Gianni Del Bimbo

Financial Risk Management on a Neutral Atom Quantum Processor

Dec 06, 2022

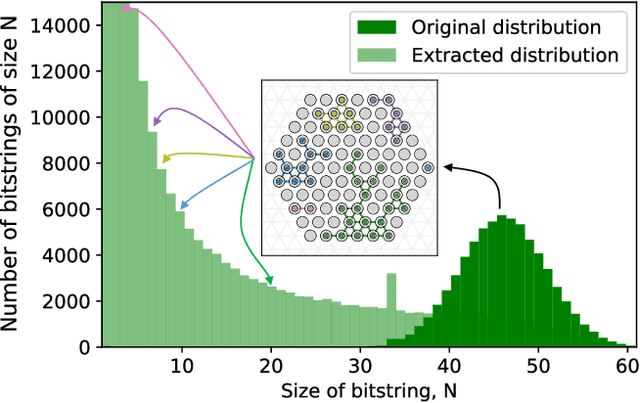

Abstract:Machine Learning models capable of handling the large datasets collected in the financial world can often become black boxes expensive to run. The quantum computing paradigm suggests new optimization techniques, that combined with classical algorithms, may deliver competitive, faster and more interpretable models. In this work we propose a quantum-enhanced machine learning solution for the prediction of credit rating downgrades, also known as fallen-angels forecasting in the financial risk management field. We implement this solution on a neutral atom Quantum Processing Unit with up to 60 qubits on a real-life dataset. We report competitive performances against the state-of-the-art Random Forest benchmark whilst our model achieves better interpretability and comparable training times. We examine how to improve performance in the near-term validating our ideas with Tensor Networks-based numerical simulations.

Quantum artificial vision for defect detection in manufacturing

Aug 09, 2022

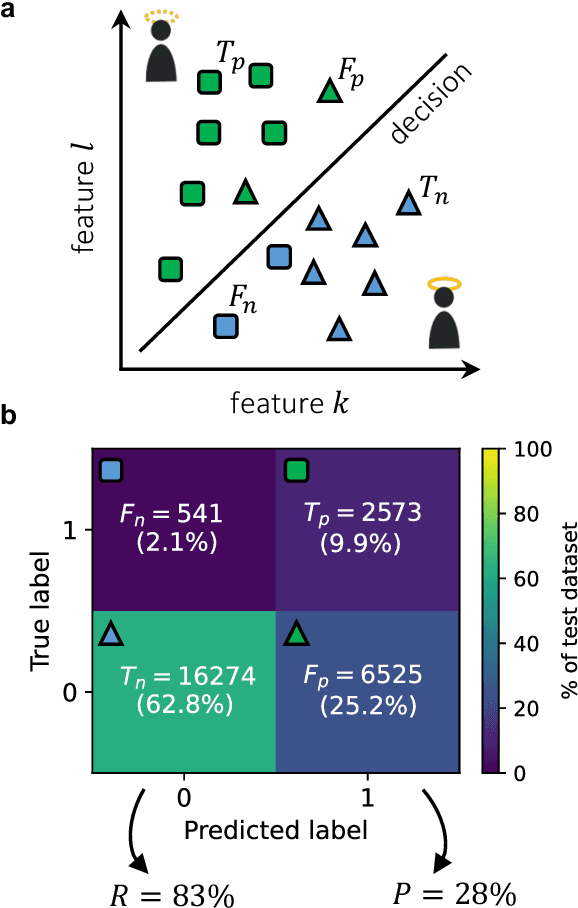

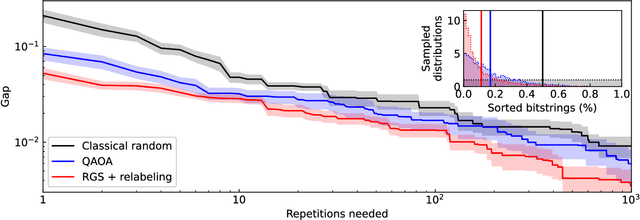

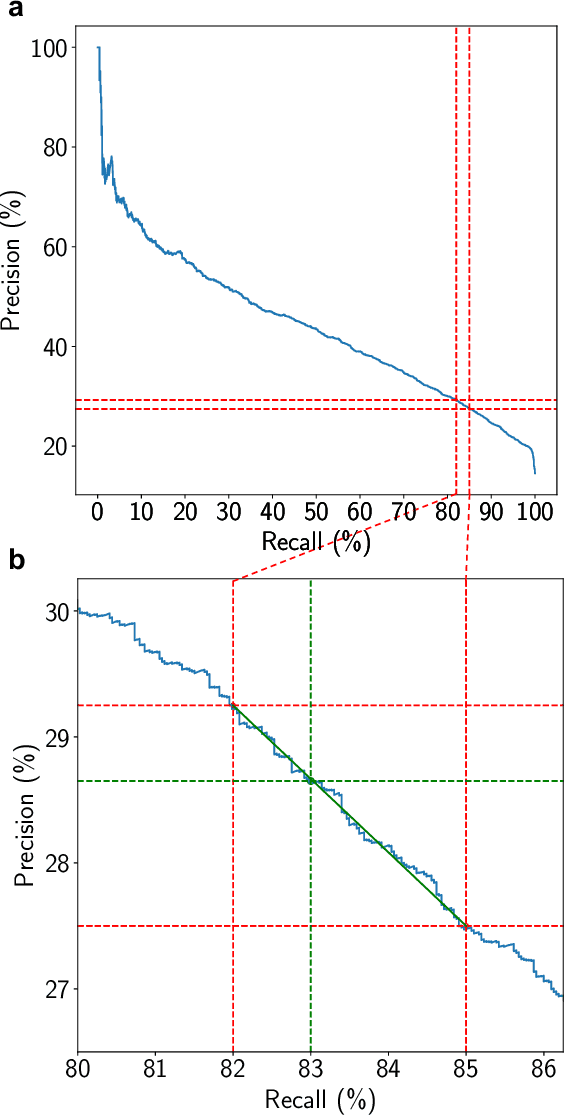

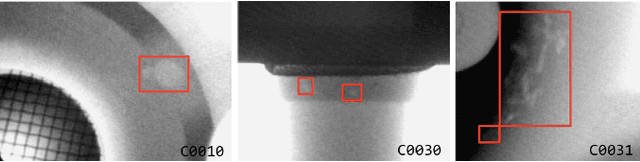

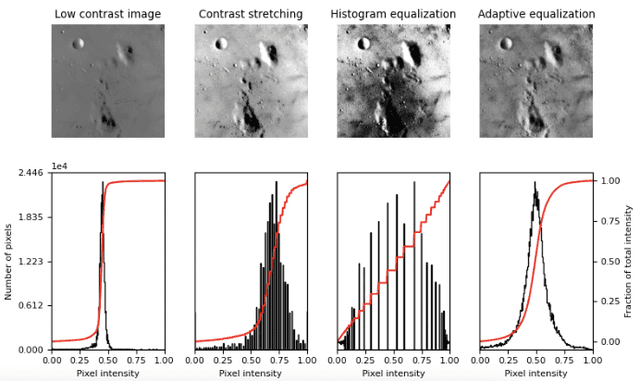

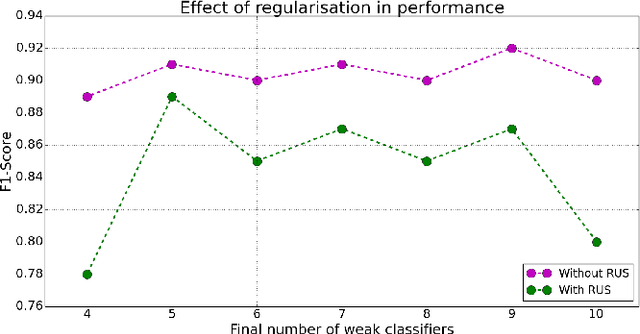

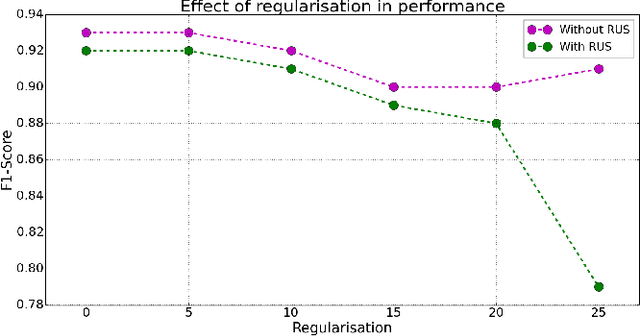

Abstract:In this paper we consider several algorithms for quantum computer vision using Noisy Intermediate-Scale Quantum (NISQ) devices, and benchmark them for a real problem against their classical counterparts. Specifically, we consider two approaches: a quantum Support Vector Machine (QSVM) on a universal gate-based quantum computer, and QBoost on a quantum annealer. The quantum vision systems are benchmarked for an unbalanced dataset of images where the aim is to detect defects in manufactured car pieces. We see that the quantum algorithms outperform their classical counterparts in several ways, with QBoost allowing for larger problems to be analyzed with present-day quantum annealers. Data preprocessing, including dimensionality reduction and contrast enhancement, is also discussed, as well as hyperparameter tuning in QBoost. To the best of our knowledge, this is the first implementation of quantum computer vision systems for a problem of industrial relevance in a manufacturing production line.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge