Paolo Tasca

LLM-Powered Multi-Agent System for Automated Crypto Portfolio Management

Jan 07, 2025

Abstract:Cryptocurrency investment is inherently difficult due to its shorter history compared to traditional assets, the need to integrate vast amounts of data from various modalities, and the requirement for complex reasoning. While deep learning approaches have been applied to address these challenges, their black-box nature raises concerns about trust and explainability. Recently, large language models (LLMs) have shown promise in financial applications due to their ability to understand multi-modal data and generate explainable decisions. However, single LLM faces limitations in complex, comprehensive tasks such as asset investment. These limitations are even more pronounced in cryptocurrency investment, where LLMs have less domain-specific knowledge in their training corpora. To overcome these challenges, we propose an explainable, multi-modal, multi-agent framework for cryptocurrency investment. Our framework uses specialized agents that collaborate within and across teams to handle subtasks such as data analysis, literature integration, and investment decision-making for the top 30 cryptocurrencies by market capitalization. The expert training module fine-tunes agents using multi-modal historical data and professional investment literature, while the multi-agent investment module employs real-time data to make informed cryptocurrency investment decisions. Unique intrateam and interteam collaboration mechanisms enhance prediction accuracy by adjusting final predictions based on confidence levels within agent teams and facilitating information sharing between teams. Empirical evaluation using data from November 2023 to September 2024 demonstrates that our framework outperforms single-agent models and market benchmarks in classification, asset pricing, portfolio, and explainability performance.

Evolution of ESG-focused DLT Research: An NLP Analysis of the Literature

Aug 23, 2023

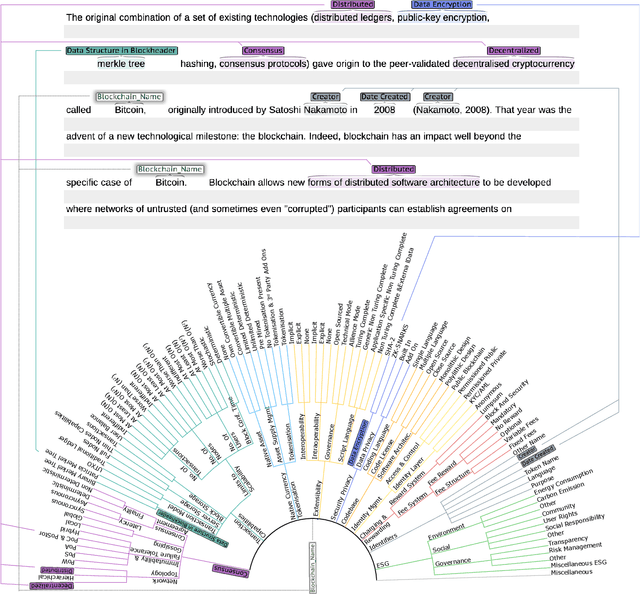

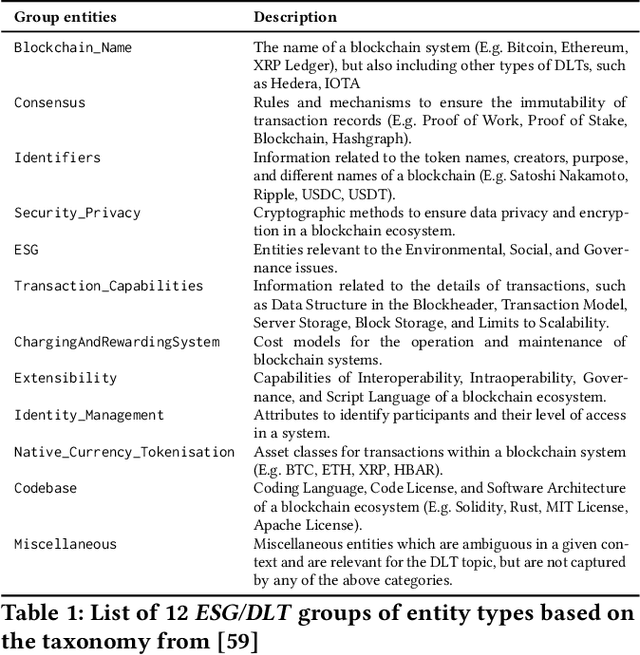

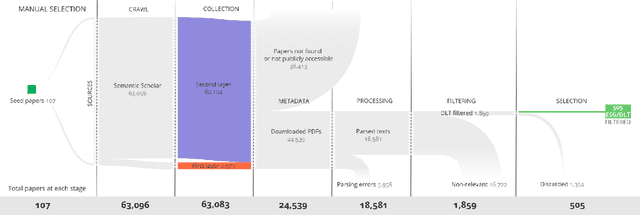

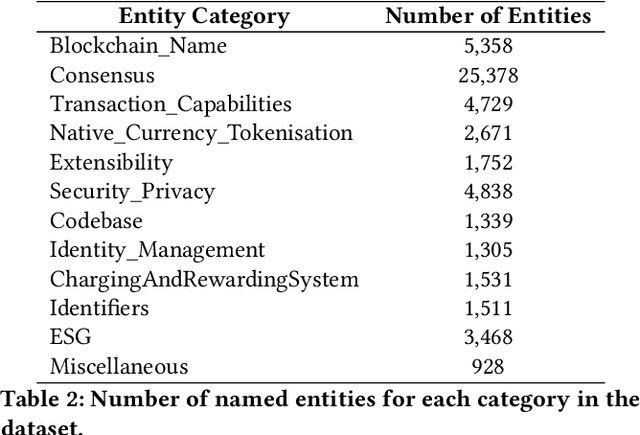

Abstract:Distributed Ledger Technologies (DLTs) have rapidly evolved, necessitating comprehensive insights into their diverse components. However, a systematic literature review that emphasizes the Environmental, Sustainability, and Governance (ESG) components of DLT remains lacking. To bridge this gap, we selected 107 seed papers to build a citation network of 63,083 references and refined it to a corpus of 24,539 publications for analysis. Then, we labeled the named entities in 46 papers according to twelve top-level categories derived from an established technology taxonomy and enhanced the taxonomy by pinpointing DLT's ESG elements. Leveraging transformer-based language models, we fine-tuned a pre-trained language model for a Named Entity Recognition (NER) task using our labeled dataset. We used our fine-tuned language model to distill the corpus to 505 key papers, facilitating a literature review via named entities and temporal graph analysis on DLT evolution in the context of ESG. Our contributions are a methodology to conduct a machine learning-driven systematic literature review in the DLT field, placing a special emphasis on ESG aspects. Furthermore, we present a first-of-its-kind NER dataset, composed of 54,808 named entities, designed for DLT and ESG-related explorations.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge