Emmanouil A. Platanios

Estimating Accuracy from Unlabeled Data: A Probabilistic Logic Approach

May 19, 2017

Abstract:We propose an efficient method to estimate the accuracy of classifiers using only unlabeled data. We consider a setting with multiple classification problems where the target classes may be tied together through logical constraints. For example, a set of classes may be mutually exclusive, meaning that a data instance can belong to at most one of them. The proposed method is based on the intuition that: (i) when classifiers agree, they are more likely to be correct, and (ii) when the classifiers make a prediction that violates the constraints, at least one classifier must be making an error. Experiments on four real-world data sets produce accuracy estimates within a few percent of the true accuracy, using solely unlabeled data. Our models also outperform existing state-of-the-art solutions in both estimating accuracies, and combining multiple classifier outputs. The results emphasize the utility of logical constraints in estimating accuracy, thus validating our intuition.

Mixture Gaussian Process Conditional Heteroscedasticity

Jan 25, 2013

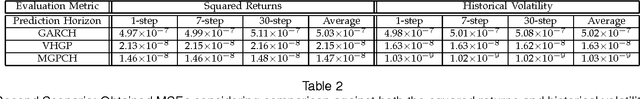

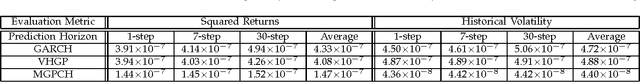

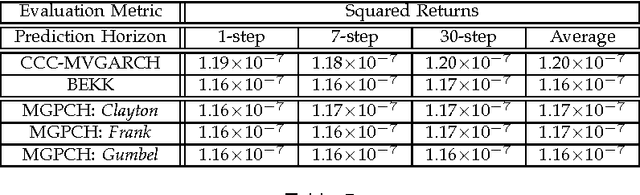

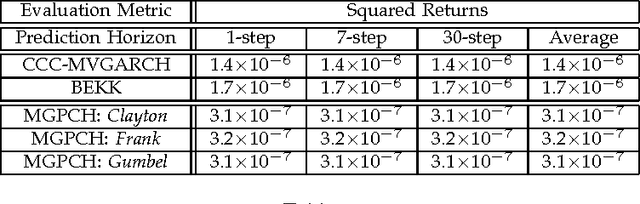

Abstract:Generalized autoregressive conditional heteroscedasticity (GARCH) models have long been considered as one of the most successful families of approaches for volatility modeling in financial return series. In this paper, we propose an alternative approach based on methodologies widely used in the field of statistical machine learning. Specifically, we propose a novel nonparametric Bayesian mixture of Gaussian process regression models, each component of which models the noise variance process that contaminates the observed data as a separate latent Gaussian process driven by the observed data. This way, we essentially obtain a mixture Gaussian process conditional heteroscedasticity (MGPCH) model for volatility modeling in financial return series. We impose a nonparametric prior with power-law nature over the distribution of the model mixture components, namely the Pitman-Yor process prior, to allow for better capturing modeled data distributions with heavy tails and skewness. Finally, we provide a copula- based approach for obtaining a predictive posterior for the covariances over the asset returns modeled by means of a postulated MGPCH model. We evaluate the efficacy of our approach in a number of benchmark scenarios, and compare its performance to state-of-the-art methodologies.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge