Financial Time Series Representation Learning

Paper and Code

Mar 27, 2020

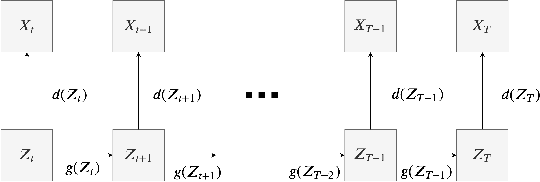

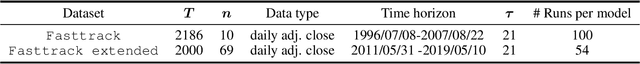

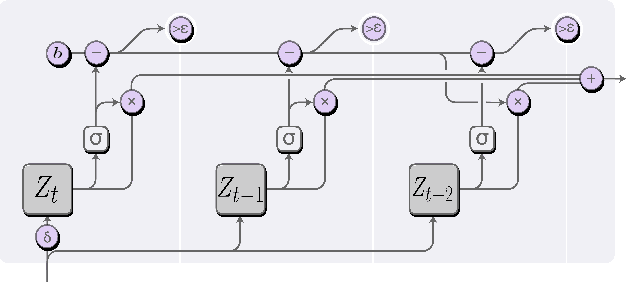

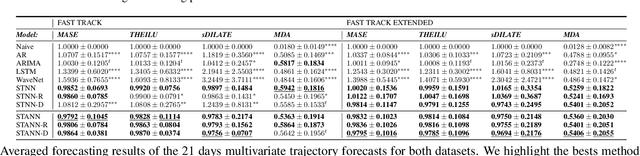

This paper addresses the difficulty of forecasting multiple financial time series (TS) conjointly using deep neural networks (DNN). We investigate whether DNN-based models could forecast these TS more efficiently by learning their representation directly. To this end, we make use of the dynamic factor graph (DFG) from that we enhance by proposing a novel variable-length attention-based mechanism to render it memory-augmented. Using this mechanism, we propose an unsupervised DNN architecture for multivariate TS forecasting that allows to learn and take advantage of the relationships between these TS. We test our model on two datasets covering 19 years of investment funds activities. Our experimental results show that our proposed approach outperforms significantly typical DNN-based and statistical models at forecasting their 21-day price trajectory.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge