Suresh Dodda

Advancing Household Robotics: Deep Interactive Reinforcement Learning for Efficient Training and Enhanced Performance

May 29, 2024

Abstract:The market for domestic robots made to perform household chores is growing as these robots relieve people of everyday responsibilities. Domestic robots are generally welcomed for their role in easing human labor, in contrast to industrial robots, which are frequently criticized for displacing human workers. But before these robots can carry out domestic chores, they need to become proficient in several minor activities, such as recognizing their surroundings, making decisions, and picking up on human behaviors. Reinforcement learning, or RL, has emerged as a key robotics technology that enables robots to interact with their environment and learn how to optimize their actions to maximize rewards. However, the goal of Deep Reinforcement Learning is to address more complicated, continuous action-state spaces in real-world settings by combining RL with Neural Networks. The efficacy of DeepRL can be further augmented through interactive feedback, in which a trainer offers real-time guidance to expedite the robot's learning process. Nevertheless, the current methods have drawbacks, namely the transient application of guidance that results in repeated learning under identical conditions. Therefore, we present a novel method to preserve and reuse information and advice via Deep Interactive Reinforcement Learning, which utilizes a persistent rule-based system. This method not only expedites the training process but also lessens the number of repetitions that instructors will have to carry out. This study has the potential to advance the development of household robots and improve their effectiveness and efficiency as learners.

Unveiling the Impact of Macroeconomic Policies: A Double Machine Learning Approach to Analyzing Interest Rate Effects on Financial Markets

Mar 31, 2024

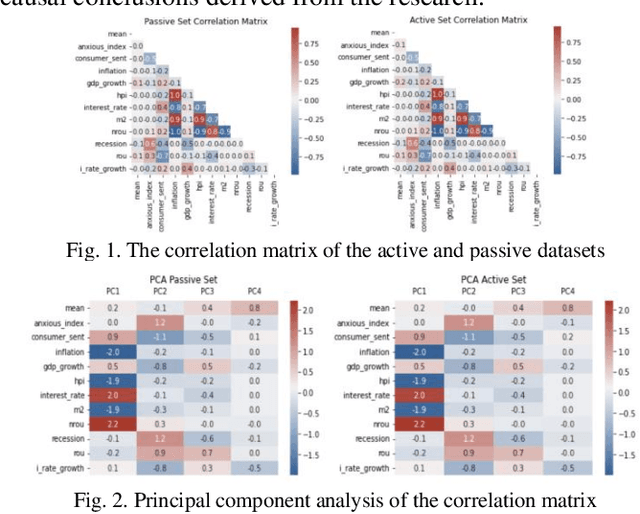

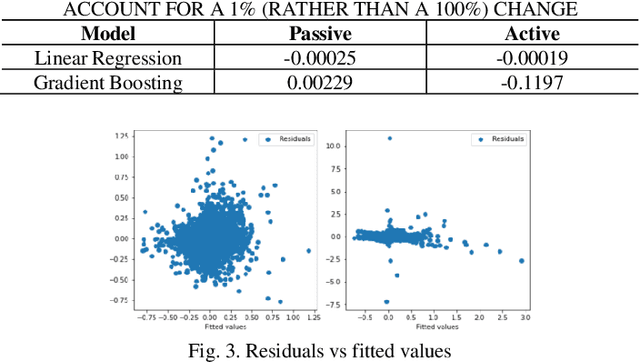

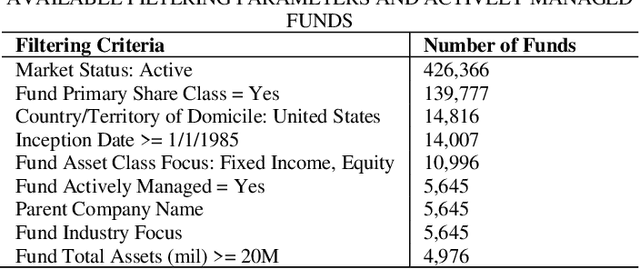

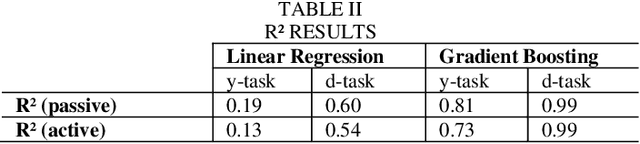

Abstract:This study examines the effects of macroeconomic policies on financial markets using a novel approach that combines Machine Learning (ML) techniques and causal inference. It focuses on the effect of interest rate changes made by the US Federal Reserve System (FRS) on the returns of fixed income and equity funds between January 1986 and December 2021. The analysis makes a distinction between actively and passively managed funds, hypothesizing that the latter are less susceptible to changes in interest rates. The study contrasts gradient boosting and linear regression models using the Double Machine Learning (DML) framework, which supports a variety of statistical learning techniques. Results indicate that gradient boosting is a useful tool for predicting fund returns; for example, a 1% increase in interest rates causes an actively managed fund's return to decrease by -11.97%. This understanding of the relationship between interest rates and fund performance provides opportunities for additional research and insightful, data-driven advice for fund managers and investors

The Emotional Impact of Game Duration: A Framework for Understanding Player Emotions in Extended Gameplay Sessions

Mar 31, 2024

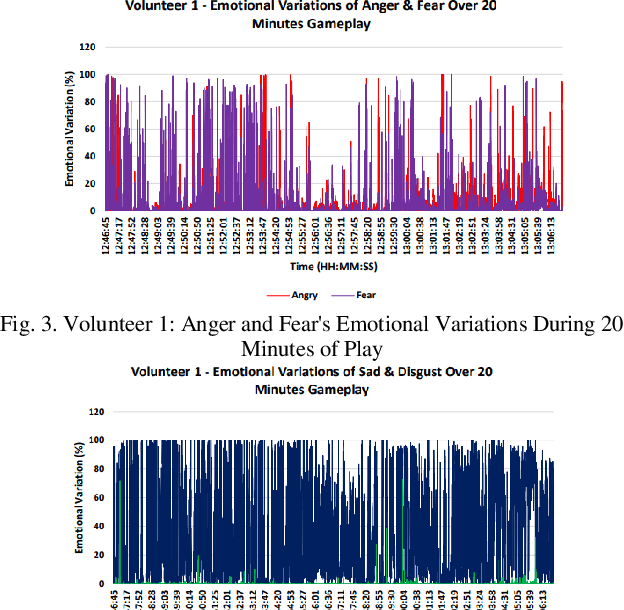

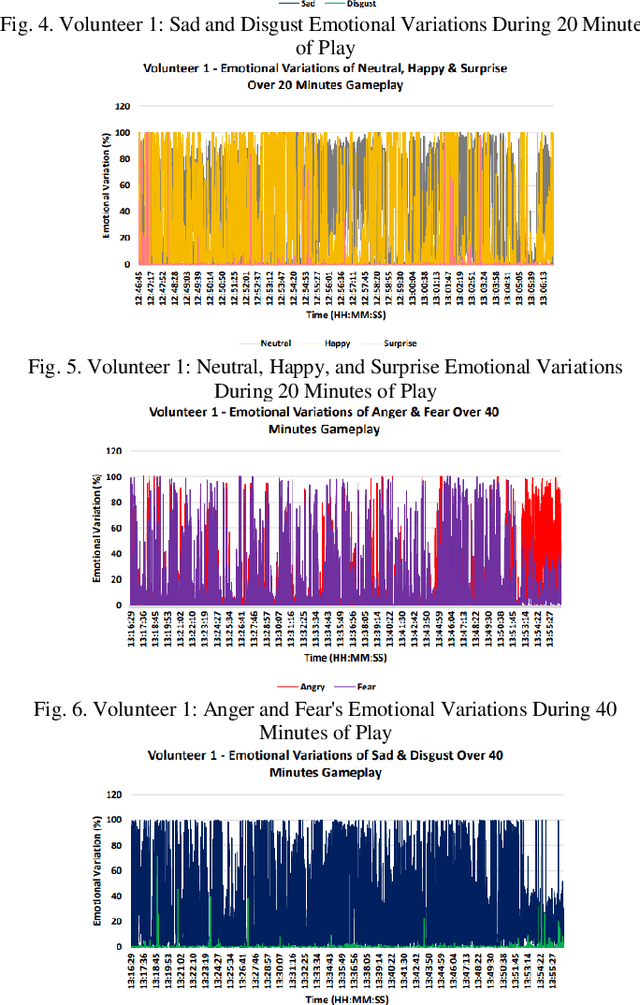

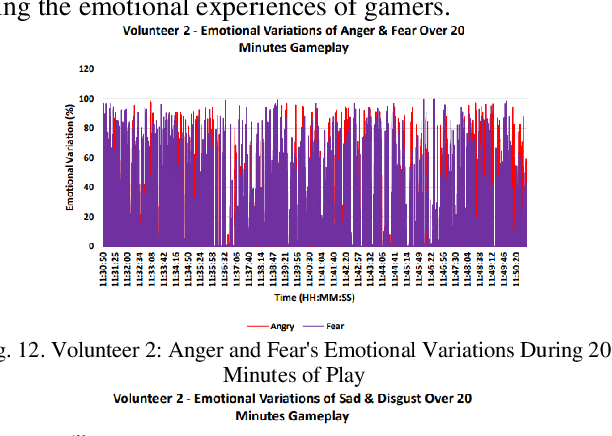

Abstract:Video games have played a crucial role in entertainment since their development in the 1970s, becoming even more prominent during the lockdown period when people were looking for ways to entertain them. However, at that time, players were unaware of the significant impact that playtime could have on their feelings. This has made it challenging for designers and developers to create new games since they have to control the emotional impact that these games will take on players. Thus, the purpose of this study is to look at how a player's emotions are affected by the duration of the game. In order to achieve this goal, a framework for emotion detection is created. According to the experiment's results, the volunteers' general ability to express emotions increased from 20 to 60 minutes. In comparison to shorter gameplay sessions, the experiment found that extended gameplay sessions did significantly affect the player's emotions. According to the results, it was recommended that in order to lessen the potential emotional impact that playing computer and video games may have in the future, game producers should think about creating shorter, entertaining games.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge