Jean-Marc Patenaude

Characterizing Financial Market Coverage using Artificial Intelligence

Feb 07, 2023

Abstract:This paper scrutinizes a database of over 4900 YouTube videos to characterize financial market coverage. Financial market coverage generates a large number of videos. Therefore, watching these videos to derive actionable insights could be challenging and complex. In this paper, we leverage Whisper, a speech-to-text model from OpenAI, to generate a text corpus of market coverage videos from Bloomberg and Yahoo Finance. We employ natural language processing to extract insights regarding language use from the market coverage. Moreover, we examine the prominent presence of trending topics and their evolution over time, and the impacts that some individuals and organizations have on the financial market. Our characterization highlights the dynamics of the financial market coverage and provides valuable insights reflecting broad discussions regarding recent financial events and the world economy.

Neural forecasting at scale

Sep 22, 2021

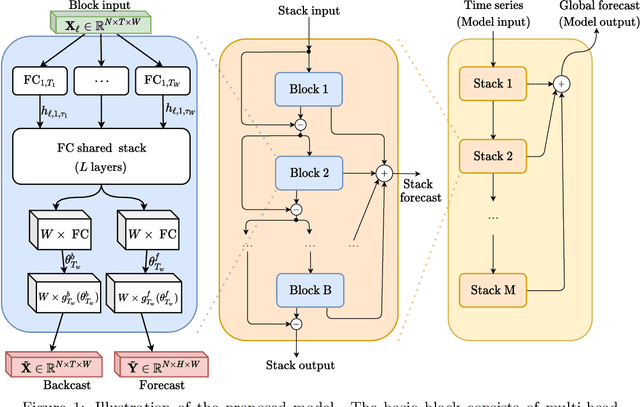

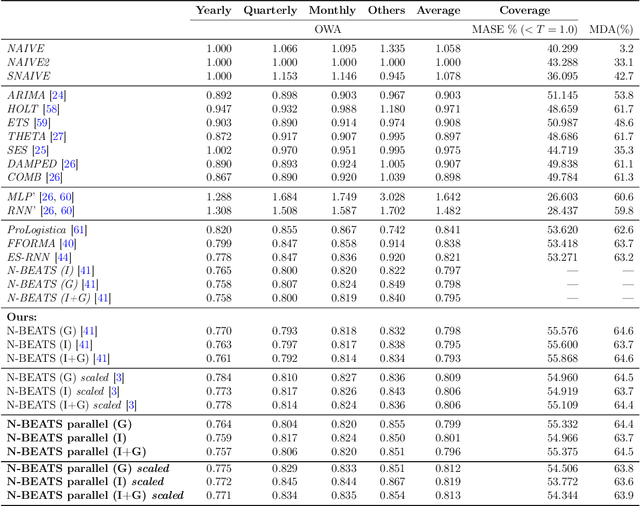

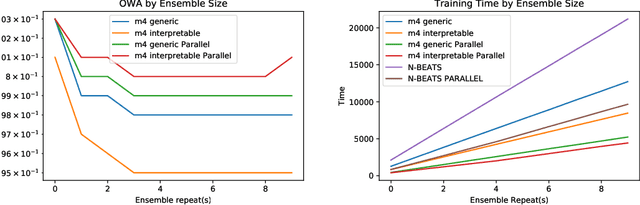

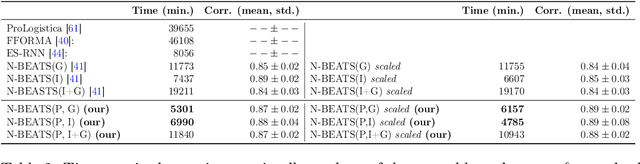

Abstract:We study the problem of efficiently scaling ensemble-based deep neural networks for time series (TS) forecasting on a large set of time series. Current state-of-the-art deep ensemble models have high memory and computational requirements, hampering their use to forecast millions of TS in practical scenarios. We propose N-BEATS(P), a global multivariate variant of the N-BEATS model designed to allow simultaneous training of multiple univariate TS forecasting models. Our model addresses the practical limitations of related models, reducing the training time by half and memory requirement by a factor of 5, while keeping the same level of accuracy. We have performed multiple experiments detailing the various ways to train our model and have obtained results that demonstrate its capacity to support zero-shot TS forecasting, i.e., to train a neural network on a source TS dataset and deploy it on a different target TS dataset without retraining, which provides an efficient and reliable solution to forecast at scale even in difficult forecasting conditions.

Financial Time Series Representation Learning

Mar 27, 2020

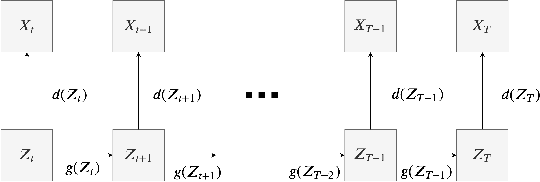

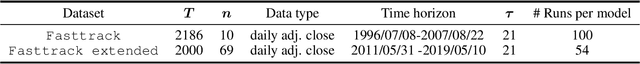

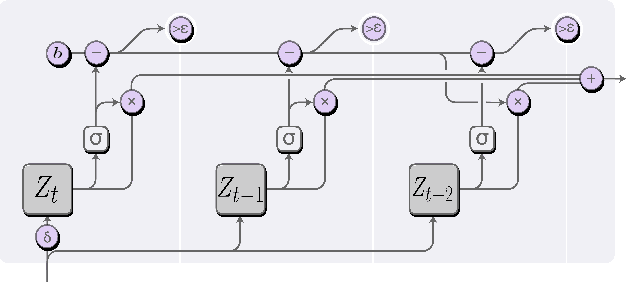

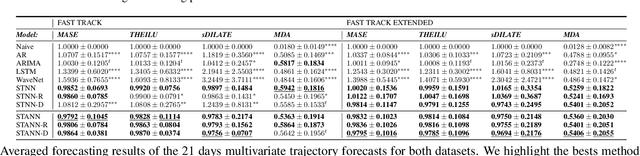

Abstract:This paper addresses the difficulty of forecasting multiple financial time series (TS) conjointly using deep neural networks (DNN). We investigate whether DNN-based models could forecast these TS more efficiently by learning their representation directly. To this end, we make use of the dynamic factor graph (DFG) from that we enhance by proposing a novel variable-length attention-based mechanism to render it memory-augmented. Using this mechanism, we propose an unsupervised DNN architecture for multivariate TS forecasting that allows to learn and take advantage of the relationships between these TS. We test our model on two datasets covering 19 years of investment funds activities. Our experimental results show that our proposed approach outperforms significantly typical DNN-based and statistical models at forecasting their 21-day price trajectory.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge