Junlei Zhu

DeepScalper: A Risk-Aware Deep Reinforcement Learning Framework for Intraday Trading with Micro-level Market Embedding

Dec 15, 2021

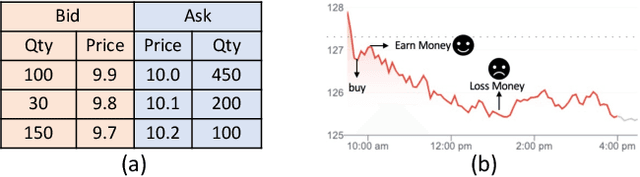

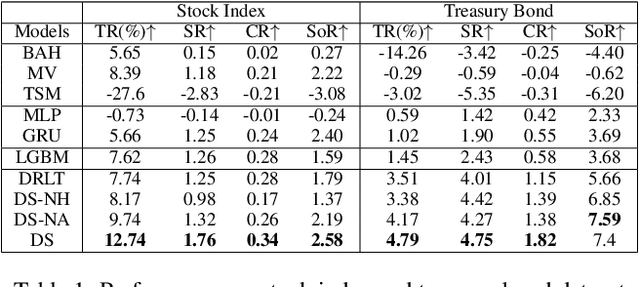

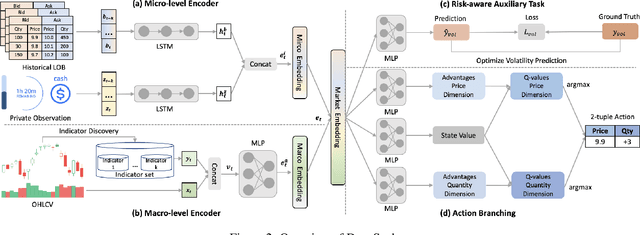

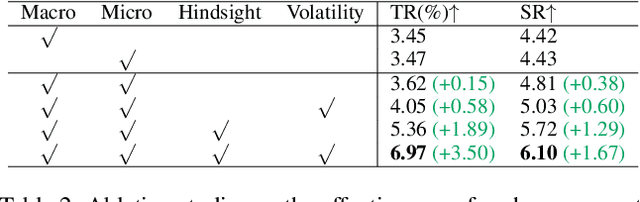

Abstract:Reinforcement learning (RL) techniques have shown great success in quantitative investment tasks, such as portfolio management and algorithmic trading. Especially, intraday trading is one of the most profitable and risky tasks because of the intraday behaviors of the financial market that reflect billions of rapidly fluctuating values. However, it is hard to apply existing RL methods to intraday trading due to the following three limitations: 1) overlooking micro-level market information (e.g., limit order book); 2) only focusing on local price fluctuation and failing to capture the overall trend of the whole trading day; 3) neglecting the impact of market risk. To tackle these limitations, we propose DeepScalper, a deep reinforcement learning framework for intraday trading. Specifically, we adopt an encoder-decoder architecture to learn robust market embedding incorporating both macro-level and micro-level market information. Moreover, a novel hindsight reward function is designed to provide the agent a long-term horizon for capturing the overall price trend. In addition, we propose a risk-aware auxiliary task by predicting future volatility, which helps the agent take market risk into consideration while maximizing profit. Finally, extensive experiments on two stock index futures and four treasury bond futures demonstrate that DeepScalper achieves significant improvement against many state-of-the-art approaches.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge