Hoyoul Luis Youn

StockEmotions: Discover Investor Emotions for Financial Sentiment Analysis and Multivariate Time Series

Jan 23, 2023

Abstract:There has been growing interest in applying NLP techniques in the financial domain, however, resources are extremely limited. This paper introduces StockEmotions, a new dataset for detecting emotions in the stock market that consists of 10,000 English comments collected from StockTwits, a financial social media platform. Inspired by behavioral finance, it proposes 12 fine-grained emotion classes that span the roller coaster of investor emotion. Unlike existing financial sentiment datasets, StockEmotions presents granular features such as investor sentiment classes, fine-grained emotions, emojis, and time series data. To demonstrate the usability of the dataset, we perform a dataset analysis and conduct experimental downstream tasks. For financial sentiment/emotion classification tasks, DistilBERT outperforms other baselines, and for multivariate time series forecasting, a Temporal Attention LSTM model combining price index, text, and emotion features achieves the best performance than using a single feature.

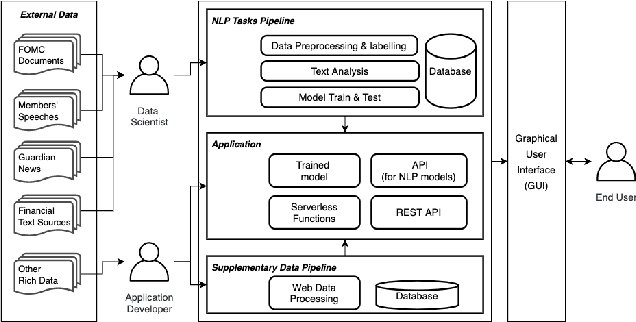

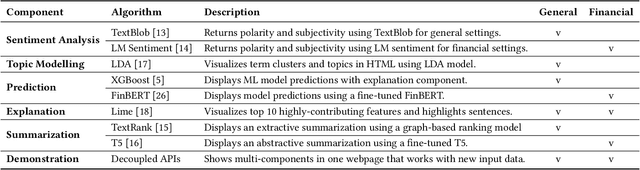

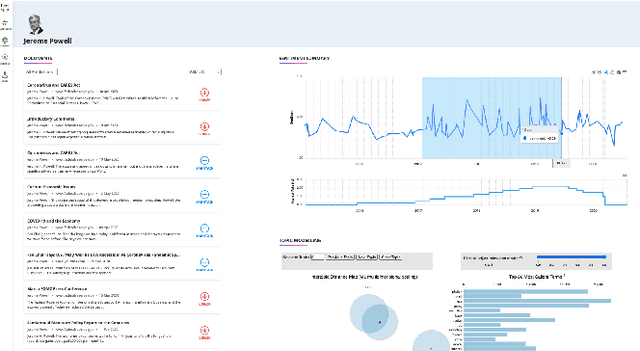

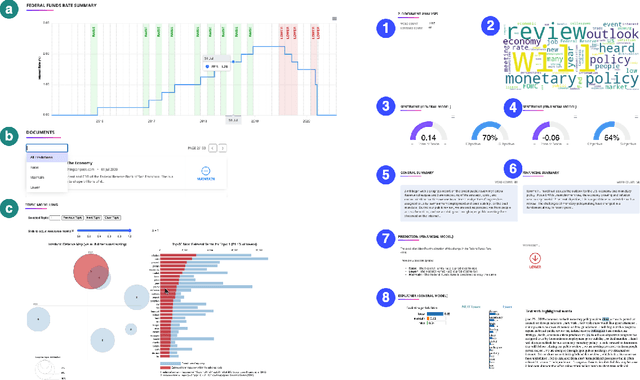

FedNLP: An interpretable NLP System to Decode Federal Reserve Communications

Jun 11, 2021

Abstract:The Federal Reserve System (the Fed) plays a significant role in affecting monetary policy and financial conditions worldwide. Although it is important to analyse the Fed's communications to extract useful information, it is generally long-form and complex due to the ambiguous and esoteric nature of content. In this paper, we present FedNLP, an interpretable multi-component Natural Language Processing system to decode Federal Reserve communications. This system is designed for end-users to explore how NLP techniques can assist their holistic understanding of the Fed's communications with NO coding. Behind the scenes, FedNLP uses multiple NLP models from traditional machine learning algorithms to deep neural network architectures in each downstream task. The demonstration shows multiple results at once including sentiment analysis, summary of the document, prediction of the Federal Funds Rate movement and visualization for interpreting the prediction model's result.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge