Petrônio Cândido de Lima e Silva

Time Series Forecasting Using Fuzzy Cognitive Maps: A Survey

Jan 10, 2022

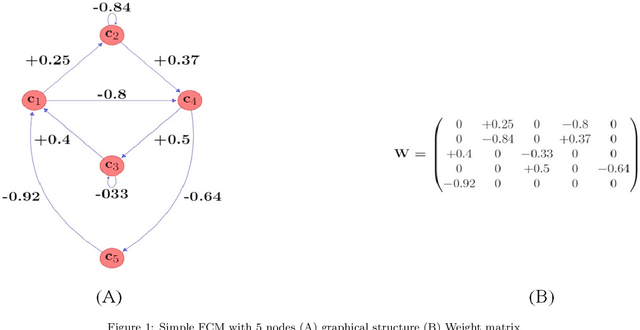

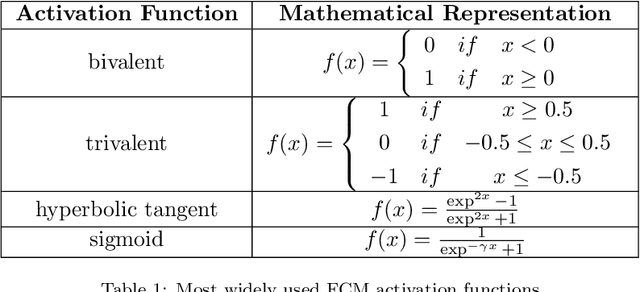

Abstract:Among various soft computing approaches for time series forecasting, Fuzzy Cognitive Maps (FCM) have shown remarkable results as a tool to model and analyze the dynamics of complex systems. FCM have similarities to recurrent neural networks and can be classified as a neuro-fuzzy method. In other words, FCMs are a mixture of fuzzy logic, neural network, and expert system aspects, which act as a powerful tool for simulating and studying the dynamic behavior of complex systems. The most interesting features are knowledge interpretability, dynamic characteristics and learning capability. The goal of this survey paper is mainly to present an overview on the most relevant and recent FCM-based time series forecasting models proposed in the literature. In addition, this article considers an introduction on the fundamentals of FCM model and learning methodologies. Also, this survey provides some ideas for future research to enhance the capabilities of FCM in order to cover some challenges in the real-world experiments such as handling non-stationary data and scalability issues. Moreover, equipping FCMs with fast learning algorithms is one of the major concerns in this area.

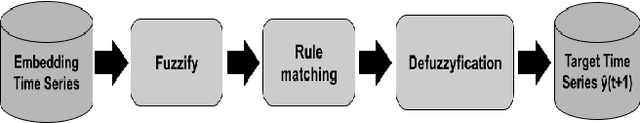

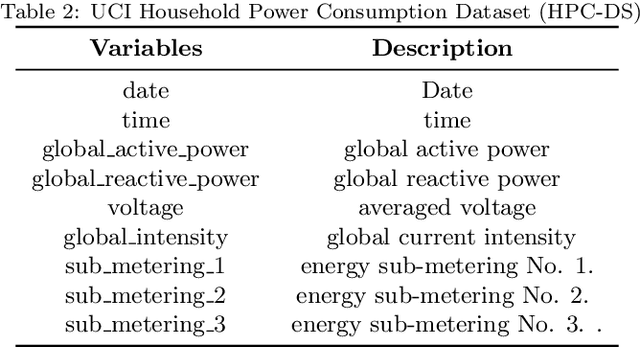

Combining Embeddings and Fuzzy Time Series for High-Dimensional Time Series Forecasting in Internet of Energy Applications

Dec 03, 2021

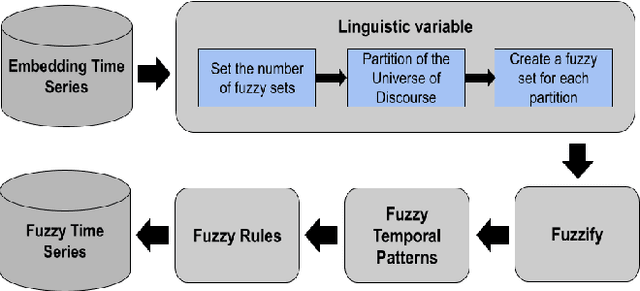

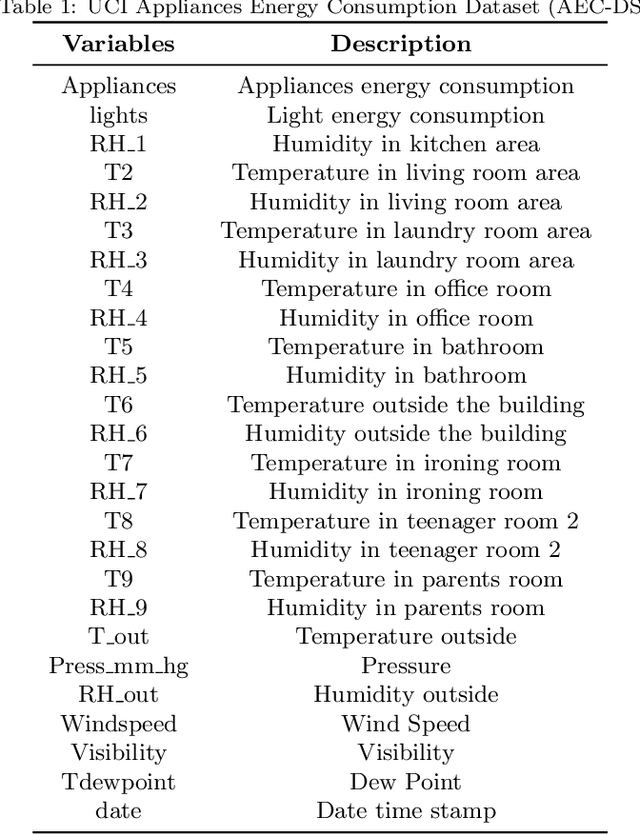

Abstract:The prediction of residential power usage is essential in assisting a smart grid to manage and preserve energy to ensure efficient use. An accurate energy forecasting at the customer level will reflect directly into efficiency improvements across the power grid system, however forecasting building energy use is a complex task due to many influencing factors, such as meteorological and occupancy patterns. In addiction, high-dimensional time series increasingly arise in the Internet of Energy (IoE), given the emergence of multi-sensor environments and the two way communication between energy consumers and the smart grid. Therefore, methods that are capable of computing high-dimensional time series are of great value in smart building and IoE applications. Fuzzy Time Series (FTS) models stand out as data-driven non-parametric models of easy implementation and high accuracy. Unfortunately, the existing FTS models can be unfeasible if all features were used to train the model. We present a new methodology for handling high-dimensional time series, by projecting the original high-dimensional data into a low dimensional embedding space and using multivariate FTS approach in this low dimensional representation. Combining these techniques enables a better representation of the complex content of multivariate time series and more accurate forecasts.

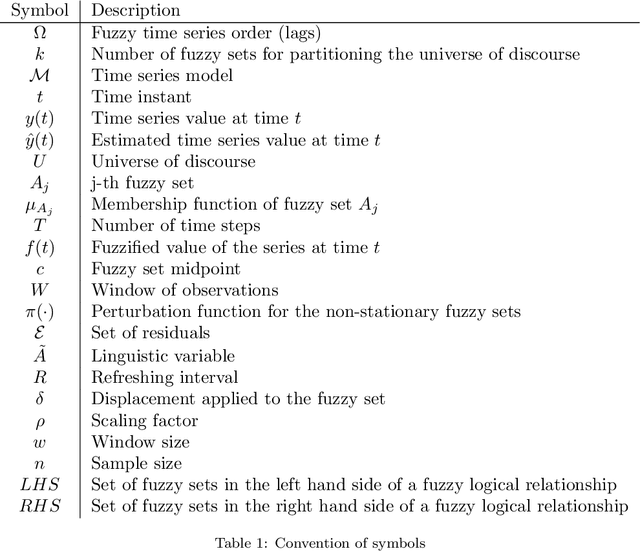

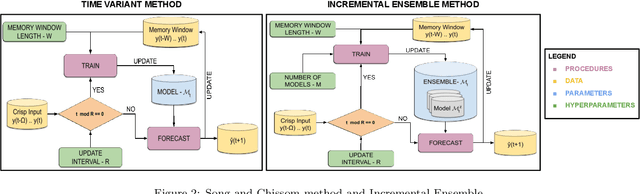

Forecasting in Non-stationary Environments with Fuzzy Time Series

Apr 27, 2020

Abstract:In this paper we introduce a Non-Stationary Fuzzy Time Series (NSFTS) method with time varying parameters adapted from the distribution of the data. In this approach, we employ Non-Stationary Fuzzy Sets, in which perturbation functions are used to adapt the membership function parameters in the knowledge base in response to statistical changes in the time series. The proposed method is capable of dynamically adapting its fuzzy sets to reflect the changes in the stochastic process based on the residual errors, without the need to retraining the model. This method can handle non-stationary and heteroskedastic data as well as scenarios with concept-drift. The proposed approach allows the model to be trained only once and remain useful long after while keeping reasonable accuracy. The flexibility of the method by means of computational experiments was tested with eight synthetic non-stationary time series data with several kinds of concept drifts, four real market indices (Dow Jones, NASDAQ, SP500 and TAIEX), three real FOREX pairs (EUR-USD, EUR-GBP, GBP-USD), and two real cryptocoins exchange rates (Bitcoin-USD and Ethereum-USD). As competitor models the Time Variant fuzzy time series and the Incremental Ensemble were used, these are two of the major approaches for handling non-stationary data sets. Non-parametric tests are employed to check the significance of the results. The proposed method shows resilience to concept drift, by adapting parameters of the model, while preserving the symbolic structure of the knowledge base.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge