Seyed Soroush Karimi Madahi

Predicting and Publishing Accurate Imbalance Prices Using Monte Carlo Tree Search

Nov 06, 2024Abstract:The growing reliance on renewable energy sources, particularly solar and wind, has introduced challenges due to their uncontrollable production. This complicates maintaining the electrical grid balance, prompting some transmission system operators in Western Europe to implement imbalance tariffs that penalize unsustainable power deviations. These tariffs create an implicit demand response framework to mitigate grid instability. Yet, several challenges limit active participation. In Belgium, for example, imbalance prices are only calculated at the end of each 15-minute settlement period, creating high risk due to price uncertainty. This risk is further amplified by the inherent volatility of imbalance prices, discouraging participation. Although transmission system operators provide minute-based price predictions, the system imbalance volatility makes accurate price predictions challenging to obtain and requires sophisticated techniques. Moreover, publishing price estimates can prompt participants to adjust their schedules, potentially affecting the system balance and the final price, adding further complexity. To address these challenges, we propose a Monte Carlo Tree Search method that publishes accurate imbalance prices while accounting for potential response actions. Our approach models the system dynamics using a neural network forecaster and a cluster of virtual batteries controlled by reinforcement learning agents. Compared to Belgium's current publication method, our technique improves price accuracy by 20.4% under ideal conditions and by 12.8% in more realistic scenarios. This research addresses an unexplored, yet crucial problem, positioning this paper as a pioneering work in analyzing the potential of more advanced imbalance price publishing techniques.

Control Policy Correction Framework for Reinforcement Learning-based Energy Arbitrage Strategies

Apr 30, 2024

Abstract:A continuous rise in the penetration of renewable energy sources, along with the use of the single imbalance pricing, provides a new opportunity for balance responsible parties to reduce their cost through energy arbitrage in the imbalance settlement mechanism. Model-free reinforcement learning (RL) methods are an appropriate choice for solving the energy arbitrage problem due to their outstanding performance in solving complex stochastic sequential problems. However, RL is rarely deployed in real-world applications since its learned policy does not necessarily guarantee safety during the execution phase. In this paper, we propose a new RL-based control framework for batteries to obtain a safe energy arbitrage strategy in the imbalance settlement mechanism. In our proposed control framework, the agent initially aims to optimize the arbitrage revenue. Subsequently, in the post-processing step, we correct (constrain) the learned policy following a knowledge distillation process based on properties that follow human intuition. Our post-processing step is a generic method and is not restricted to the energy arbitrage domain. We use the Belgian imbalance price of 2023 to evaluate the performance of our proposed framework. Furthermore, we deploy our proposed control framework on a real battery to show its capability in the real world.

Distill2Explain: Differentiable decision trees for explainable reinforcement learning in energy application controllers

Mar 18, 2024Abstract:Demand-side flexibility is gaining importance as a crucial element in the energy transition process. Accounting for about 25% of final energy consumption globally, the residential sector is an important (potential) source of energy flexibility. However, unlocking this flexibility requires developing a control framework that (1) easily scales across different houses, (2) is easy to maintain, and (3) is simple to understand for end-users. A potential control framework for such a task is data-driven control, specifically model-free reinforcement learning (RL). Such RL-based controllers learn a good control policy by interacting with their environment, learning purely based on data and with minimal human intervention. Yet, they lack explainability, which hampers user acceptance. Moreover, limited hardware capabilities of residential assets forms a hurdle (e.g., using deep neural networks). To overcome both those challenges, we propose a novel method to obtain explainable RL policies by using differentiable decision trees. Using a policy distillation approach, we train these differentiable decision trees to mimic standard RL-based controllers, leading to a decision tree-based control policy that is data-driven and easy to explain. As a proof-of-concept, we examine the performance and explainability of our proposed approach in a battery-based home energy management system to reduce energy costs. For this use case, we show that our proposed approach can outperform baseline rule-based policies by about 20-25%, while providing simple, explainable control policies. We further compare these explainable policies with standard RL policies and examine the performance trade-offs associated with this increased explainability.

Distributional Reinforcement Learning-based Energy Arbitrage Strategies in Imbalance Settlement Mechanism

Dec 23, 2023

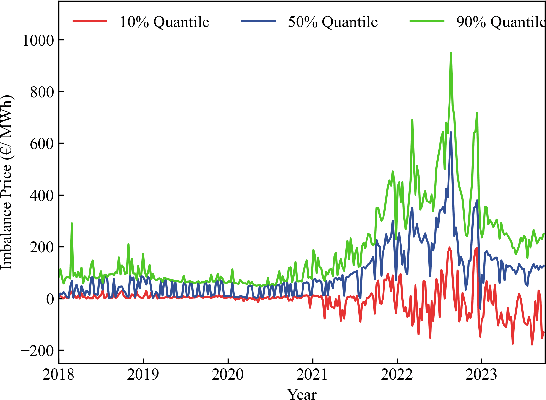

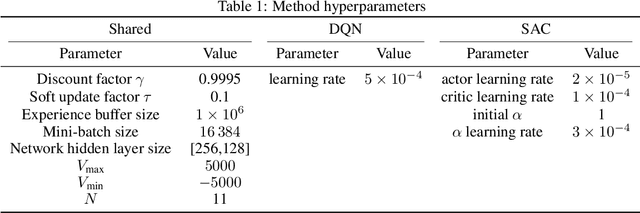

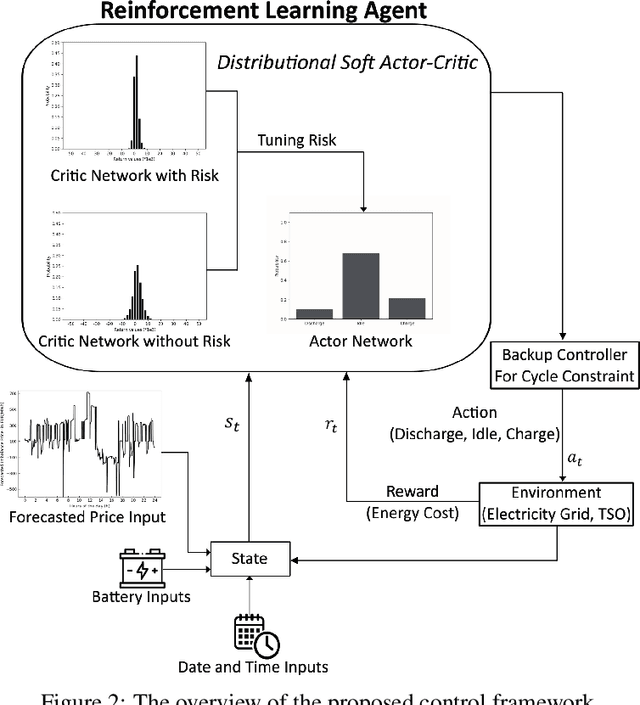

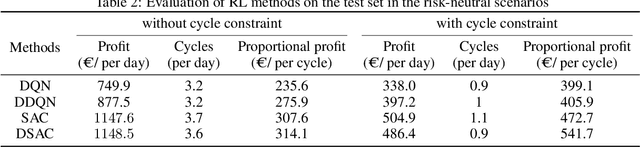

Abstract:Growth in the penetration of renewable energy sources makes supply more uncertain and leads to an increase in the system imbalance. This trend, together with the single imbalance pricing, opens an opportunity for balance responsible parties (BRPs) to perform energy arbitrage in the imbalance settlement mechanism. To this end, we propose a battery control framework based on distributional reinforcement learning (DRL). Our proposed control framework takes a risk-sensitive perspective, allowing BRPs to adjust their risk preferences: we aim to optimize a weighted sum of the arbitrage profit and a risk measure while constraining the daily number of cycles for the battery. We assess the performance of our proposed control framework using the Belgian imbalance prices of 2022 and compare two state-of-the-art RL methods, deep Q learning and soft actor-critic. Results reveal that the distributional soft actor-critic method can outperform other methods. Moreover, we note that our fully risk-averse agent appropriately learns to hedge against the risk related to the unknown imbalance price by (dis)charging the battery only when the agent is more certain about the price.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge