William Knauth

The Self-Simplifying Machine: Exploiting the Structure of Piecewise Linear Neural Networks to Create Interpretable Models

Dec 02, 2020

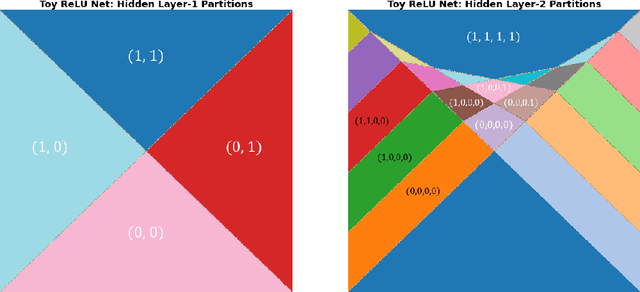

Abstract:Today, it is more important than ever before for users to have trust in the models they use. As Machine Learning models fall under increased regulatory scrutiny and begin to see more applications in high-stakes situations, it becomes critical to explain our models. Piecewise Linear Neural Networks (PLNN) with the ReLU activation function have quickly become extremely popular models due to many appealing properties; however, they still present many challenges in the areas of robustness and interpretation. To this end, we introduce novel methodology toward simplification and increased interpretability of Piecewise Linear Neural Networks for classification tasks. Our methods include the use of a trained, deep network to produce a well-performing, single-hidden-layer network without further stochastic training, in addition to an algorithm to reduce flat networks to a smaller, more interpretable size with minimal loss in performance. On these methods, we conduct preliminary studies of model performance, as well as a case study on Wells Fargo's Home Lending dataset, together with visual model interpretation.

Unwrapping The Black Box of Deep ReLU Networks: Interpretability, Diagnostics, and Simplification

Nov 08, 2020

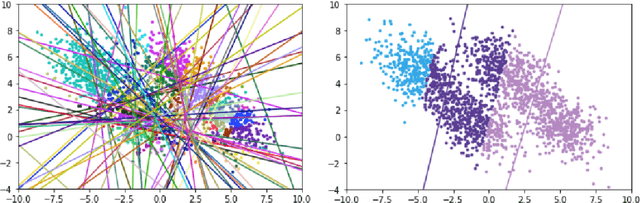

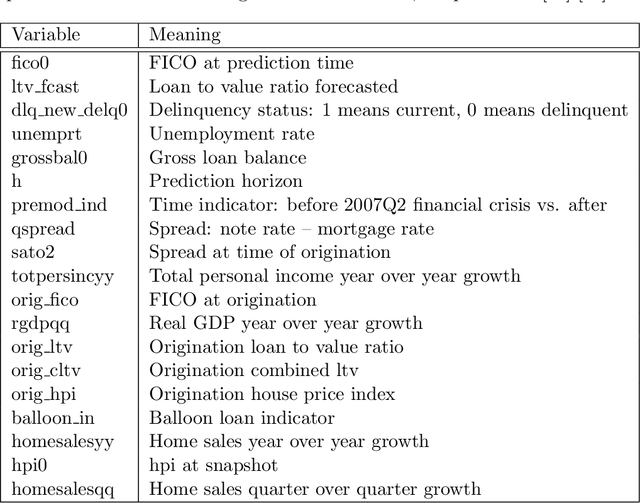

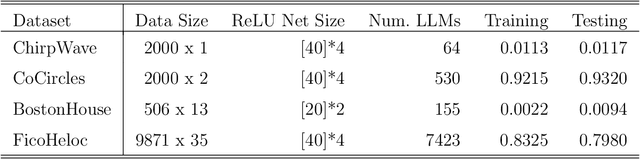

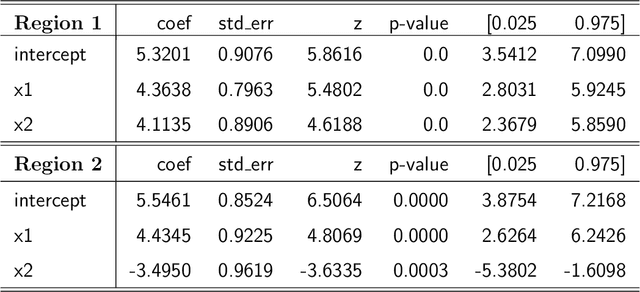

Abstract:The deep neural networks (DNNs) have achieved great success in learning complex patterns with strong predictive power, but they are often thought of as "black box" models without a sufficient level of transparency and interpretability. It is important to demystify the DNNs with rigorous mathematics and practical tools, especially when they are used for mission-critical applications. This paper aims to unwrap the black box of deep ReLU networks through local linear representation, which utilizes the activation pattern and disentangles the complex network into an equivalent set of local linear models (LLMs). We develop a convenient LLM-based toolkit for interpretability, diagnostics, and simplification of a pre-trained deep ReLU network. We propose the local linear profile plot and other visualization methods for interpretation and diagnostics, and an effective merging strategy for network simplification. The proposed methods are demonstrated by simulation examples, benchmark datasets, and a real case study in home lending credit risk assessment.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge