Mufhumudzi Muthivhi

BiCoRec: Bias-Mitigated Context-Aware Sequential Recommendation Model

Dec 15, 2025Abstract:Sequential recommendation models aim to learn from users evolving preferences. However, current state-of-the-art models suffer from an inherent popularity bias. This study developed a novel framework, BiCoRec, that adaptively accommodates users changing preferences for popular and niche items. Our approach leverages a co-attention mechanism to obtain a popularity-weighted user sequence representation, facilitating more accurate predictions. We then present a new training scheme that learns from future preferences using a consistency loss function. BiCoRec aimed to improve the recommendation performance of users who preferred niche items. For these users, BiCoRec achieves a 26.00% average improvement in NDCG@10 over state-of-the-art baselines. When ranking the relevant item against the entire collection, BiCoRec achieves NDCG@10 scores of 0.0102, 0.0047, 0.0021, and 0.0005 for the Movies, Fashion, Games and Music datasets.

Wildlife Target Re-Identification Using Self-supervised Learning in Non-Urban Settings

Jul 03, 2025Abstract:Wildlife re-identification aims to match individuals of the same species across different observations. Current state-of-the-art (SOTA) models rely on class labels to train supervised models for individual classification. This dependence on annotated data has driven the curation of numerous large-scale wildlife datasets. This study investigates self-supervised learning Self-Supervised Learning (SSL) for wildlife re-identification. We automatically extract two distinct views of an individual using temporal image pairs from camera trap data without supervision. The image pairs train a self-supervised model from a potentially endless stream of video data. We evaluate the learnt representations against supervised features on open-world scenarios and transfer learning in various wildlife downstream tasks. The analysis of the experimental results shows that self-supervised models are more robust even with limited data. Moreover, self-supervised features outperform supervision across all downstream tasks. The code is available here https://github.com/pxpana/SSLWildlife.

Improving Wildlife Out-of-Distribution Detection: Africas Big Five

Jun 07, 2025Abstract:Mitigating human-wildlife conflict seeks to resolve unwanted encounters between these parties. Computer Vision provides a solution to identifying individuals that might escalate into conflict, such as members of the Big Five African animals. However, environments often contain several varied species. The current state-of-the-art animal classification models are trained under a closed-world assumption. They almost always remain overconfident in their predictions even when presented with unknown classes. This study investigates out-of-distribution (OOD) detection of wildlife, specifically the Big Five. To this end, we select a parametric Nearest Class Mean (NCM) and a non-parametric contrastive learning approach as baselines to take advantage of pretrained and projected features from popular classification encoders. Moreover, we compare our baselines to various common OOD methods in the literature. The results show feature-based methods reflect stronger generalisation capability across varying classification thresholds. Specifically, NCM with ImageNet pre-trained features achieves a 2%, 4% and 22% improvement on AUPR-IN, AUPR-OUT and AUTC over the best OOD methods, respectively. The code can be found here https://github.com/pxpana/BIG5OOD

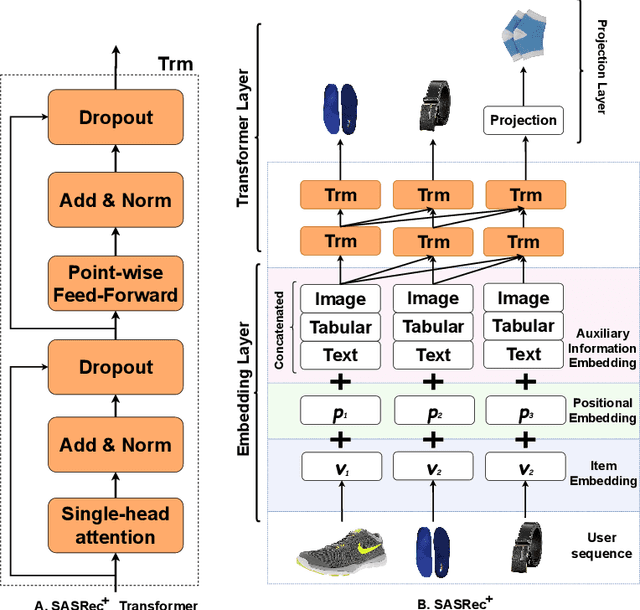

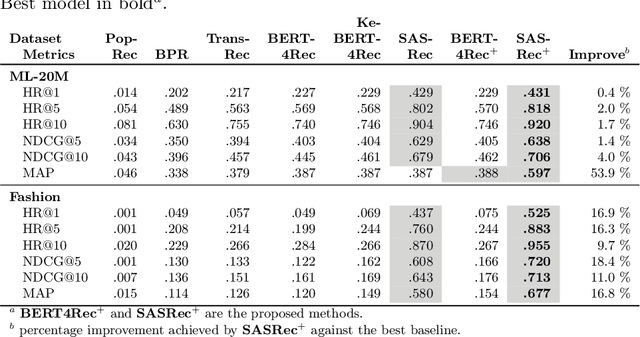

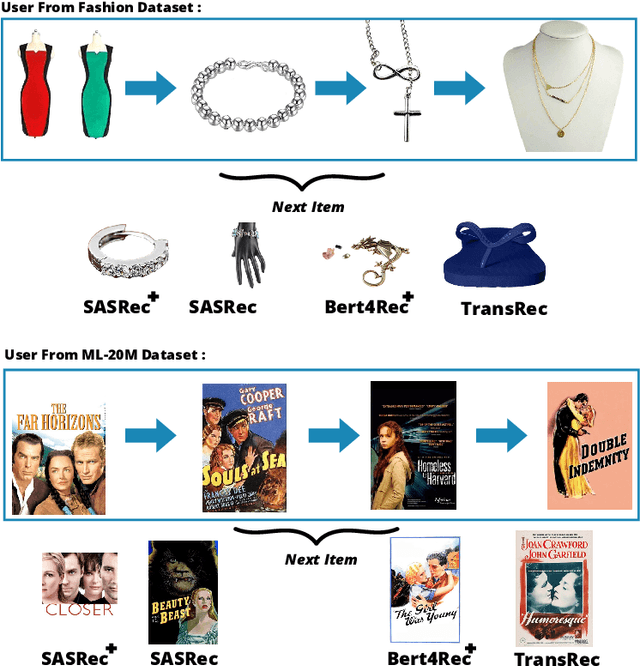

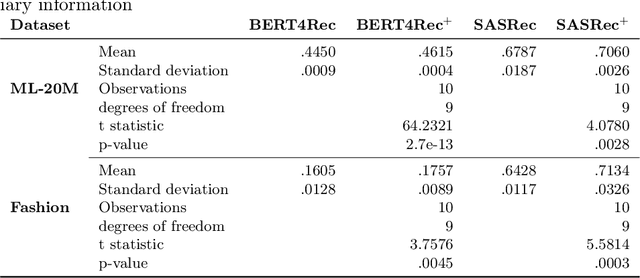

Multi-Modal Recommendation System with Auxiliary Information

Oct 13, 2022

Abstract:Context-aware recommendation systems improve upon classical recommender systems by including, in the modelling, a user's behaviour. Research into context-aware recommendation systems has previously only considered the sequential ordering of items as contextual information. However, there is a wealth of unexploited additional multi-modal information available in auxiliary knowledge related to items. This study extends the existing research by evaluating a multi-modal recommendation system that exploits the inclusion of comprehensive auxiliary knowledge related to an item. The empirical results explore extracting vector representations (embeddings) from unstructured and structured data using data2vec. The fused embeddings are then used to train several state-of-the-art transformer architectures for sequential user-item representations. The analysis of the experimental results shows a statistically significant improvement in prediction accuracy, which confirms the effectiveness of including auxiliary information in a context-aware recommendation system. We report a 4% and 11% increase in the NDCG score for long and short user sequence datasets, respectively.

Fusion of Sentiment and Asset Price Predictions for Portfolio Optimization

Mar 10, 2022

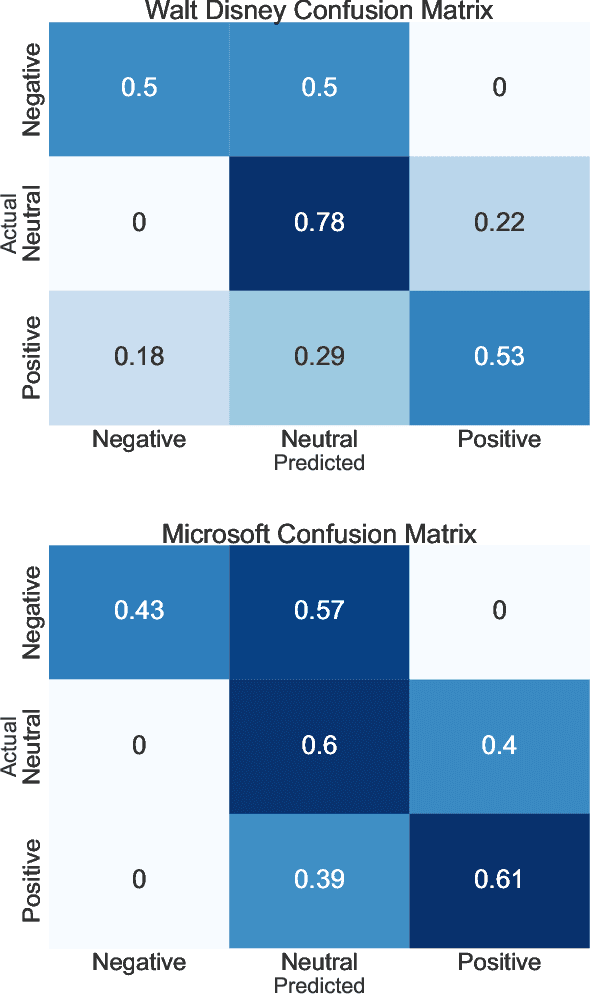

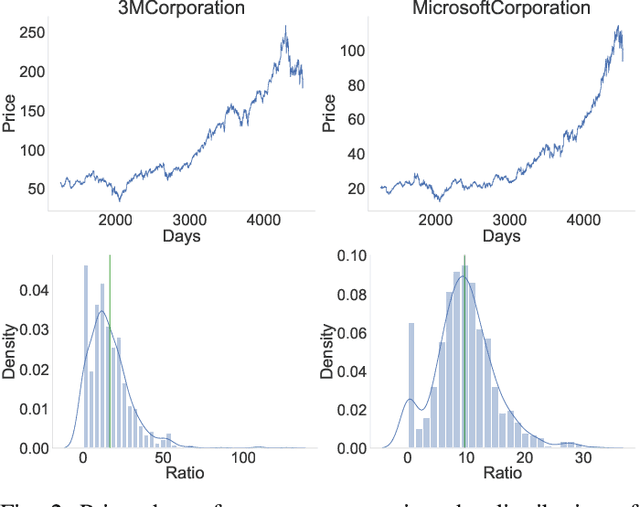

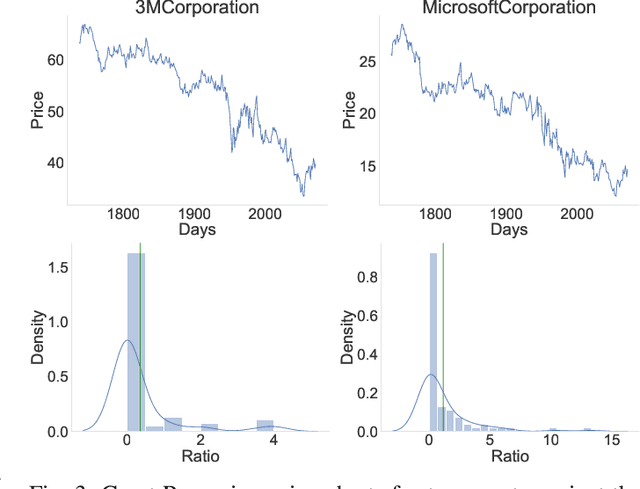

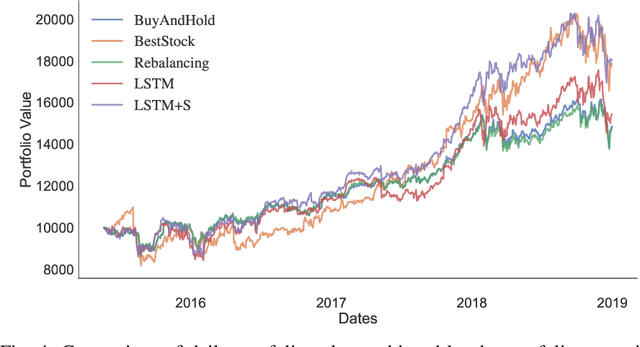

Abstract:The fusion of public sentiment data in the form of text with stock price prediction is a topic of increasing interest within the financial community. However, the research literature seldom explores the application of investor sentiment in the Portfolio Selection problem. This paper aims to unpack and develop an enhanced understanding of the sentiment aware portfolio selection problem. To this end, the study uses a Semantic Attention Model to predict sentiment towards an asset. We select the optimal portfolio through a sentiment-aware Long Short Term Memory (LSTM) recurrent neural network for price prediction and a mean-variance strategy. Our sentiment portfolio strategies achieved on average a significant increase in revenue above the non-sentiment aware models. However, the results show that our strategy does not outperform traditional portfolio allocation strategies from a stability perspective. We argue that an improved fusion of sentiment prediction with a combination of price prediction and portfolio optimization leads to an enhanced portfolio selection strategy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge