Pradip Mainali

ExMo: Explainable AI Model using Inverse Frequency Decision Rules

May 20, 2022Abstract:In this paper, we present a novel method to compute decision rules to build a more accurate interpretable machine learning model, denoted as ExMo. The ExMo interpretable machine learning model consists of a list of IF...THEN... statements with a decision rule in the condition. This way, ExMo naturally provides an explanation for a prediction using the decision rule that was triggered. ExMo uses a new approach to extract decision rules from the training data using term frequency-inverse document frequency (TF-IDF) features. With TF-IDF, decision rules with feature values that are more relevant to each class are extracted. Hence, the decision rules obtained by ExMo can distinguish the positive and negative classes better than the decision rules used in the existing Bayesian Rule List (BRL) algorithm, obtained using the frequent pattern mining approach. The paper also shows that ExMo learns a qualitatively better model than BRL. Furthermore, ExMo demonstrates that the textual explanation can be provided in a human-friendly way so that the explanation can be easily understood by non-expert users. We validate ExMo on several datasets with different sizes to evaluate its efficacy. Experimental validation on a real-world fraud detection application shows that ExMo is 20% more accurate than BRL and that it achieves accuracy similar to those of deep learning models.

Explainable Machine Learning for Fraud Detection

May 13, 2021

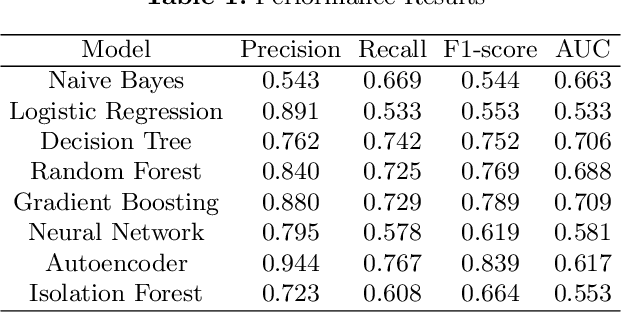

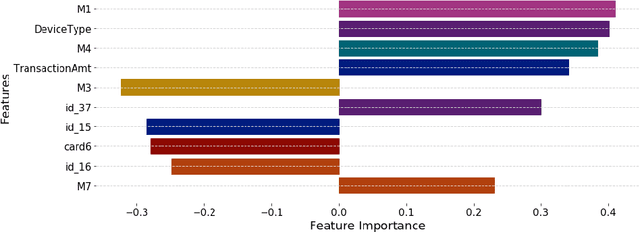

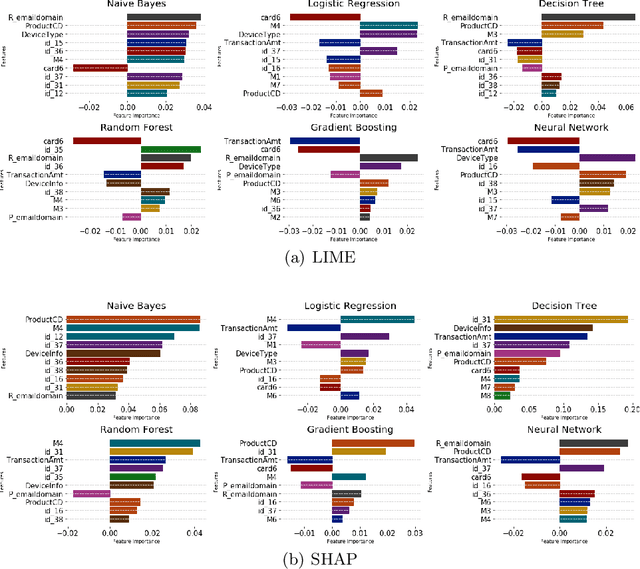

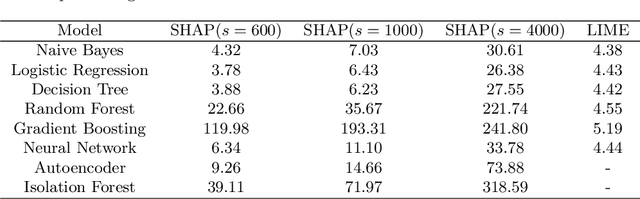

Abstract:The application of machine learning to support the processing of large datasets holds promise in many industries, including financial services. However, practical issues for the full adoption of machine learning remain with the focus being on understanding and being able to explain the decisions and predictions made by complex models. In this paper, we explore explainability methods in the domain of real-time fraud detection by investigating the selection of appropriate background datasets and runtime trade-offs on both supervised and unsupervised models.

Providing Confidential Cloud-based Fall Detection from Remote Sensor Data Using Multi-Party Computation

Apr 22, 2019

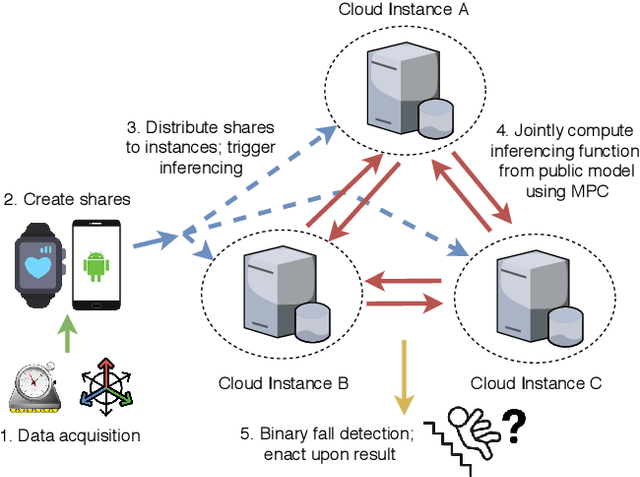

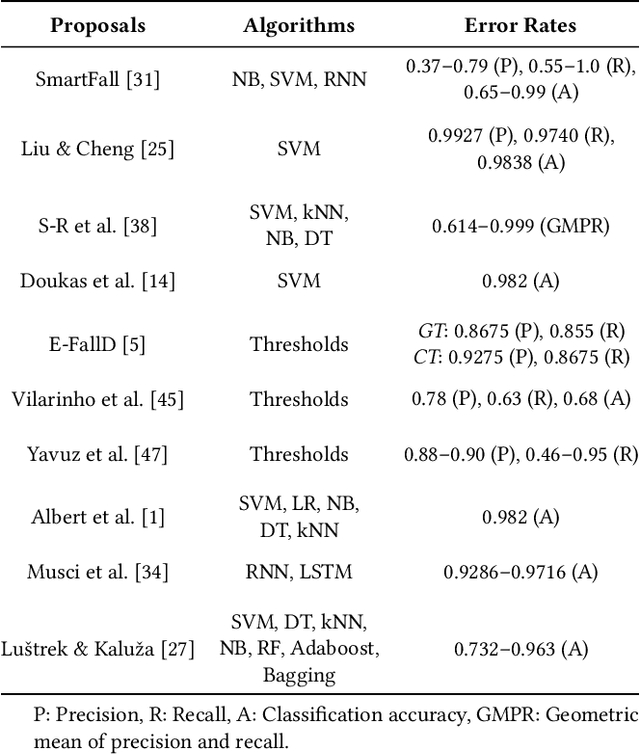

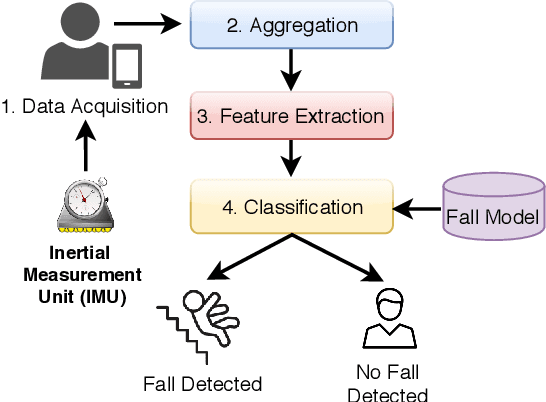

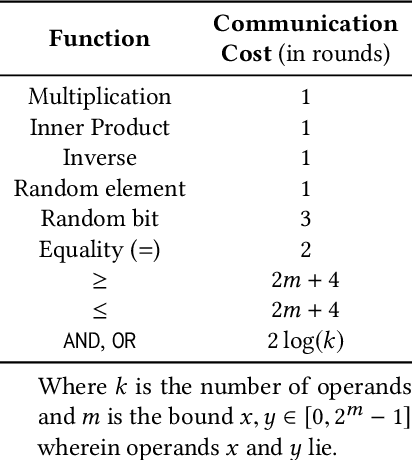

Abstract:Fall detection systems are concerned with rapidly detecting the occurrence of falls from elderly and disabled users using data from a body-worn inertial measurement unit (IMU), which is typically used in conjunction with machine learning-based classification. Such systems, however, necessitate the collection of high-resolution measurements that can violate users' privacy, such as revealing their gait, activities of daily living (ADLs), and relative position using dead reckoning. In this paper, for the first time, we present the design, implementation and evaluation of applying multi-party computation (MPC) to IMU-based fall detection for assuring the confidentiality of device measurements. The system is evaluated in a cloud-based setting that precludes parties from learning the underlying data using three parties deployed in geographically disparate locations in three cloud configurations. Using a publicly-available dataset comprising fall data from real-world users, we explore the applicability of derivative-based features to mitigate the complexity of MPC-based operations in a state-of-the-art fall detection system. We demonstrate that MPC-based fall detection from IMU measurements is both feasible and practical, executing in 365.2 milliseconds, which falls well below the required time window for on-device data acquisition (750ms).

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge