Arthur Gervais

TxRay: Agentic Postmortem of Live Blockchain Attacks

Feb 01, 2026Abstract:Decentralized Finance (DeFi) has turned blockchains into financial infrastructure, allowing anyone to trade, lend, and build protocols without intermediaries, but this openness exposes pools of value controlled by code. Within five years, the DeFi ecosystem has lost over 15.75B USD to reported exploits. Many exploits arise from permissionless opportunities that any participant can trigger using only public state and standard interfaces, which we call Anyone-Can-Take (ACT) opportunities. Despite on-chain transparency, postmortem analysis remains slow and manual: investigations start from limited evidence, sometimes only a single transaction hash, and must reconstruct the exploit lifecycle by recovering related transactions, contract code, and state dependencies. We present TxRay, a Large Language Model (LLM) agentic postmortem system that uses tool calls to reconstruct live ACT attacks from limited evidence. Starting from one or more seed transactions, TxRay recovers the exploit lifecycle, derives an evidence-backed root cause, and generates a runnable, self-contained Proof of Concept (PoC) that deterministically reproduces the incident. TxRay self-checks postmortems by encoding incident-specific semantic oracles as executable assertions. To evaluate PoC correctness and quality, we develop PoCEvaluator, an independent agentic execution-and-review evaluator. On 114 incidents from DeFiHackLabs, TxRay produces an expert-aligned root cause and an executable PoC for 105 incidents, achieving 92.11% end-to-end reproduction. Under PoCEvaluator, 98.1% of TxRay PoCs avoid hard-coding attacker addresses, a +24.8pp lift over DeFiHackLabs. In a live deployment, TxRay delivers validated root causes in 40 minutes and PoCs in 59 minutes at median latency. TxRay's oracle-validated PoCs enable attack imitation, improving coverage by 15.6% and 65.5% over STING and APE.

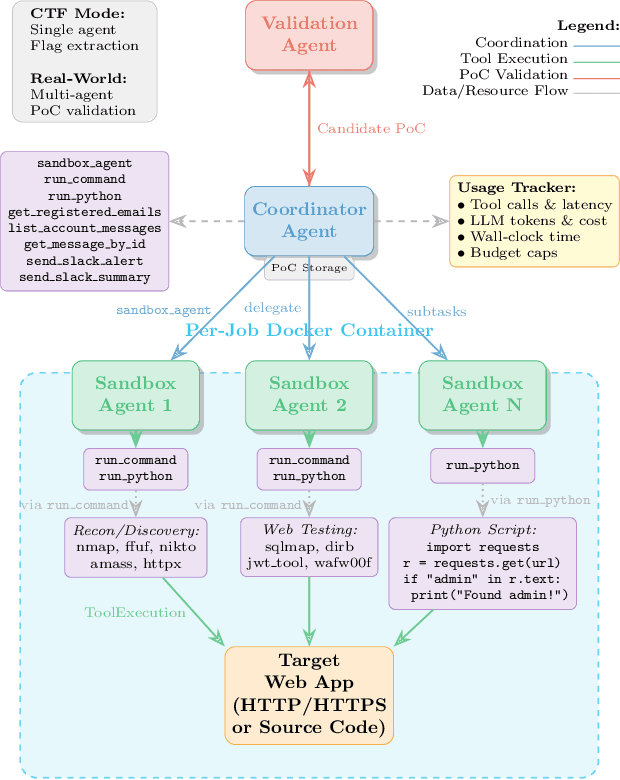

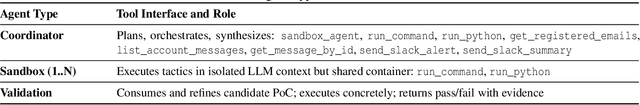

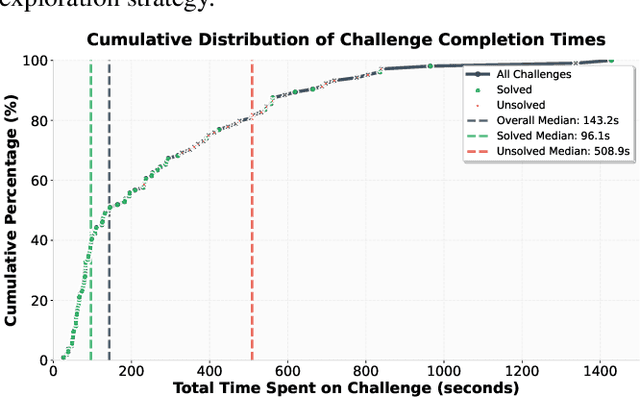

Multi-Agent Penetration Testing AI for the Web

Aug 28, 2025

Abstract:AI-powered development platforms are making software creation accessible to a broader audience, but this democratization has triggered a scalability crisis in security auditing. With studies showing that up to 40% of AI-generated code contains vulnerabilities, the pace of development now vastly outstrips the capacity for thorough security assessment. We present MAPTA, a multi-agent system for autonomous web application security assessment that combines large language model orchestration with tool-grounded execution and end-to-end exploit validation. On the 104-challenge XBOW benchmark, MAPTA achieves 76.9% overall success with perfect performance on SSRF and misconfiguration vulnerabilities, 83% success on broken authorization, and strong results on injection attacks including server-side template injection (85%) and SQL injection (83%). Cross-site scripting (57%) and blind SQL injection (0%) remain challenging. Our comprehensive cost analysis across all challenges totals $21.38 with a median cost of $0.073 for successful attempts versus $0.357 for failures. Success correlates strongly with resource efficiency, enabling practical early-stopping thresholds at approximately 40 tool calls or $0.30 per challenge. MAPTA's real-world findings are impactful given both the popularity of the respective scanned GitHub repositories (8K-70K stars) and MAPTA's low average operating cost of $3.67 per open-source assessment: MAPTA discovered critical vulnerabilities including RCEs, command injections, secret exposure, and arbitrary file write vulnerabilities. Findings are responsibly disclosed, 10 findings are under CVE review.

Blockchain Large Language Models

Apr 29, 2023

Abstract:This paper presents a dynamic, real-time approach to detecting anomalous blockchain transactions. The proposed tool, BlockGPT, generates tracing representations of blockchain activity and trains from scratch a large language model to act as a real-time Intrusion Detection System. Unlike traditional methods, BlockGPT is designed to offer an unrestricted search space and does not rely on predefined rules or patterns, enabling it to detect a broader range of anomalies. We demonstrate the effectiveness of BlockGPT through its use as an anomaly detection tool for Ethereum transactions. In our experiments, it effectively identifies abnormal transactions among a dataset of 68M transactions and has a batched throughput of 2284 transactions per second on average. Our results show that, BlockGPT identifies abnormal transactions by ranking 49 out of 124 attacks among the top-3 most abnormal transactions interacting with their victim contracts. This work makes contributions to the field of blockchain transaction analysis by introducing a custom data encoding compatible with the transformer architecture, a domain-specific tokenization technique, and a tree encoding method specifically crafted for the Ethereum Virtual Machine (EVM) trace representation.

Exploring the Advantages of Transformers for High-Frequency Trading

Feb 20, 2023Abstract:This paper explores the novel deep learning Transformers architectures for high-frequency Bitcoin-USDT log-return forecasting and compares them to the traditional Long Short-Term Memory models. A hybrid Transformer model, called \textbf{HFformer}, is then introduced for time series forecasting which incorporates a Transformer encoder, linear decoder, spiking activations, and quantile loss function, and does not use position encoding. Furthermore, possible high-frequency trading strategies for use with the HFformer model are discussed, including trade sizing, trading signal aggregation, and minimal trading threshold. Ultimately, the performance of the HFformer and Long Short-Term Memory models are assessed and results indicate that the HFformer achieves a higher cumulative PnL than the LSTM when trading with multiple signals during backtesting.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge