Qibing Li

Semi-supervised Learning Meets Factorization: Learning to Recommend with Chain Graph Model

Mar 05, 2020

Abstract:Recently latent factor model (LFM) has been drawing much attention in recommender systems due to its good performance and scalability. However, existing LFMs predict missing values in a user-item rating matrix only based on the known ones, and thus the sparsity of the rating matrix always limits their performance. Meanwhile, semi-supervised learning (SSL) provides an effective way to alleviate the label (i.e., rating) sparsity problem by performing label propagation, which is mainly based on the smoothness insight on affinity graphs. However, graph-based SSL suffers serious scalability and graph unreliable problems when directly being applied to do recommendation. In this paper, we propose a novel probabilistic chain graph model (CGM) to marry SSL with LFM. The proposed CGM is a combination of Bayesian network and Markov random field. The Bayesian network is used to model the rating generation and regression procedures, and the Markov random field is used to model the confidence-aware smoothness constraint between the generated ratings. Experimental results show that our proposed CGM significantly outperforms the state-of-the-art approaches in terms of four evaluation metrics, and with a larger performance margin when data sparsity increases.

FinBrain: When Finance Meets AI 2.0

Aug 26, 2018

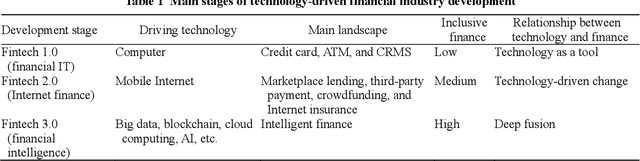

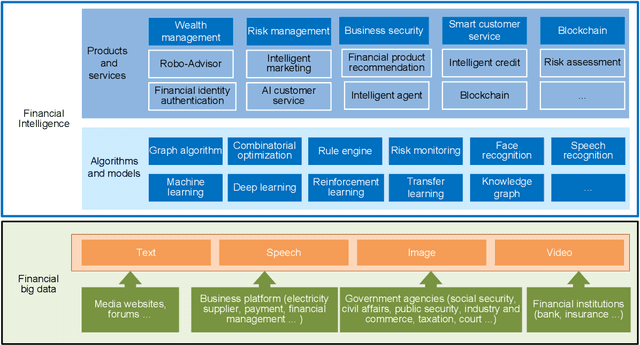

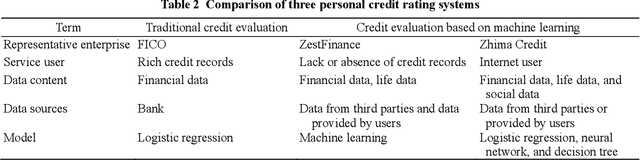

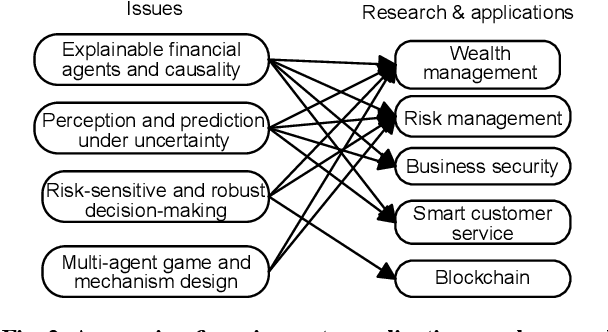

Abstract:Artificial intelligence (AI) is the core technology of technological revolution and industrial transformation. As one of the new intelligent needs in the AI 2.0 era, financial intelligence has elicited much attention from the academia and industry. In our current dynamic capital market, financial intelligence demonstrates a fast and accurate machine learning capability to handle complex data and has gradually acquired the potential to become a "financial brain". In this work, we survey existing studies on financial intelligence. First, we describe the concept of financial intelligence and elaborate on its position in the financial technology field. Second, we introduce the development of financial intelligence and review state-of-the-art techniques in wealth management, risk management, financial security, financial consulting, and blockchain. Finally, we propose a research framework called FinBrain and summarize four open issues, namely, explainable financial agents and causality, perception and prediction under uncertainty, risk-sensitive and robust decision making, and multi-agent game and mechanism design. We believe that these research directions can lay the foundation for the development of AI 2.0 in the finance field.

* 11 pages

Collaborative Autoencoder for Recommender Systems

Jan 30, 2018

Abstract:In recent years, deep neural networks have yielded state-of-the-art performance on several tasks. Although some recent works have focused on combining deep learning with recommendation, we highlight three issues of existing works. First, most works perform deep content feature learning and resort to matrix factorization, which cannot effectively model the highly complex user-item interaction function. Second, due to the difficulty on training deep neural networks, existing models utilize a shallow architecture, and thus limit the expressive potential of deep learning. Third, neural network models are easy to overfit on the implicit setting, because negative interactions are not taken into account. To tackle these issues, we present a generic recommender framework called Neural Collaborative Autoencoder (NCAE) to perform collaborative filtering, which works well for both explicit feedback and implicit feedback. NCAE can effectively capture the relationship between interactions via a non-linear matrix factorization process. To optimize the deep architecture of NCAE, we develop a three-stage pre-training mechanism that combines supervised and unsupervised feature learning. Moreover, to prevent overfitting on the implicit setting, we propose an error reweighting module and a sparsity-aware data-augmentation strategy. Extensive experiments on three real-world datasets demonstrate that NCAE can significantly advance the state-of-the-art.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge