Maoyi Xie

DeFiScope: Detecting Various DeFi Price Manipulations with LLM Reasoning

Feb 17, 2025

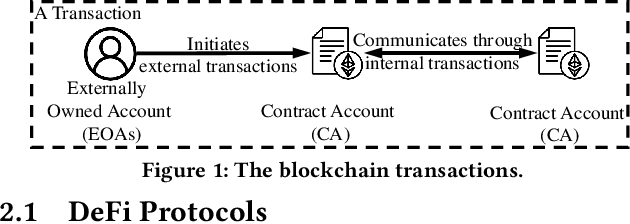

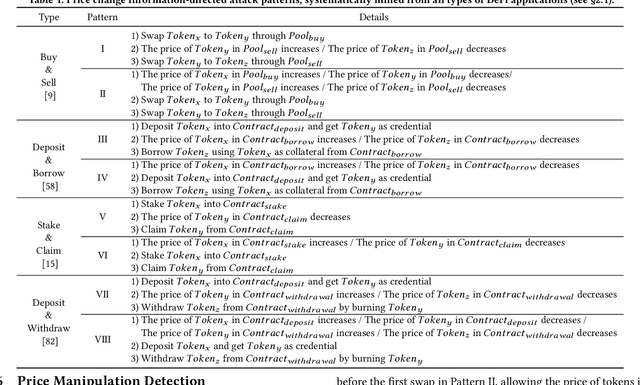

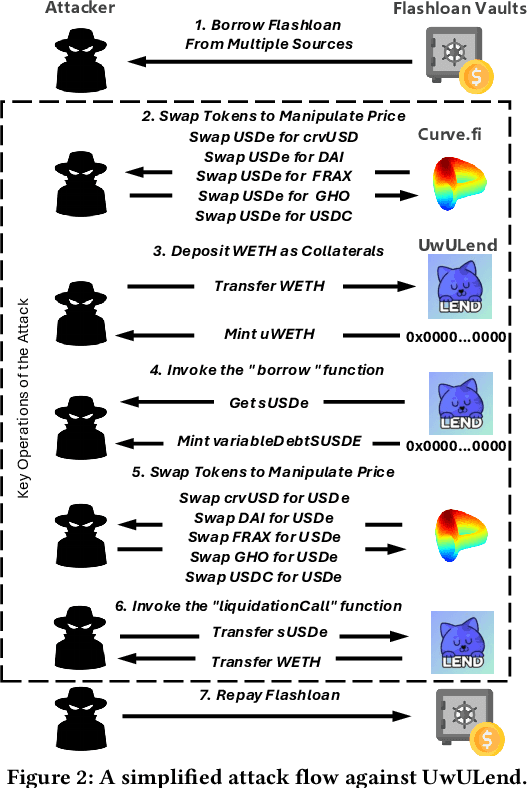

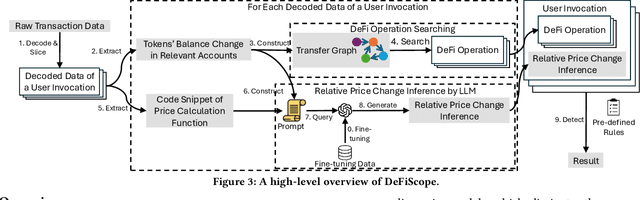

Abstract:DeFi (Decentralized Finance) is one of the most important applications of today's cryptocurrencies and smart contracts. It manages hundreds of billions in Total Value Locked (TVL) on-chain, yet it remains susceptible to common DeFi price manipulation attacks. Despite state-of-the-art (SOTA) systems like DeFiRanger and DeFort, we found that they are less effective to non-standard price models in custom DeFi protocols, which account for 44.2% of the 95 DeFi price manipulation attacks reported over the past three years. In this paper, we introduce the first LLM-based approach, DeFiScope, for detecting DeFi price manipulation attacks in both standard and custom price models. Our insight is that large language models (LLMs) have certain intelligence to abstract price calculation from code and infer the trend of token price changes based on the extracted price models. To further strengthen LLMs in this aspect, we leverage Foundry to synthesize on-chain data and use it to fine-tune a DeFi price-specific LLM. Together with the high-level DeFi operations recovered from low-level transaction data, DeFiScope detects various DeFi price manipulations according to systematically mined patterns. Experimental results show that DeFiScope achieves a high precision of 96% and a recall rate of 80%, significantly outperforming SOTA approaches. Moreover, we evaluate DeFiScope's cost-effectiveness and demonstrate its practicality by helping our industry partner confirm 147 real-world price manipulation attacks, including discovering 81 previously unknown historical incidents.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge