Unveiling the Impact of Macroeconomic Policies: A Double Machine Learning Approach to Analyzing Interest Rate Effects on Financial Markets

Paper and Code

Mar 31, 2024

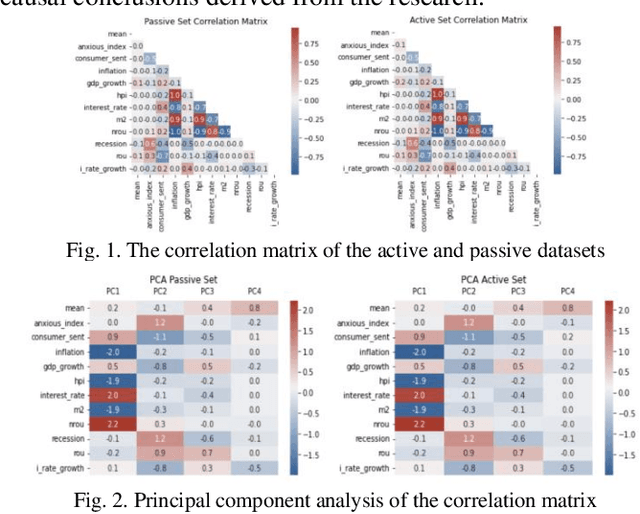

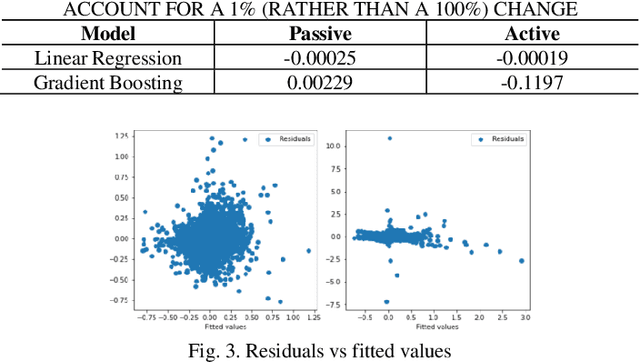

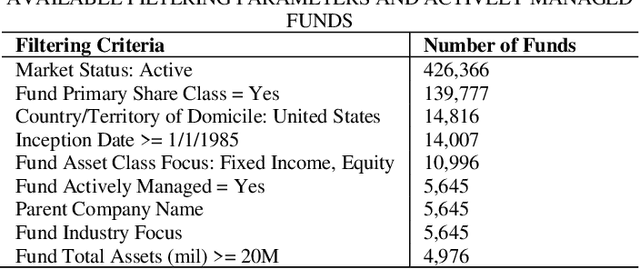

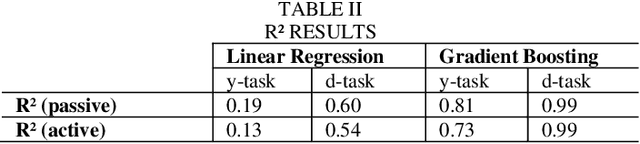

This study examines the effects of macroeconomic policies on financial markets using a novel approach that combines Machine Learning (ML) techniques and causal inference. It focuses on the effect of interest rate changes made by the US Federal Reserve System (FRS) on the returns of fixed income and equity funds between January 1986 and December 2021. The analysis makes a distinction between actively and passively managed funds, hypothesizing that the latter are less susceptible to changes in interest rates. The study contrasts gradient boosting and linear regression models using the Double Machine Learning (DML) framework, which supports a variety of statistical learning techniques. Results indicate that gradient boosting is a useful tool for predicting fund returns; for example, a 1% increase in interest rates causes an actively managed fund's return to decrease by -11.97%. This understanding of the relationship between interest rates and fund performance provides opportunities for additional research and insightful, data-driven advice for fund managers and investors

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge