Diogo Oliveira

Seq2Seq Model-Based Chatbot with LSTM and Attention Mechanism for Enhanced User Interaction

Dec 27, 2024

Abstract:A chatbot is an intelligent software application that automates conversations and engages users in natural language through messaging platforms. Leveraging artificial intelligence (AI), chatbots serve various functions, including customer service, information gathering, and casual conversation. Existing virtual assistant chatbots, such as ChatGPT and Gemini, demonstrate the potential of AI in Natural Language Processing (NLP). However, many current solutions rely on predefined APIs, which can result in vendor lock-in and high costs. To address these challenges, this work proposes a chatbot developed using a Sequence-to-Sequence (Seq2Seq) model with an encoder-decoder architecture that incorporates attention mechanisms and Long Short-Term Memory (LSTM) cells. By avoiding predefined APIs, this approach ensures flexibility and cost-effectiveness. The chatbot is trained, validated, and tested on a dataset specifically curated for the tourism sector in Draa-Tafilalet, Morocco. Key evaluation findings indicate that the proposed Seq2Seq model-based chatbot achieved high accuracies: approximately 99.58% in training, 98.03% in validation, and 94.12% in testing. These results demonstrate the chatbot's effectiveness in providing relevant and coherent responses within the tourism domain, highlighting the potential of specialized AI applications to enhance user experience and satisfaction in niche markets.

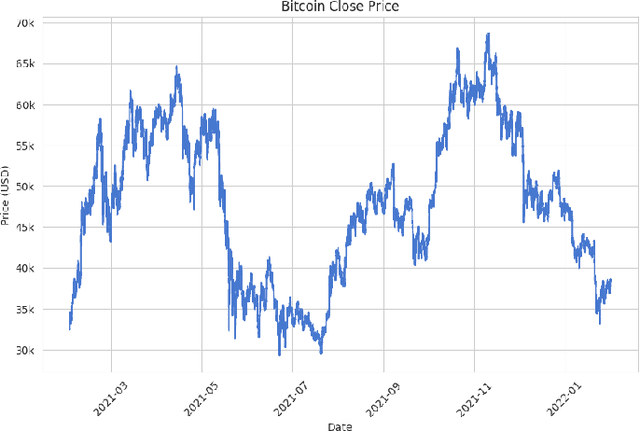

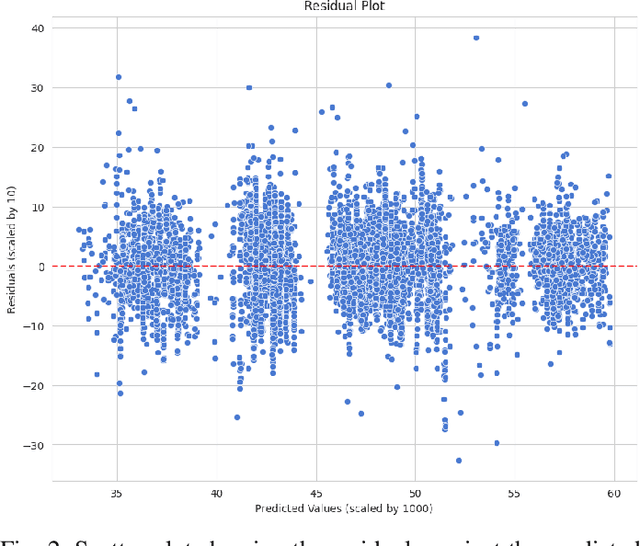

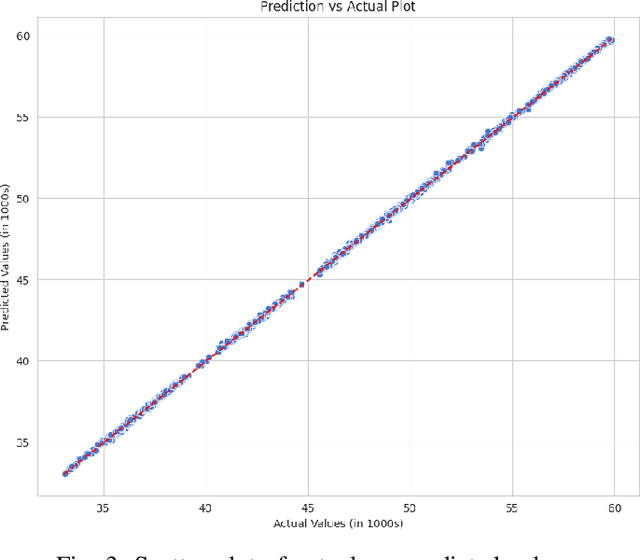

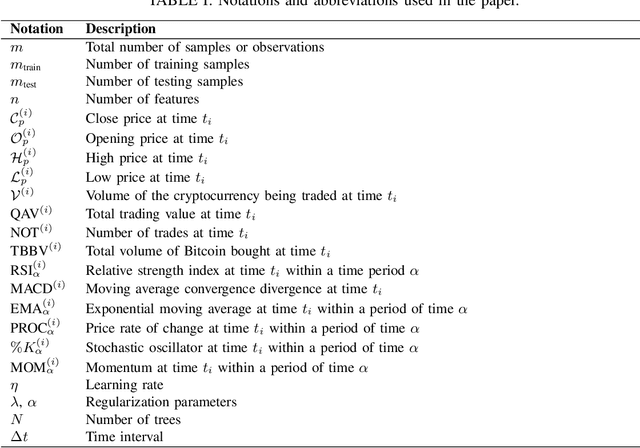

Cryptocurrency Price Forecasting Using XGBoost Regressor and Technical Indicators

Jul 16, 2024

Abstract:The rapid growth of the stock market has attracted many investors due to its potential for significant profits. However, predicting stock prices accurately is difficult because financial markets are complex and constantly changing. This is especially true for the cryptocurrency market, which is known for its extreme volatility, making it challenging for traders and investors to make wise and profitable decisions. This study introduces a machine learning approach to predict cryptocurrency prices. Specifically, we make use of important technical indicators such as Exponential Moving Average (EMA) and Moving Average Convergence Divergence (MACD) to train and feed the XGBoost regressor model. We demonstrate our approach through an analysis focusing on the closing prices of Bitcoin cryptocurrency. We evaluate the model's performance through various simulations, showing promising results that suggest its usefulness in aiding/guiding cryptocurrency traders and investors in dynamic market conditions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge