Denise Gorse

Axial-LOB: High-Frequency Trading with Axial Attention

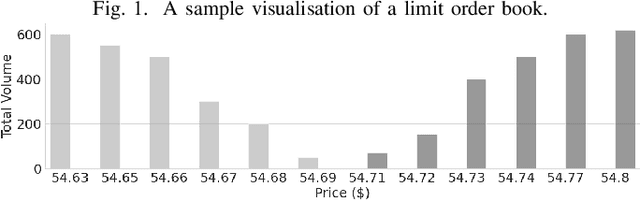

Dec 04, 2022Abstract:Previous attempts to predict stock price from limit order book (LOB) data are mostly based on deep convolutional neural networks. Although convolutions offer efficiency by restricting their operations to local interactions, it is at the cost of potentially missing out on the detection of long-range dependencies. Recent studies address this problem by employing additional recurrent or attention layers that increase computational complexity. In this work, we propose Axial-LOB, a novel fully-attentional deep learning architecture for predicting price movements of stocks from LOB data. By utilizing gated position-sensitive axial attention layers our architecture is able to construct feature maps that incorporate global interactions, while significantly reducing the size of the parameter space. Unlike previous works, Axial-LOB does not rely on hand-crafted convolutional kernels and hence has stable performance under input permutations and the capacity to incorporate additional LOB features. The effectiveness of Axial-LOB is demonstrated on a large benchmark dataset, containing time series representations of millions of high-frequency trading events, where our model establishes a new state of the art, achieving an excellent directional classification performance at all tested prediction horizons.

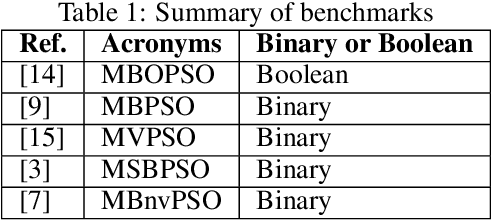

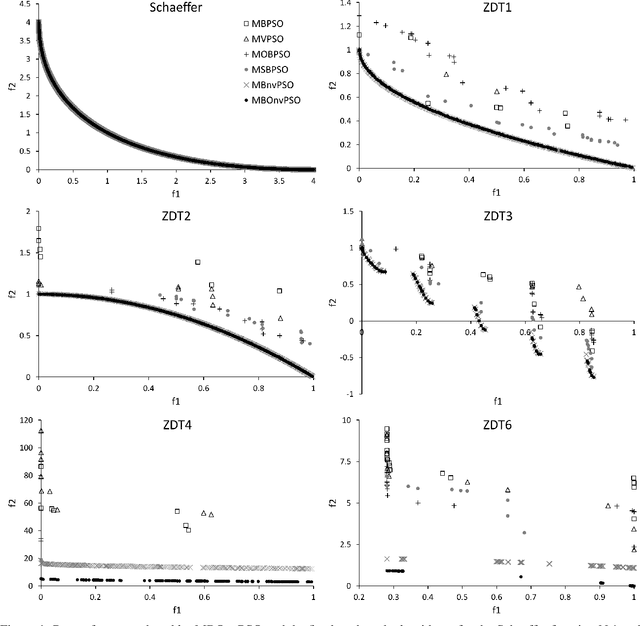

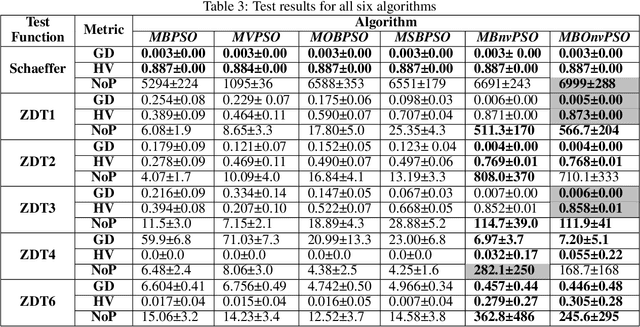

A Novel Multi-Objective Velocity-Free Boolean Particle Swarm Optimization

Oct 12, 2022

Abstract:This paper extends boolean particle swarm optimization to a multi-objective setting, to our knowledge for the first time in the literature. Our proposed new boolean algorithm, MBOnvPSO, is notably simplified by the omission of a velocity update rule and has enhanced exploration ability due to the inclusion of a 'noise' term in the position update rule that prevents particles being trapped in local optima. Our algorithm additionally makes use of an external archive to store non-dominated solutions and implements crowding distance to encourage solution diversity. In benchmark tests, MBOnvPSO produced high quality Pareto fronts, when compared to benchmarked alternatives, for all of the multi-objective test functions considered, with competitive performance in search spaces with up to 600 discrete dimensions.

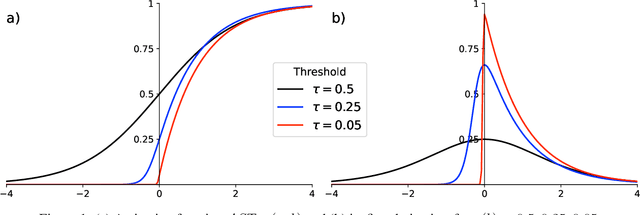

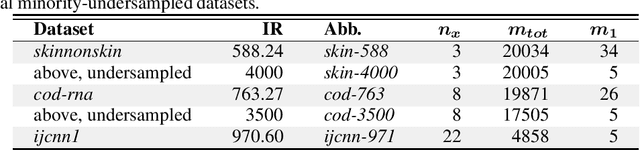

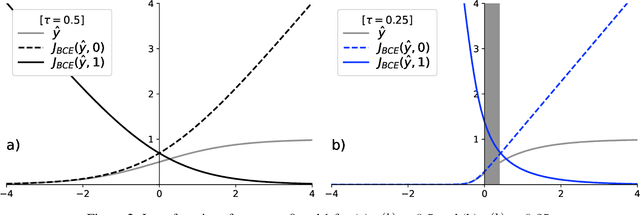

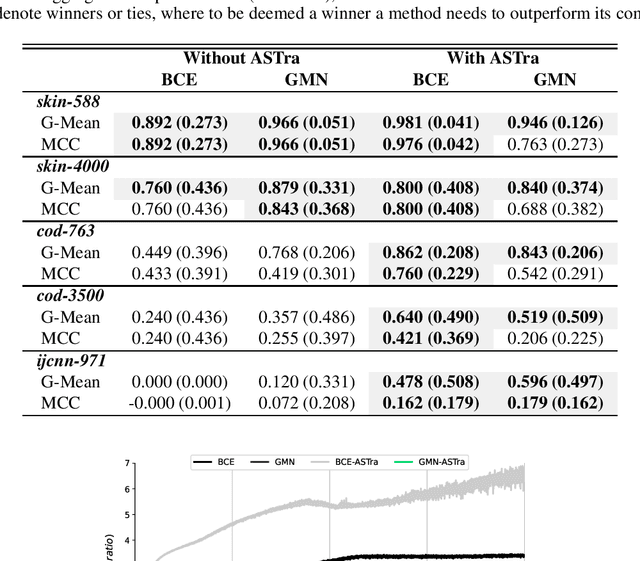

ASTra: A Novel Algorithm-Level Approach to Imbalanced Classification

Sep 04, 2022

Abstract:We propose a novel output layer activation function, which we name ASTra (Asymmetric Sigmoid Transfer function), which makes the classification of minority examples, in scenarios of high imbalance, more tractable. We combine this with a loss function that helps to effectively target minority misclassification. These two methods can be used together or separately, with their combination recommended for the most severely imbalanced cases. The proposed approach is tested on datasets with IRs from 588.24 to 4000 and very few minority examples (in some datasets, as few as five). Results using neural networks with from two to 12 hidden units are demonstrated to be comparable to, or better than, equivalent results obtained in a recent study that deployed a wide range of complex, hybrid data-level ensemble classifiers.

Deep vs. Shallow Learning: A Benchmark Study in Low Magnitude Earthquake Detection

May 01, 2022

Abstract:While deep learning models have seen recent high uptake in the geosciences, and are appealing in their ability to learn from minimally processed input data, as black box models they do not provide an easy means to understand how a decision is reached, which in safety-critical tasks especially can be problematical. An alternative route is to use simpler, more transparent white box models, in which task-specific feature construction replaces the more opaque feature discovery process performed automatically within deep learning models. Using data from the Groningen Gas Field in the Netherlands, we build on an existing logistic regression model by the addition of four further features discovered using elastic net driven data mining within the catch22 time series analysis package. We then evaluate the performance of the augmented logistic regression model relative to a deep (CNN) model, pre-trained on the Groningen data, on progressively increasing noise-to-signal ratios. We discover that, for each ratio, our logistic regression model correctly detects every earthquake, while the deep model fails to detect nearly 20 % of seismic events, thus justifying at least a degree of caution in the application of deep models, especially to data with higher noise-to-signal ratios.

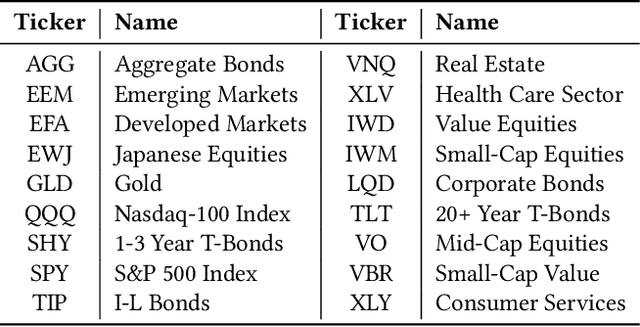

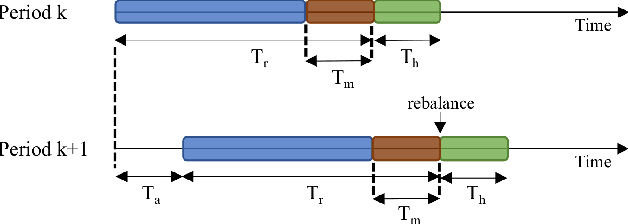

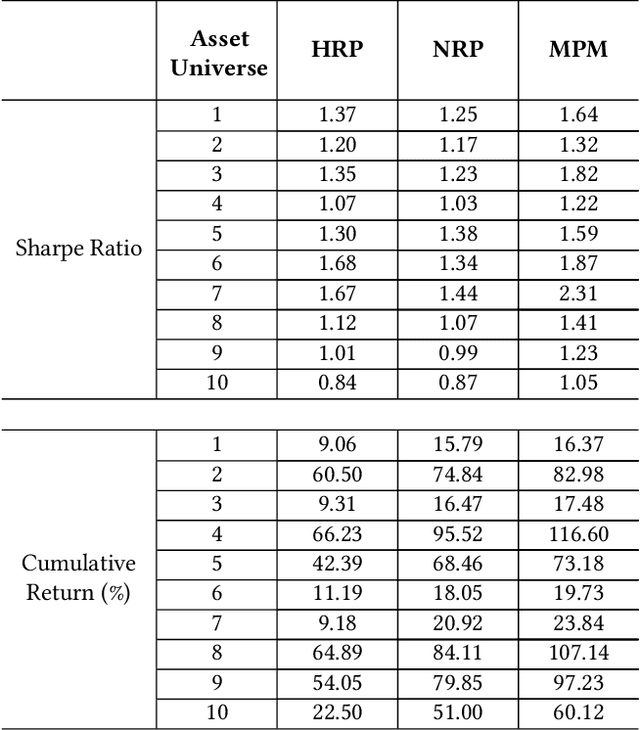

A Meta-Method for Portfolio Management Using Machine Learning for Adaptive Strategy Selection

Nov 10, 2021

Abstract:This work proposes a novel portfolio management technique, the Meta Portfolio Method (MPM), inspired by the successes of meta approaches in the field of bioinformatics and elsewhere. The MPM uses XGBoost to learn how to switch between two risk-based portfolio allocation strategies, the Hierarchical Risk Parity (HRP) and more classical Na\"ive Risk Parity (NRP). It is demonstrated that the MPM is able to successfully take advantage of the best characteristics of each strategy (the NRP's fast growth during market uptrends, and the HRP's protection against drawdowns during market turmoil). As a result, the MPM is shown to possess an excellent out-of-sample risk-reward profile, as measured by the Sharpe ratio, and in addition offers a high degree of interpretability of its asset allocation decisions.

Intra-Day Price Simulation with Generative Adversarial Modelling of the Order Flow

Sep 28, 2021

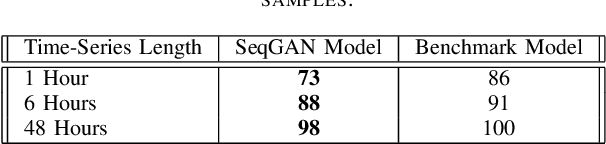

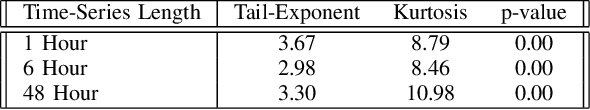

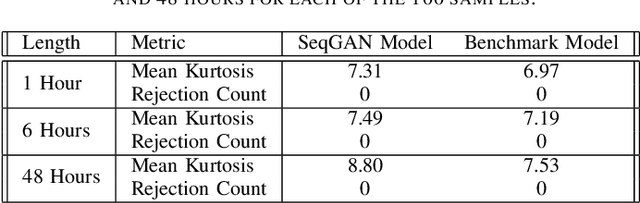

Abstract:Intra-day price variations in financial markets are driven by the sequence of orders, called the order flow, that is submitted at high frequency by traders. This paper introduces a novel application of the Sequence Generative Adversarial Networks framework to model the order flow, such that random sequences of the order flow can then be generated to simulate the intra-day variation of prices. As a benchmark, a well-known parametric model from the quantitative finance literature is selected. The models are fitted, and then multiple random paths of the order flow sequences are sampled from each model. Model performances are then evaluated by using the generated sequences to simulate price variations, and we compare the empirical regularities between the price variations produced by the generated and real sequences. The empirical regularities considered include the distribution of the price log-returns, the price volatility, and the heavy-tail of the log-returns distributions. The results show that the order sequences from the generative model are better able to reproduce the statistical behaviour of real price variations than the sequences from the benchmark.

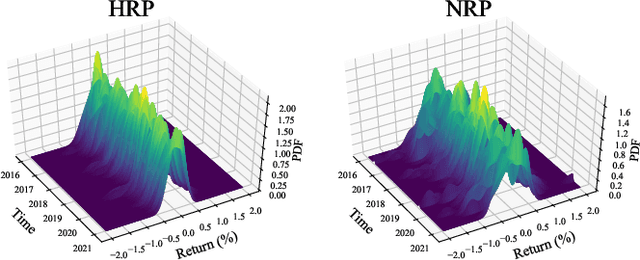

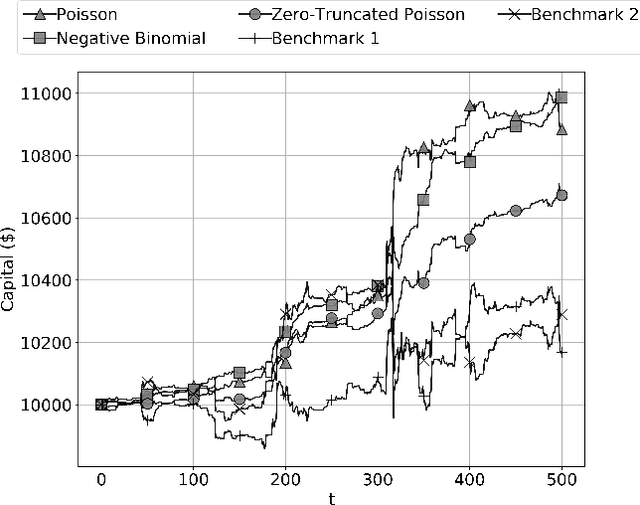

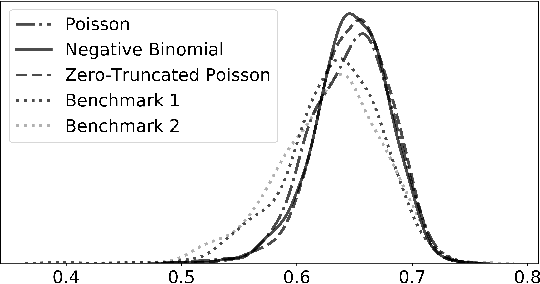

Deep Probabilistic Modelling of Price Movements for High-Frequency Trading

Mar 31, 2020

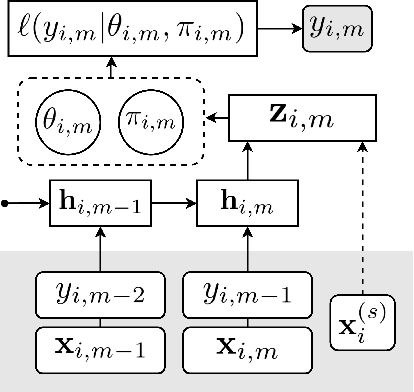

Abstract:In this paper we propose a deep recurrent architecture for the probabilistic modelling of high-frequency market prices, important for the risk management of automated trading systems. Our proposed architecture incorporates probabilistic mixture models into deep recurrent neural networks. The resulting deep mixture models simultaneously address several practical challenges important in the development of automated high-frequency trading strategies that were previously neglected in the literature: 1) probabilistic forecasting of the price movements; 2) single objective prediction of both the direction and size of the price movements. We train our models on high-frequency Bitcoin market data and evaluate them against benchmark models obtained from the literature. We show that our model outperforms the benchmark models in both a metric-based test and in a simulated trading scenario

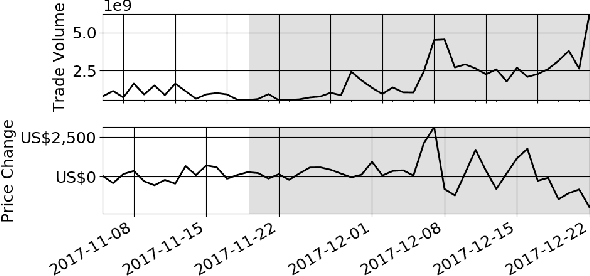

Deep Recurrent Modelling of Stationary Bitcoin Price Formation Using the Order Flow

Mar 31, 2020

Abstract:In this paper we propose a deep recurrent model based on the order flow for the stationary modelling of the high-frequency directional prices movements. The order flow is the microsecond stream of orders arriving at the exchange, driving the formation of prices seen on the price chart of a stock or currency. To test the stationarity of our proposed model we train our model on data before the 2017 Bitcoin bubble period and test our model during and after the bubble. We show that without any retraining, the proposed model is temporally stable even as Bitcoin trading shifts into an extremely volatile "bubble trouble" period. The significance of the result is shown by benchmarking against existing state-of-the-art models in the literature for modelling price formation using deep learning.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge