Vadlamani Ravi

Improved Differential Evolution based Feature Selection through Quantum, Chaos, and Lasso

Aug 20, 2024Abstract:Modern deep learning continues to achieve outstanding performance on an astounding variety of high-dimensional tasks. In practice, this is obtained by fitting deep neural models to all the input data with minimal feature engineering, thus sacrificing interpretability in many cases. However, in applications such as medicine, where interpretability is crucial, feature subset selection becomes an important problem. Metaheuristics such as Binary Differential Evolution are a popular approach to feature selection, and the research literature continues to introduce novel ideas, drawn from quantum computing and chaos theory, for instance, to improve them. In this paper, we demonstrate that introducing chaos-generated variables, generated from considerations of the Lyapunov time, in place of random variables in quantum-inspired metaheuristics significantly improves their performance on high-dimensional medical classification tasks and outperforms other approaches. We show that this chaos-induced improvement is a general phenomenon by demonstrating it for multiple varieties of underlying quantum-inspired metaheuristics. Performance is further enhanced through Lasso-assisted feature pruning. At the implementation level, we vastly speed up our algorithms through a scalable island-based computing cluster parallelization technique.

Quantum-Inspired Evolutionary Algorithms for Feature Subset Selection: A Comprehensive Survey

Jul 25, 2024

Abstract:The clever hybridization of quantum computing concepts and evolutionary algorithms (EAs) resulted in a new field called quantum-inspired evolutionary algorithms (QIEAs). Unlike traditional EAs, QIEAs employ quantum bits to adopt a probabilistic representation of the state of a feature in a given solution. This unprecedented feature enables them to achieve better diversity and perform global search, effectively yielding a tradeoff between exploration and exploitation. We conducted a comprehensive survey across various publishers and gathered 56 papers. We thoroughly analyzed these publications, focusing on the novelty elements and types of heuristics employed by the extant quantum-inspired evolutionary algorithms (QIEAs) proposed to solve the feature subset selection (FSS) problem. Importantly, we provided a detailed analysis of the different types of objective functions and popular quantum gates, i.e., rotation gates, employed throughout the literature. Additionally, we suggested several open research problems to attract the attention of the researchers.

Causal Inference for Banking Finance and Insurance A Survey

Jul 31, 2023Abstract:Causal Inference plays an significant role in explaining the decisions taken by statistical models and artificial intelligence models. Of late, this field started attracting the attention of researchers and practitioners alike. This paper presents a comprehensive survey of 37 papers published during 1992-2023 and concerning the application of causal inference to banking, finance, and insurance. The papers are categorized according to the following families of domains: (i) Banking, (ii) Finance and its subdomains such as corporate finance, governance finance including financial risk and financial policy, financial economics, and Behavioral finance, and (iii) Insurance. Further, the paper covers the primary ingredients of causal inference namely, statistical methods such as Bayesian Causal Network, Granger Causality and jargon used thereof such as counterfactuals. The review also recommends some important directions for future research. In conclusion, we observed that the application of causal inference in the banking and insurance sectors is still in its infancy, and thus more research is possible to turn it into a viable method.

FedPNN: One-shot Federated Classification via Evolving Clustering Method and Probabilistic Neural Network hybrid

Apr 09, 2023Abstract:Protecting data privacy is paramount in the fields such as finance, banking, and healthcare. Federated Learning (FL) has attracted widespread attention due to its decentralized, distributed training and the ability to protect the privacy while obtaining a global shared model. However, FL presents challenges such as communication overhead, and limited resource capability. This motivated us to propose a two-stage federated learning approach toward the objective of privacy protection, which is a first-of-its-kind study as follows: (i) During the first stage, the synthetic dataset is generated by employing two different distributions as noise to the vanilla conditional tabular generative adversarial neural network (CTGAN) resulting in modified CTGAN, and (ii) In the second stage, the Federated Probabilistic Neural Network (FedPNN) is developed and employed for building globally shared classification model. We also employed synthetic dataset metrics to check the quality of the generated synthetic dataset. Further, we proposed a meta-clustering algorithm whereby the cluster centers obtained from the clients are clustered at the server for training the global model. Despite PNN being a one-pass learning classifier, its complexity depends on the training data size. Therefore, we employed a modified evolving clustering method (ECM), another one-pass algorithm to cluster the training data thereby increasing the speed further. Moreover, we conducted sensitivity analysis by varying Dthr, a hyperparameter of ECM at the server and client, one at a time. The effectiveness of our approach is validated on four finance and medical datasets.

ATM Fraud Detection using Streaming Data Analytics

Mar 08, 2023

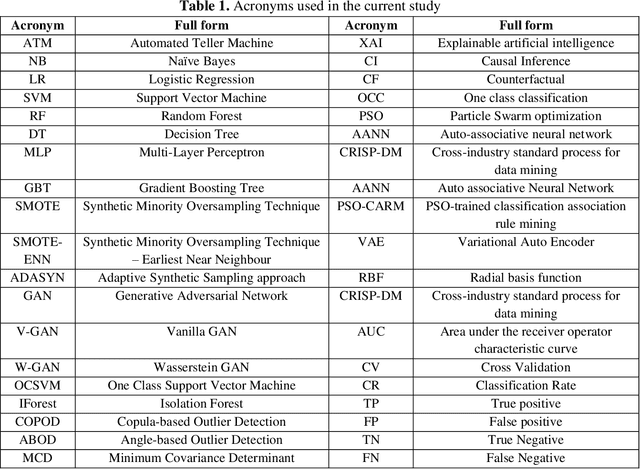

Abstract:Gaining the trust and confidence of customers is the essence of the growth and success of financial institutions and organizations. Of late, the financial industry is significantly impacted by numerous instances of fraudulent activities. Further, owing to the generation of large voluminous datasets, it is highly essential that underlying framework is scalable and meet real time needs. To address this issue, in the study, we proposed ATM fraud detection in static and streaming contexts respectively. In the static context, we investigated a parallel and scalable machine learning algorithms for ATM fraud detection that is built on Spark and trained with a variety of machine learning (ML) models including Naive Bayes (NB), Logistic Regression (LR), Support Vector Machine (SVM), Decision Tree (DT), Random Forest (RF), Gradient Boosting Tree (GBT), and Multi-layer perceptron (MLP). We also employed several balancing techniques like Synthetic Minority Oversampling Technique (SMOTE) and its variants, Generative Adversarial Networks (GAN), to address the rarity in the dataset. In addition, we proposed a streaming based ATM fraud detection in the streaming context. Our sliding window based method collects ATM transactions that are performed within a specified time interval and then utilizes to train several ML models, including NB, RF, DT, and K-Nearest Neighbour (KNN). We selected these models based on their less model complexity and quicker response time. In both contexts, RF turned out to be the best model. RF obtained the best mean AUC of 0.975 in the static context and mean AUC of 0.910 in the streaming context. RF is also empirically proven to be statistically significant than the next-best performing models.

Chaotic Variational Auto encoder-based Adversarial Machine Learning

Feb 25, 2023Abstract:Machine Learning (ML) has become the new contrivance in almost every field. This makes them a target of fraudsters by various adversary attacks, thereby hindering the performance of ML models. Evasion and Data-Poison-based attacks are well acclaimed, especially in finance, healthcare, etc. This motivated us to propose a novel computationally less expensive attack mechanism based on the adversarial sample generation by Variational Auto Encoder (VAE). It is well known that Wavelet Neural Network (WNN) is considered computationally efficient in solving image and audio processing, speech recognition, and time-series forecasting. This paper proposed VAE-Deep-Wavelet Neural Network (VAE-Deep-WNN), where Encoder and Decoder employ WNN networks. Further, we proposed chaotic variants of both VAE with Multi-layer perceptron (MLP) and Deep-WNN and named them C-VAE-MLP and C-VAE-Deep-WNN, respectively. Here, we employed a Logistic map to generate random noise in the latent space. In this paper, we performed VAE-based adversary sample generation and applied it to various problems related to finance and cybersecurity domain-related problems such as loan default, credit card fraud, and churn modelling, etc., We performed both Evasion and Data-Poison attacks on Logistic Regression (LR) and Decision Tree (DT) models. The results indicated that VAE-Deep-WNN outperformed the rest in the majority of the datasets and models. However, its chaotic variant C-VAE-Deep-WNN performed almost similarly to VAE-Deep-WNN in the majority of the datasets.

Chaotic Variational Auto Encoder based One Class Classifier for Insurance Fraud Detection

Dec 15, 2022

Abstract:Of late, insurance fraud detection has assumed immense significance owing to the huge financial & reputational losses fraud entails and the phenomenal success of the fraud detection techniques. Insurance is majorly divided into two categories: (i) Life and (ii) Non-life. Non-life insurance in turn includes health insurance and auto insurance among other things. In either of the categories, the fraud detection techniques should be designed in such a way that they capture as many fraudulent transactions as possible. Owing to the rarity of fraudulent transactions, in this paper, we propose a chaotic variational autoencoder (C-VAE to perform one-class classification (OCC) on genuine transactions. Here, we employed the logistic chaotic map to generate random noise in the latent space. The effectiveness of C-VAE is demonstrated on the health insurance fraud and auto insurance datasets. We considered vanilla Variational Auto Encoder (VAE) as the baseline. It is observed that C-VAE outperformed VAE in both datasets. C-VAE achieved a classification rate of 77.9% and 87.25% in health and automobile insurance datasets respectively. Further, the t-test conducted at 1% level of significance and 18 degrees of freedom infers that C-VAE is statistically significant than the VAE.

Explainable Artificial Intelligence and Causal Inference based ATM Fraud Detection

Nov 19, 2022

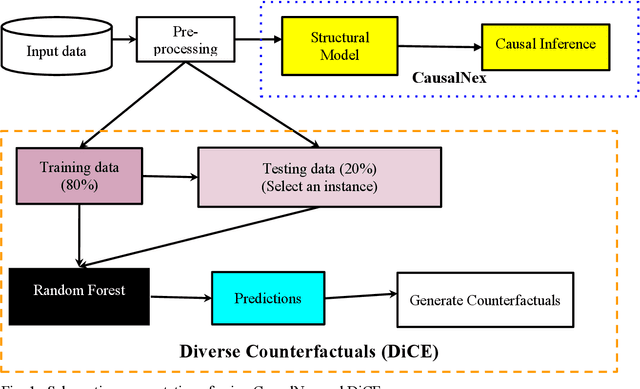

Abstract:Gaining the trust of customers and providing them empathy are very critical in the financial domain. Frequent occurrence of fraudulent activities affects these two factors. Hence, financial organizations and banks must take utmost care to mitigate them. Among them, ATM fraudulent transaction is a common problem faced by banks. There following are the critical challenges involved in fraud datasets: the dataset is highly imbalanced, the fraud pattern is changing, etc. Owing to the rarity of fraudulent activities, Fraud detection can be formulated as either a binary classification problem or One class classification (OCC). In this study, we handled these techniques on an ATM transactions dataset collected from India. In binary classification, we investigated the effectiveness of various over-sampling techniques, such as the Synthetic Minority Oversampling Technique (SMOTE) and its variants, Generative Adversarial Networks (GAN), to achieve oversampling. Further, we employed various machine learning techniques viz., Naive Bayes (NB), Logistic Regression (LR), Support Vector Machine (SVM), Decision Tree (DT), Random Forest (RF), Gradient Boosting Tree (GBT), Multi-layer perceptron (MLP). GBT outperformed the rest of the models by achieving 0.963 AUC, and DT stands second with 0.958 AUC. DT is the winner if the complexity and interpretability aspects are considered. Among all the oversampling approaches, SMOTE and its variants were observed to perform better. In OCC, IForest attained 0.959 CR, and OCSVM secured second place with 0.947 CR. Further, we incorporated explainable artificial intelligence (XAI) and causal inference (CI) in the fraud detection framework and studied it through various analyses.

Parallel and Streaming Wavelet Neural Networks for Classification and Regression under Apache Spark

Sep 07, 2022

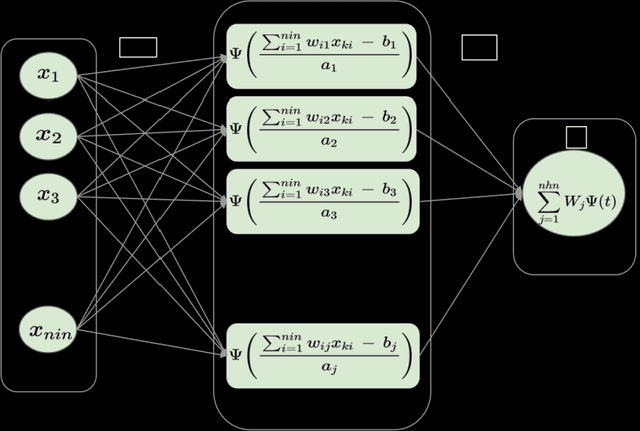

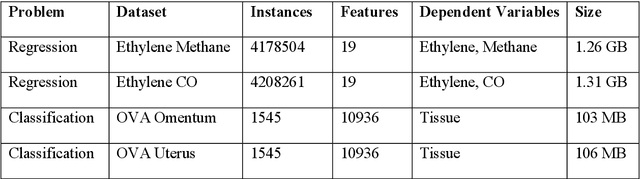

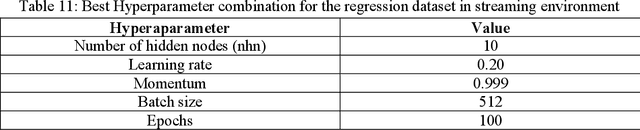

Abstract:Wavelet neural networks (WNN) have been applied in many fields to solve regression as well as classification problems. After the advent of big data, as data gets generated at a brisk pace, it is imperative to analyze it as soon as it is generated owing to the fact that the nature of the data may change dramatically in short time intervals. This is necessitated by the fact that big data is all pervasive and throws computational challenges for data scientists. Therefore, in this paper, we built an efficient Scalable, Parallelized Wavelet Neural Network (SPWNN) which employs the parallel stochastic gradient algorithm (SGD) algorithm. SPWNN is designed and developed under both static and streaming environments in the horizontal parallelization framework. SPWNN is implemented by using Morlet and Gaussian functions as activation functions. This study is conducted on big datasets like gas sensor data which has more than 4 million samples and medical research data which has more than 10,000 features, which are high dimensional in nature. The experimental analysis indicates that in the static environment, SPWNN with Morlet activation function outperformed SPWNN with Gaussian on the classification datasets. However, in the case of regression, the opposite was observed. In contrast, in the streaming environment i.e., Gaussian outperformed Morlet on the classification and Morlet outperformed Gaussian on the regression datasets. Overall, the proposed SPWNN architecture achieved a speedup of 1.32-1.40.

Application of Causal Inference to Analytical Customer Relationship Management in Banking and Insurance

Aug 19, 2022

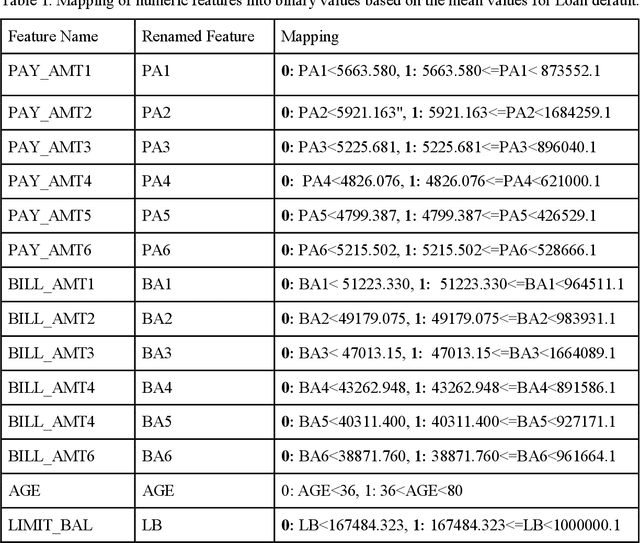

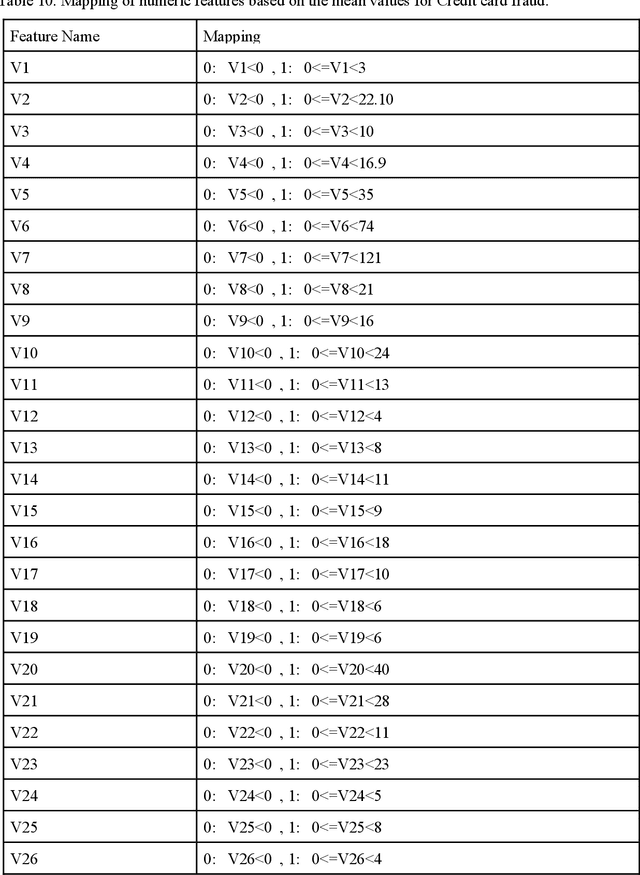

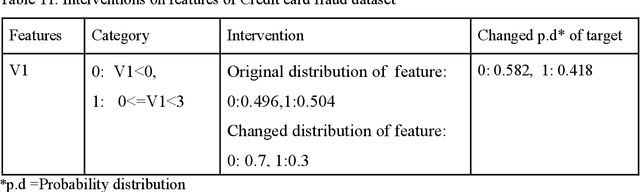

Abstract:Of late, in order to have better acceptability among various domain, researchers have argued that machine intelligence algorithms must be able to provide explanations that humans can understand causally. This aspect, also known as causability, achieves a specific level of human-level explainability. A specific class of algorithms known as counterfactuals may be able to provide causability. In statistics, causality has been studied and applied for many years, but not in great detail in artificial intelligence (AI). In a first-of-its-kind study, we employed the principles of causal inference to provide explainability for solving the analytical customer relationship management (ACRM) problems. In the context of banking and insurance, current research on interpretability tries to address causality-related questions like why did this model make such decisions, and was the model's choice influenced by a particular factor? We propose a solution in the form of an intervention, wherein the effect of changing the distribution of features of ACRM datasets is studied on the target feature. Subsequently, a set of counterfactuals is also obtained that may be furnished to any customer who demands an explanation of the decision taken by the bank/insurance company. Except for the credit card churn prediction dataset, good quality counterfactuals were generated for the loan default, insurance fraud detection, and credit card fraud detection datasets, where changes in no more than three features are observed.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge