Philip Nadler

A Scalable Inference Method For Large Dynamic Economic Systems

Oct 27, 2021

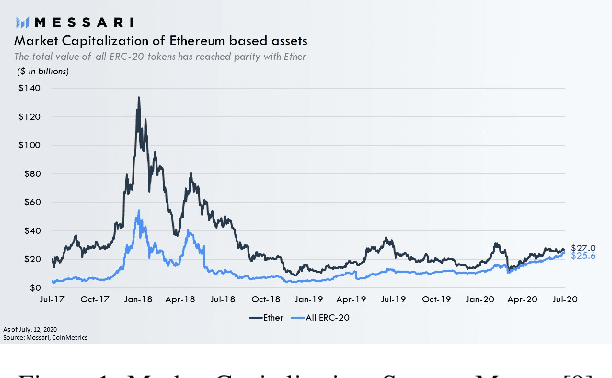

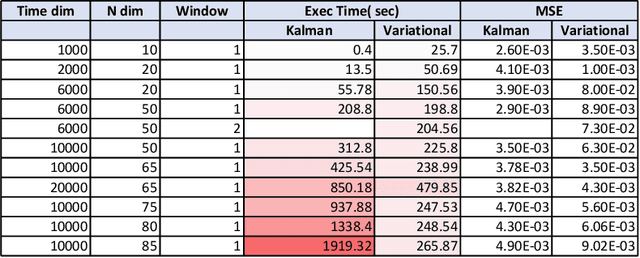

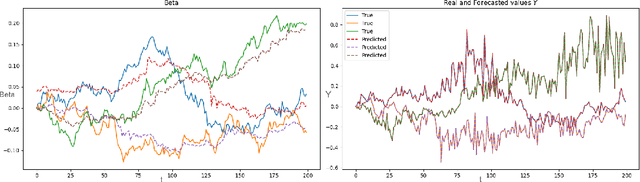

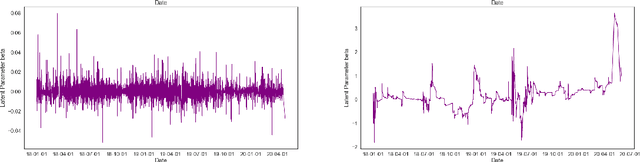

Abstract:The nature of available economic data has changed fundamentally in the last decade due to the economy's digitisation. With the prevalence of often black box data-driven machine learning methods, there is a necessity to develop interpretable machine learning methods that can conduct econometric inference, helping policymakers leverage the new nature of economic data. We therefore present a novel Variational Bayesian Inference approach to incorporate a time-varying parameter auto-regressive model which is scalable for big data. Our model is applied to a large blockchain dataset containing prices, transactions of individual actors, analyzing transactional flows and price movements on a very granular level. The model is extendable to any dataset which can be modelled as a dynamical system. We further improve the simple state-space modelling by introducing non-linearities in the forward model with the help of machine learning architectures.

Protecting Retail Investors from Order Book Spoofing using a GRU-based Detection Model

Oct 08, 2021

Abstract:Market manipulation is tackled through regulation in traditional markets because of its detrimental effect on market efficiency and many participating financial actors. The recent increase of private retail investors due to new low-fee platforms and new asset classes such as decentralised digital currencies has increased the number of vulnerable actors due to lack of institutional sophistication and strong regulation. This paper proposes a method to detect illicit activity and inform investors on spoofing attempts, a well-known market manipulation technique. Our framework is based on a highly extendable Gated Recurrent Unit (GRU) model and allows the inclusion of market variables that can explain spoofing and potentially other illicit activities. The model is tested on granular order book data, in one of the most unregulated markets prone to spoofing with a large number of non-institutional traders. The results show that the model is performing well in an early detection context, allowing the identification of spoofing attempts soon enough to allow investors to react. This is the first step to a fully comprehensive model that will protect investors in various unregulated trading environments and regulators to identify illicit activity.

An Epidemiological Modelling Approach for Covid19 via Data Assimilation

Apr 25, 2020

Abstract:The global pandemic of the 2019-nCov requires the evaluation of policy interventions to mitigate future social and economic costs of quarantine measures worldwide. We propose an epidemiological model for forecasting and policy evaluation which incorporates new data in real-time through variational data assimilation. We analyze and discuss infection rates in China, the US and Italy. In particular, we develop a custom compartmental SIR model fit to variables related to the epidemic in Chinese cities, named SITR model. We compare and discuss model results which conducts updates as new observations become available. A hybrid data assimilation approach is applied to make results robust to initial conditions. We use the model to do inference on infection numbers as well as parameters such as the disease transmissibility rate or the rate of recovery. The parameterisation of the model is parsimonious and extendable, allowing for the incorporation of additional data and parameters of interest. This allows for scalability and the extension of the model to other locations or the adaption of novel data sources.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge