Keer Yang

Behavioral Machine Learning? Computer Predictions of Corporate Earnings also Overreact

Mar 25, 2023

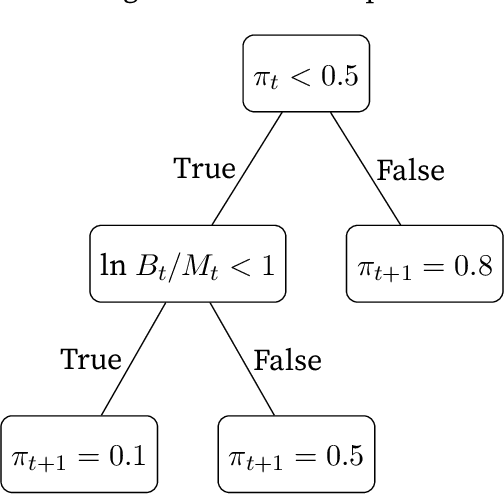

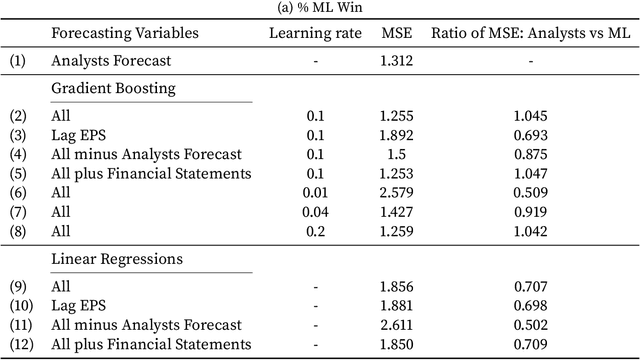

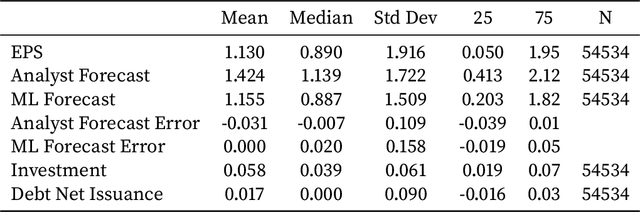

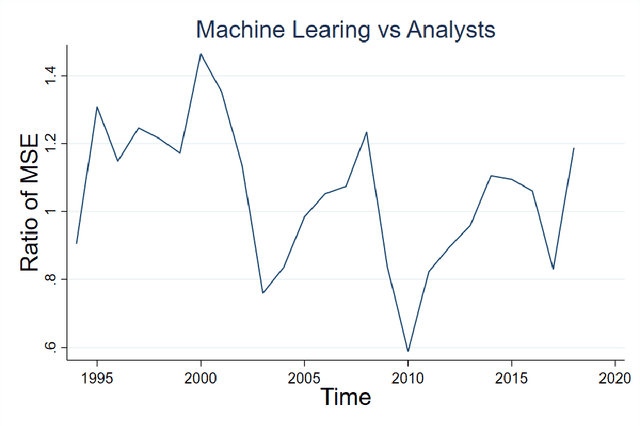

Abstract:There is considerable evidence that machine learning algorithms have better predictive abilities than humans in various financial settings. But, the literature has not tested whether these algorithmic predictions are more rational than human predictions. We study the predictions of corporate earnings from several algorithms, notably linear regressions and a popular algorithm called Gradient Boosted Regression Trees (GBRT). On average, GBRT outperformed both linear regressions and human stock analysts, but it still overreacted to news and did not satisfy rational expectation as normally defined. By reducing the learning rate, the magnitude of overreaction can be minimized, but it comes with the cost of poorer out-of-sample prediction accuracy. Human stock analysts who have been trained in machine learning methods overreact less than traditionally trained analysts. Additionally, stock analyst predictions reflect information not otherwise available to machine algorithms.

Improving CNN-base Stock Trading By Considering Data Heterogeneity and Burst

Mar 14, 2023

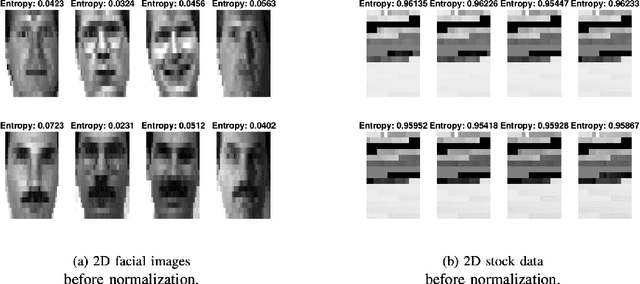

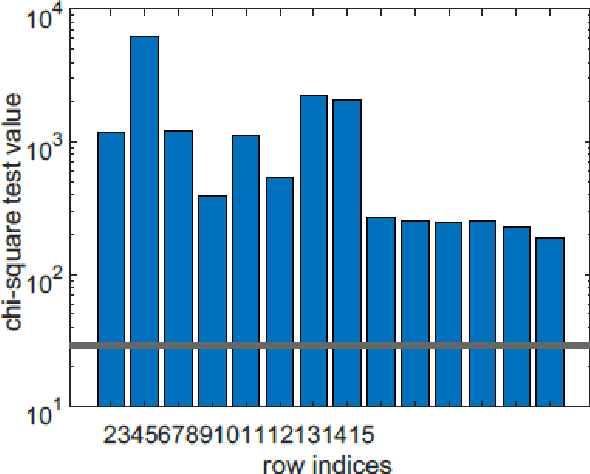

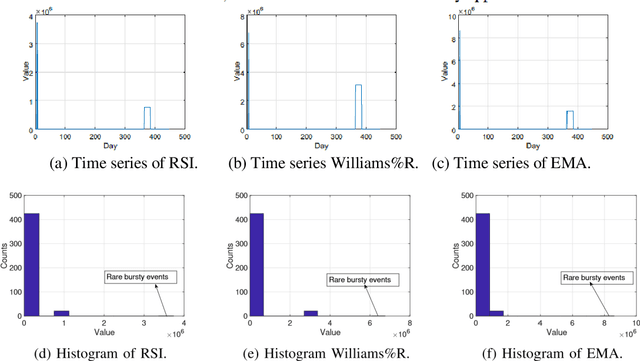

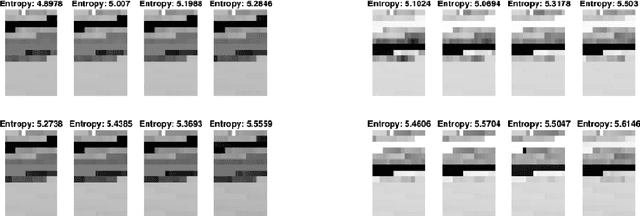

Abstract:In recent years, there have been quite a few attempts to apply intelligent techniques to financial trading, i.e., constructing automatic and intelligent trading framework based on historical stock price. Due to the unpredictable, uncertainty and volatile nature of financial market, researchers have also resorted to deep learning to construct the intelligent trading framework. In this paper, we propose to use CNN as the core functionality of such framework, because it is able to learn the spatial dependency (i.e., between rows and columns) of the input data. However, different with existing deep learning-based trading frameworks, we develop novel normalization process to prepare the stock data. In particular, we first empirically observe that the stock data is intrinsically heterogeneous and bursty, and then validate the heterogeneity and burst nature of stock data from a statistical perspective. Next, we design the data normalization method in a way such that the data heterogeneity is preserved and bursty events are suppressed. We verify out developed CNN-based trading framework plus our new normalization method on 29 stocks. Experiment results show that our approach can outperform other comparing approaches.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge