Behavioral Machine Learning? Computer Predictions of Corporate Earnings also Overreact

Paper and Code

Mar 25, 2023

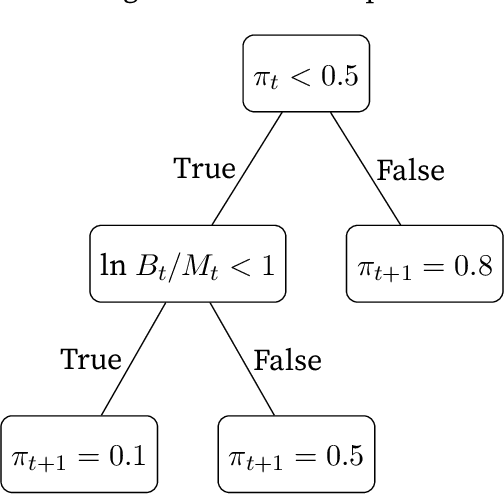

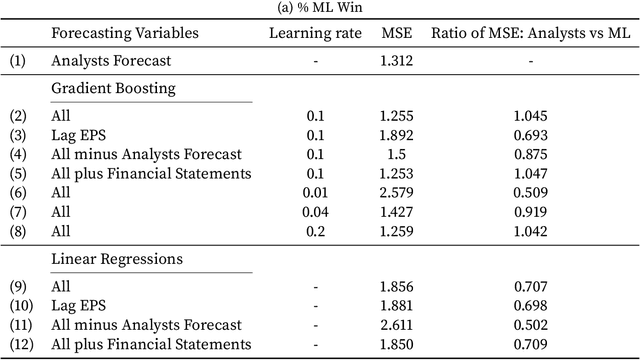

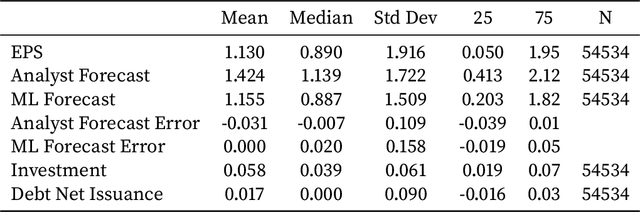

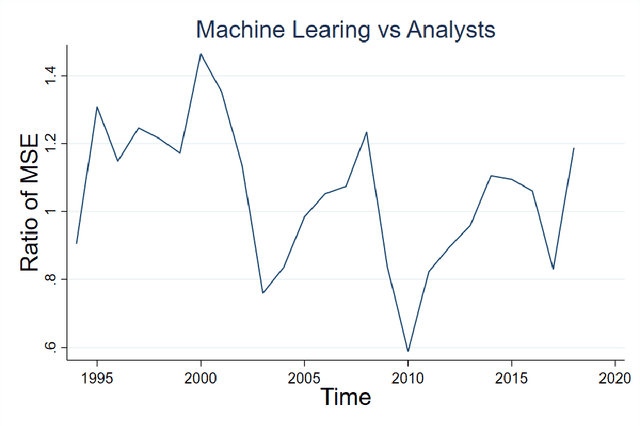

There is considerable evidence that machine learning algorithms have better predictive abilities than humans in various financial settings. But, the literature has not tested whether these algorithmic predictions are more rational than human predictions. We study the predictions of corporate earnings from several algorithms, notably linear regressions and a popular algorithm called Gradient Boosted Regression Trees (GBRT). On average, GBRT outperformed both linear regressions and human stock analysts, but it still overreacted to news and did not satisfy rational expectation as normally defined. By reducing the learning rate, the magnitude of overreaction can be minimized, but it comes with the cost of poorer out-of-sample prediction accuracy. Human stock analysts who have been trained in machine learning methods overreact less than traditionally trained analysts. Additionally, stock analyst predictions reflect information not otherwise available to machine algorithms.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge