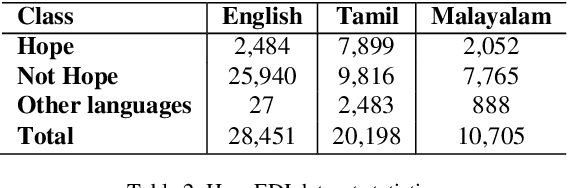

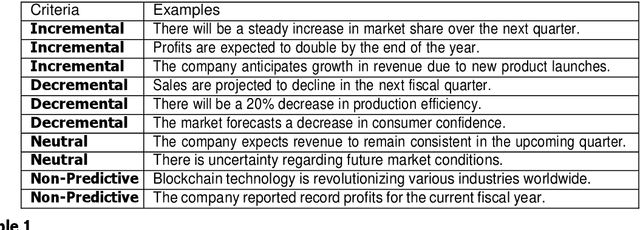

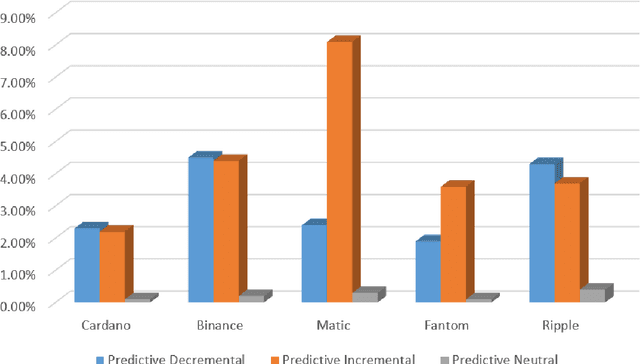

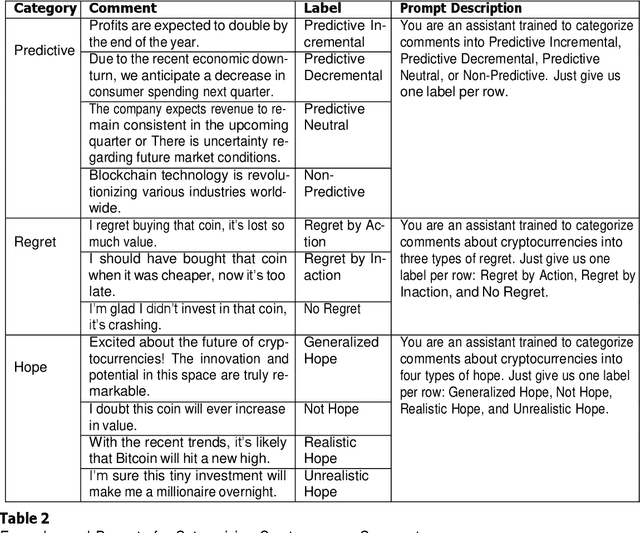

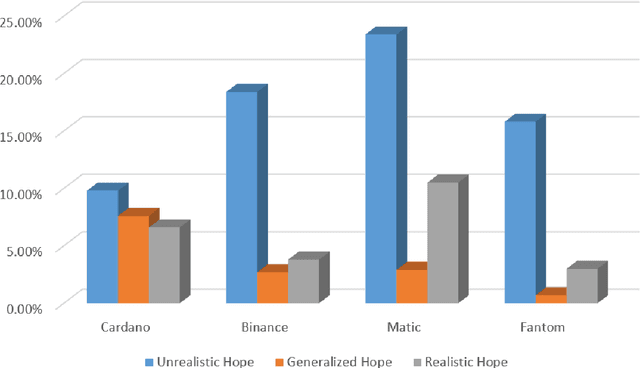

Abstract:This study performs analysis of Predictive statements, Hope speech, and Regret Detection behaviors within cryptocurrency-related discussions, leveraging advanced natural language processing techniques. We introduce a novel classification scheme named "Prediction statements," categorizing comments into Predictive Incremental, Predictive Decremental, Predictive Neutral, or Non-Predictive categories. Employing GPT-4o, a cutting-edge large language model, we explore sentiment dynamics across five prominent cryptocurrencies: Cardano, Binance, Matic, Fantom, and Ripple. Our analysis reveals distinct patterns in predictive sentiments, with Matic demonstrating a notably higher propensity for optimistic predictions. Additionally, we investigate hope and regret sentiments, uncovering nuanced interplay between these emotions and predictive behaviors. Despite encountering limitations related to data volume and resource availability, our study reports valuable discoveries concerning investor behavior and sentiment trends within the cryptocurrency market, informing strategic decision-making and future research endeavors.

Analyzing Emotional Trends from X platform using SenticNet: A Comparative Analysis with Cryptocurrency Price

May 06, 2024Abstract:This study delves into the relationship between emotional trends from X platform data and the market dynamics of well-known cryptocurrencies Cardano, Binance, Fantom, Matic, and Ripple over the period from October 2022 to March 2023. Leveraging SenticNet, we identified emotions like Fear and Anxiety, Rage and Anger, Grief and Sadness, Delight and Pleasantness, Enthusiasm and Eagerness, and Delight and Joy. Following data extraction, we segmented each month into bi-weekly intervals, replicating this process for price data obtained from Finance-Yahoo. Consequently, a comparative analysis was conducted, establishing connections between emotional trends observed across bi-weekly intervals and cryptocurrency prices, uncovering significant correlations between emotional sentiments and coin valuations.

Utilizing deep learning models for the identification of enhancers and super-enhancers based on genomic and epigenomic features

Jan 15, 2024Abstract:This paper provides an extensive examination of a sizable dataset of English tweets focusing on nine widely recognized cryptocurrencies, specifically Cardano, Binance, Bitcoin, Dogecoin, Ethereum, Fantom, Matic, Shiba, and Ripple. Our primary objective was to conduct a psycholinguistic and emotion analysis of social media content associated with these cryptocurrencies. To enable investigators to make more informed decisions. The study involved comparing linguistic characteristics across the diverse digital coins, shedding light on the distinctive linguistic patterns that emerge within each coin's community. To achieve this, we utilized advanced text analysis techniques. Additionally, our work unveiled an intriguing Understanding of the interplay between these digital assets within the cryptocurrency community. By examining which coin pairs are mentioned together most frequently in the dataset, we established correlations between different cryptocurrencies. To ensure the reliability of our findings, we initially gathered a total of 832,559 tweets from Twitter. These tweets underwent a rigorous preprocessing stage, resulting in a refined dataset of 115,899 tweets that were used for our analysis. Overall, our research offers valuable Perception into the linguistic nuances of various digital coins' online communities and provides a deeper understanding of their interactions in the cryptocurrency space.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge