Michael Bücker

Fast Learning of Dynamic Hand Gesture Recognition with Few-Shot Learning Models

Dec 16, 2022

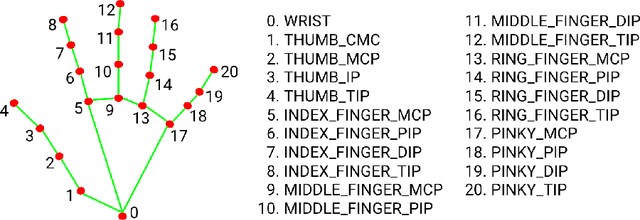

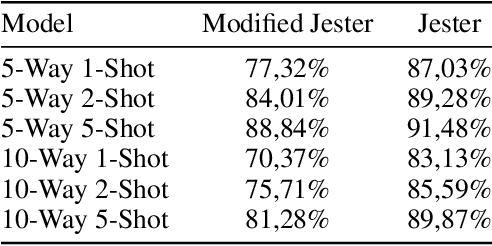

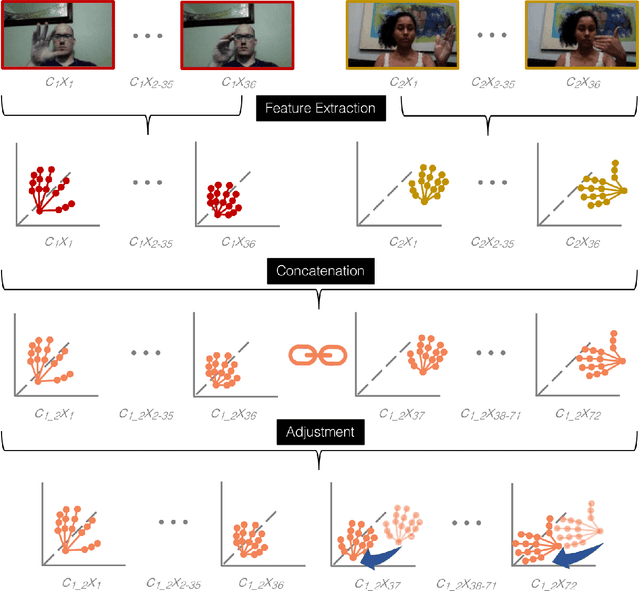

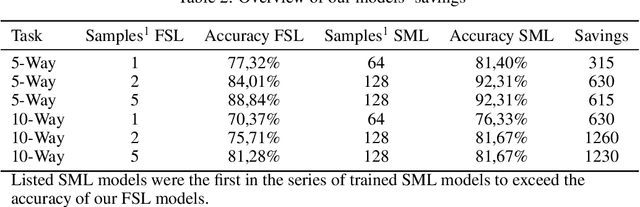

Abstract:We develop Few-Shot Learning models trained to recognize five or ten different dynamic hand gestures, respectively, which are arbitrarily interchangeable by providing the model with one, two, or five examples per hand gesture. All models were built in the Few-Shot Learning architecture of the Relation Network (RN), in which Long-Short-Term Memory cells form the backbone. The models use hand reference points extracted from RGB-video sequences of the Jester dataset which was modified to contain 190 different types of hand gestures. Result show accuracy of up to 88.8% for recognition of five and up to 81.2% for ten dynamic hand gestures. The research also sheds light on the potential effort savings of using a Few-Shot Learning approach instead of a traditional Deep Learning approach to detect dynamic hand gestures. Savings were defined as the number of additional observations required when a Deep Learning model is trained on new hand gestures instead of a Few Shot Learning model. The difference with respect to the total number of observations required to achieve approximately the same accuracy indicates potential savings of up to 630 observations for five and up to 1260 observations for ten hand gestures to be recognized. Since labeling video recordings of hand gestures implies significant effort, these savings can be considered substantial.

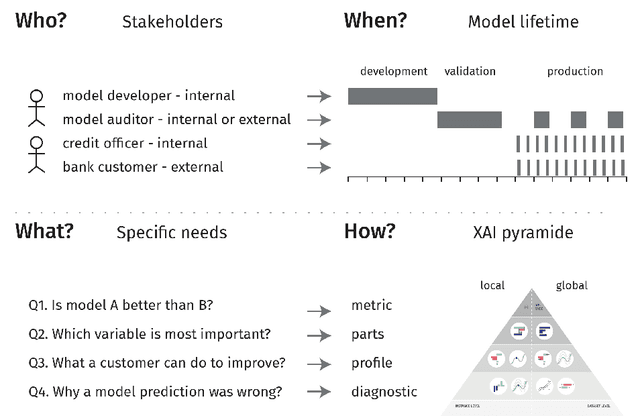

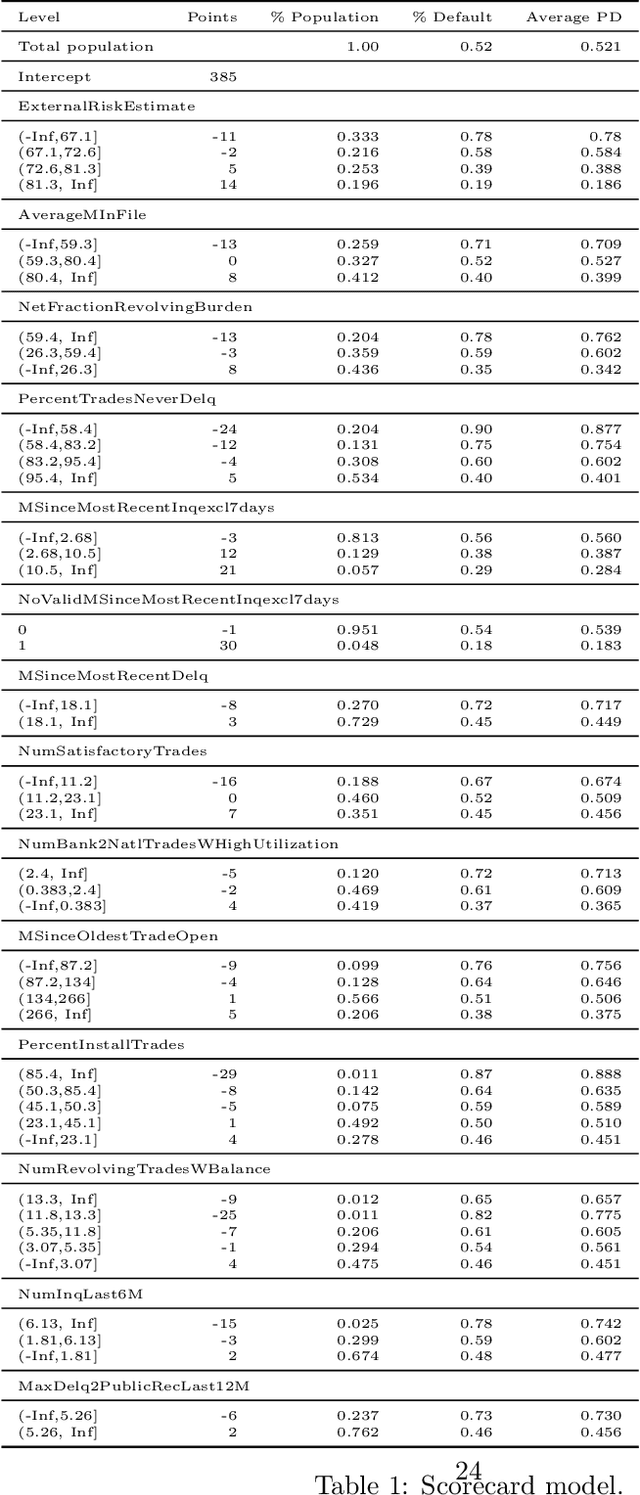

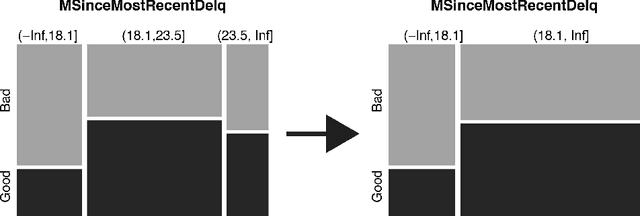

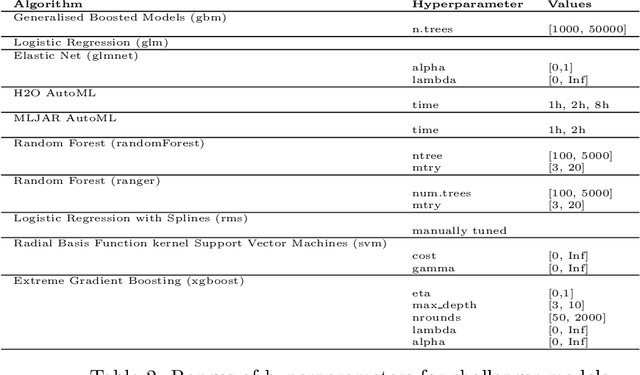

Transparency, Auditability and eXplainability of Machine Learning Models in Credit Scoring

Sep 28, 2020

Abstract:A major requirement for credit scoring models is to provide a maximally accurate risk prediction. Additionally, regulators demand these models to be transparent and auditable. Thus, in credit scoring, very simple predictive models such as logistic regression or decision trees are still widely used and the superior predictive power of modern machine learning algorithms cannot be fully leveraged. Significant potential is therefore missed, leading to higher reserves or more credit defaults. This paper works out different dimensions that have to be considered for making credit scoring models understandable and presents a framework for making ``black box'' machine learning models transparent, auditable and explainable. Following this framework, we present an overview of techniques, demonstrate how they can be applied in credit scoring and how results compare to the interpretability of score cards. A real world case study shows that a comparable degree of interpretability can be achieved while machine learning techniques keep their ability to improve predictive power.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge