Arpita Ghosh

Empirical Quantum Advantage Analysis of Quantum Kernel in Gene Expression Data

Nov 11, 2024Abstract:The incorporation of quantum ansatz with machine learning classification models demonstrates the ability to extract patterns from data for classification tasks. However, taking advantage of the enhanced computational power of quantum machine learning necessitates dealing with various constraints. In this paper, we focus on constraints like finding suitable datasets where quantum advantage is achievable and evaluating the relevance of features chosen by classical and quantum methods. Additionally, we compare quantum and classical approaches using benchmarks and estimate the computational complexity of quantum circuits to assess real-world usability. For our experimental validation, we selected the gene expression dataset, given the critical role of genetic variations in regulating physiological behavior and disease susceptibility. Through this study, we aim to contribute to the advancement of quantum machine learning methodologies, offering valuable insights into their potential for addressing complex classification challenges in various domains.

Bargaining for Revenue Shares on Tree Trading Networks

Apr 22, 2013

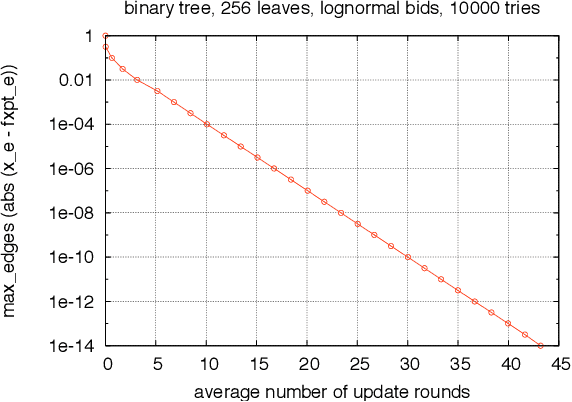

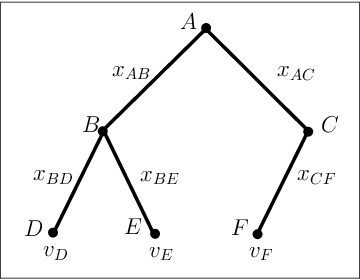

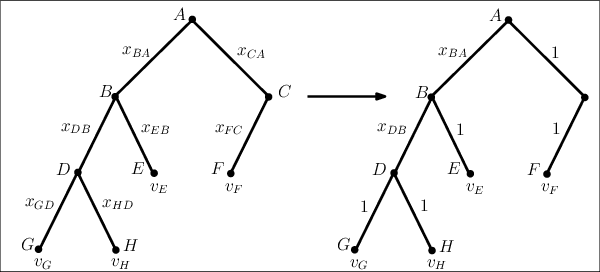

Abstract:We study trade networks with a tree structure, where a seller with a single indivisible good is connected to buyers, each with some value for the good, via a unique path of intermediaries. Agents in the tree make multiplicative revenue share offers to their parent nodes, who choose the best offer and offer part of it to their parent, and so on; the winning path is determined by who finally makes the highest offer to the seller. In this paper, we investigate how these revenue shares might be set via a natural bargaining process between agents on the tree, specifically, egalitarian bargaining between endpoints of each edge in the tree. We investigate the fixed point of this system of bargaining equations and prove various desirable for this solution concept, including (i) existence, (ii) uniqueness, (iii) efficiency, (iv) membership in the core, (v) strict monotonicity, (vi) polynomial-time computability to any given accuracy. Finally, we present numerical evidence that asynchronous dynamics with randomly ordered updates always converges to the fixed point, indicating that the fixed point shares might arise from decentralized bargaining amongst agents on the trade network.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge