Indranil SenGupta

A data-science-driven short-term analysis of Amazon, Apple, Google, and Microsoft stocks

Jul 30, 2021

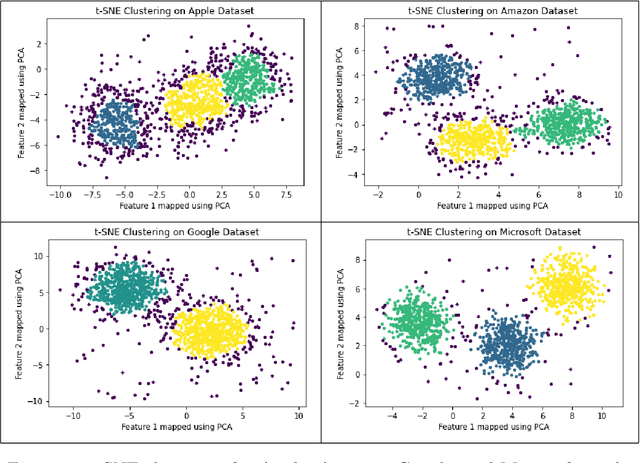

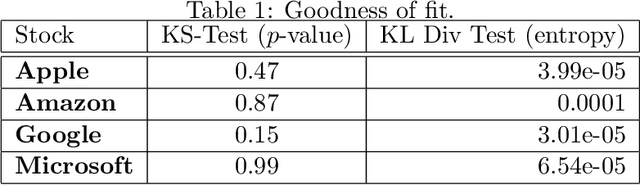

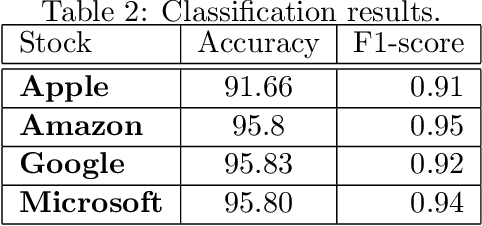

Abstract:In this paper, we implement a combination of technical analysis and machine/deep learning-based analysis to build a trend classification model. The goal of the paper is to apprehend short-term market movement, and incorporate it to improve the underlying stochastic model. Also, the analysis presented in this paper can be implemented in a \emph{model-independent} fashion. We execute a data-science-driven technique that makes short-term forecasts dependent on the price trends of current stock market data. Based on the analysis, three different labels are generated for a data set: $+1$ (buy signal), $0$ (hold signal), or $-1$ (sell signal). We propose a detailed analysis of four major stocks- Amazon, Apple, Google, and Microsoft. We implement various technical indicators to label the data set according to the trend and train various models for trend estimation. Statistical analysis of the outputs and classification results are obtained.

Hedging and machine learning driven crude oil data analysis using a refined Barndorff-Nielsen and Shephard model

Apr 29, 2020

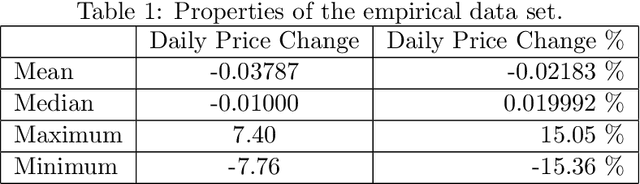

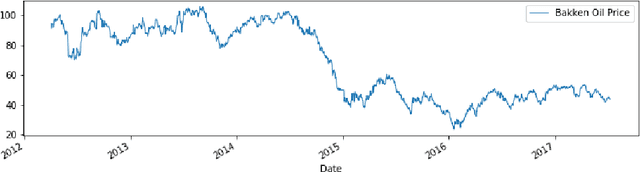

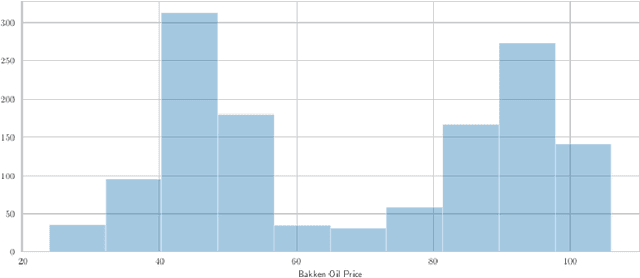

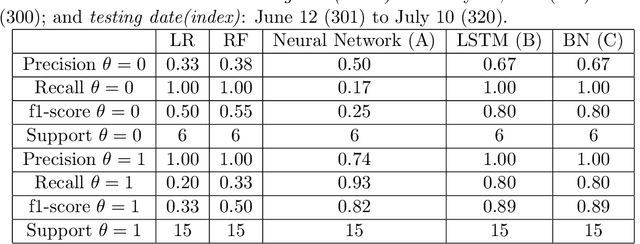

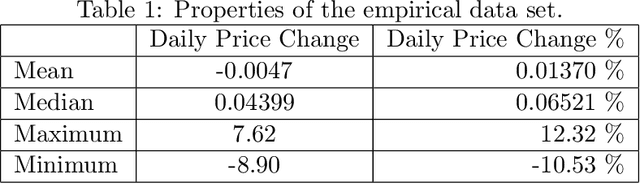

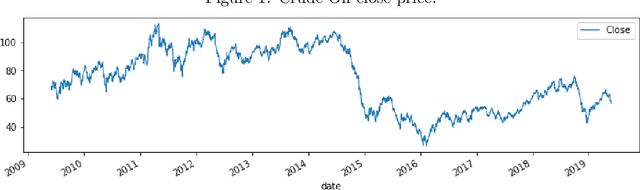

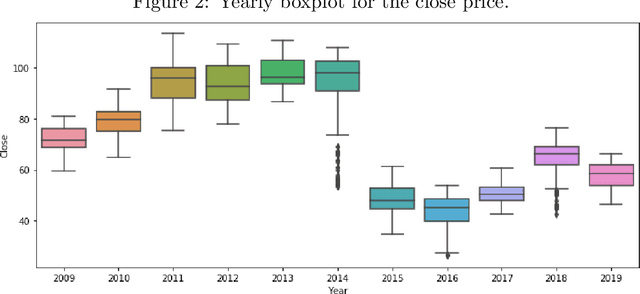

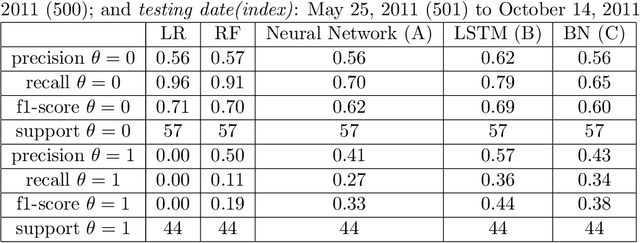

Abstract:In this paper, a refined Barndorff-Nielsen and Shephard (BN-S) model is implemented to find an optimal hedging strategy for commodity markets. The refinement of the BN-S model is obtained with various machine and deep learning algorithms. The refinement leads to the extraction of a deterministic parameter from the empirical data set. The problem is transformed to an appropriate classification problem with a couple of different approaches: the volatility approach and the duration approach. The analysis is implemented to the Bakken crude oil data and the aforementioned deterministic parameter is obtained for a wide range of data sets. With the implementation of this parameter in the refined model, the resulting model performs much better than the classical BN-S model.

Sequential hypothesis testing in machine learning driven crude oil jump detection

Apr 19, 2020

Abstract:In this paper we present a sequential hypothesis test for the detection of general jump size distrubution. Infinitesimal generators for the corresponding log-likelihood ratios are presented and analyzed. Bounds for infinitesimal generators in terms of super-solutions and sub-solutions are computed. This is shown to be implementable in relation to various classification problems for a crude oil price data set. Machine and deep learning algorithms are implemented to extract a specific deterministic component from the crude oil data set, and the deterministic component is implemented to improve the Barndorff-Nielsen and Shephard model, a commonly used stochastic model for derivative and commodity market analysis.

Refinements of Barndorff-Nielsen and Shephard model: an analysis of crude oil price with machine learning

Nov 29, 2019

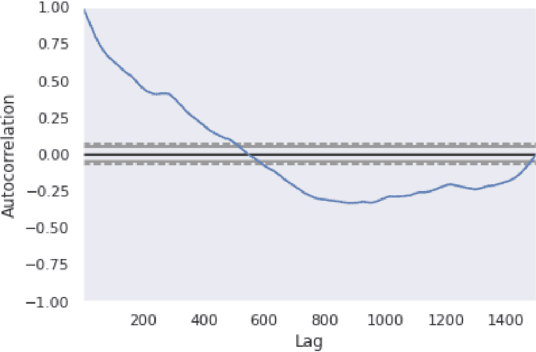

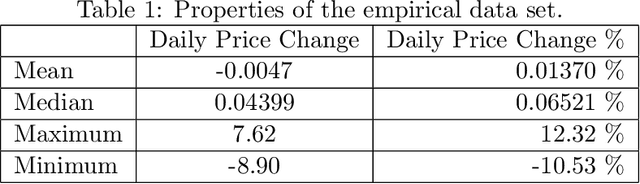

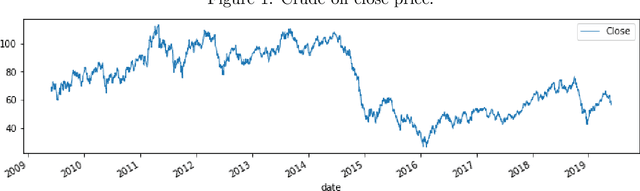

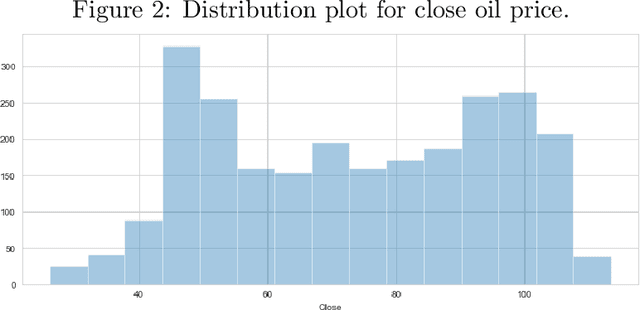

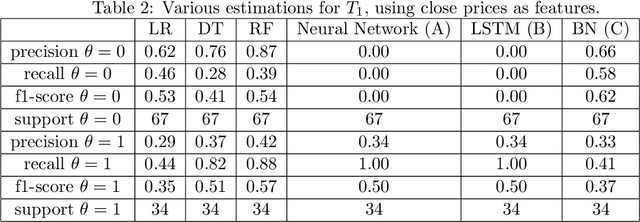

Abstract:A commonly used stochastic model for derivative and commodity market analysis is the Barndorff-Nielsen and Shephard (BN-S) model. Though this model is very efficient and analytically tractable, it suffers from the absence of long range dependence and many other issues. For this paper, the analysis is restricted to crude oil price dynamics. A simple way of improving the BN-S model with the implementation of various machine learning algorithms is proposed. This refined BN-S model is more efficient and has fewer parameters than other models which are used in practice as improvements of the BN-S model. The procedure and the model show the application of data science for extracting a "deterministic component" out of processes that are usually considered to be completely stochastic. Empirical applications validate the efficacy of the proposed model for long range dependence.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge