Antal Jakovác

ALT: A Python Package for Lightweight Feature Representation in Time Series Classification

Apr 17, 2025

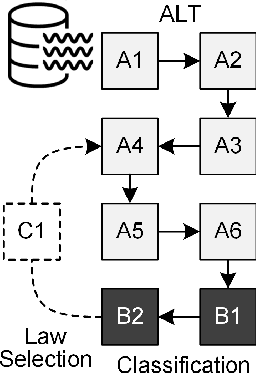

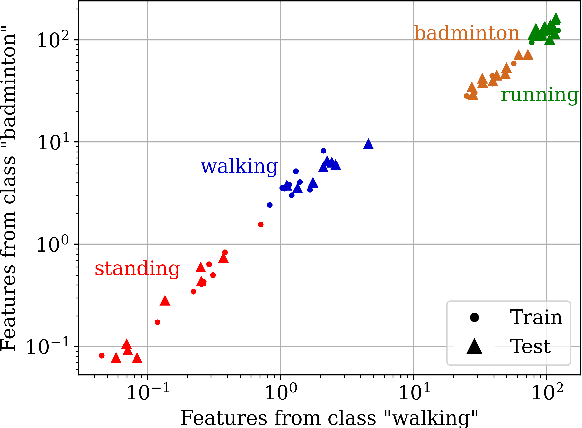

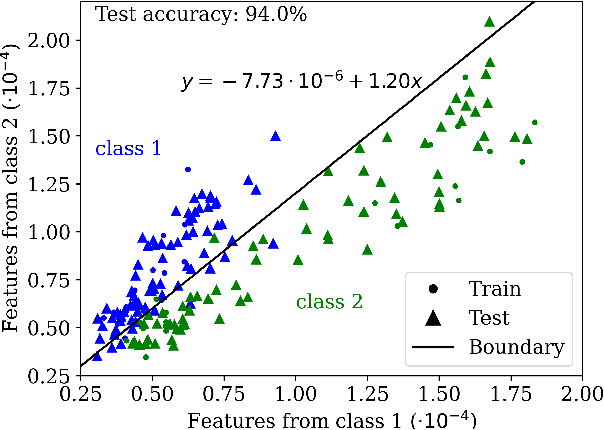

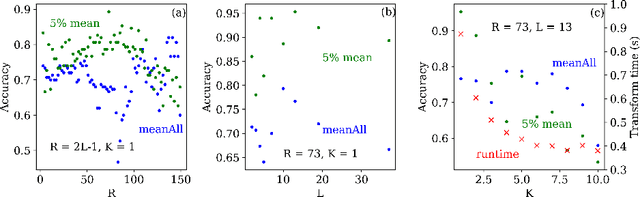

Abstract:We introduce ALT, an open-source Python package created for efficient and accurate time series classification (TSC). The package implements the adaptive law-based transformation (ALT) algorithm, which transforms raw time series data into a linearly separable feature space using variable-length shifted time windows. This adaptive approach enhances its predecessor, the linear law-based transformation (LLT), by effectively capturing patterns of varying temporal scales. The software is implemented for scalability, interpretability, and ease of use, achieving state-of-the-art performance with minimal computational overhead. Extensive benchmarking on real-world datasets demonstrates the utility of ALT for diverse TSC tasks in physics and related domains.

Adaptive Law-Based Transformation (ALT): A Lightweight Feature Representation for Time Series Classification

Jan 16, 2025

Abstract:Time series classification (TSC) is fundamental in numerous domains, including finance, healthcare, and environmental monitoring. However, traditional TSC methods often struggle with the inherent complexity and variability of time series data. Building on our previous work with the linear law-based transformation (LLT) - which improved classification accuracy by transforming the feature space based on key data patterns - we introduce adaptive law-based transformation (ALT). ALT enhances LLT by incorporating variable-length shifted time windows, enabling it to capture distinguishing patterns of various lengths and thereby handle complex time series more effectively. By mapping features into a linearly separable space, ALT provides a fast, robust, and transparent solution that achieves state-of-the-art performance with only a few hyperparameters.

Unified Causality Analysis Based on the Degrees of Freedom

Oct 25, 2024Abstract:Temporally evolving systems are typically modeled by dynamic equations. A key challenge in accurate modeling is understanding the causal relationships between subsystems, as well as identifying the presence and influence of unobserved hidden drivers on the observed dynamics. This paper presents a unified method capable of identifying fundamental causal relationships between pairs of systems, whether deterministic or stochastic. Notably, the method also uncovers hidden common causes beyond the observed variables. By analyzing the degrees of freedom in the system, our approach provides a more comprehensive understanding of both causal influence and hidden confounders. This unified framework is validated through theoretical models and simulations, demonstrating its robustness and potential for broader application.

Learning ECG signal features without backpropagation

Jul 04, 2023

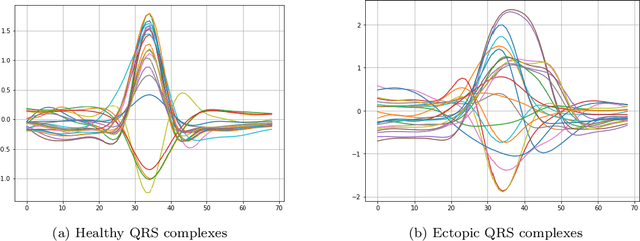

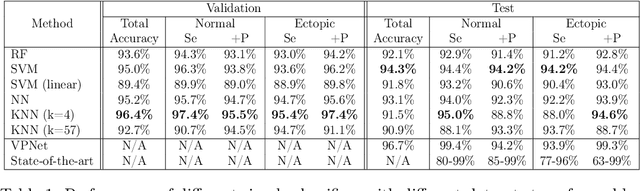

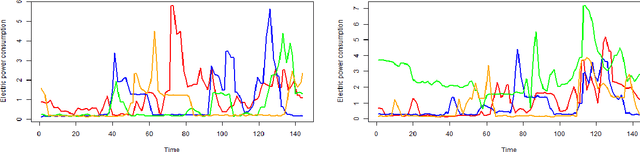

Abstract:Representation learning has become a crucial area of research in machine learning, as it aims to discover efficient ways of representing raw data with useful features to increase the effectiveness, scope and applicability of downstream tasks such as classification and prediction. In this paper, we propose a novel method to generate representations for time series-type data. This method relies on ideas from theoretical physics to construct a compact representation in a data-driven way, and it can capture both the underlying structure of the data and task-specific information while still remaining intuitive, interpretable and verifiable. This novel methodology aims to identify linear laws that can effectively capture a shared characteristic among samples belonging to a specific class. By subsequently utilizing these laws to generate a classifier-agnostic representation in a forward manner, they become applicable in a generalized setting. We demonstrate the effectiveness of our approach on the task of ECG signal classification, achieving state-of-the-art performance.

LLT: An R package for Linear Law-based Feature Space Transformation

Apr 27, 2023

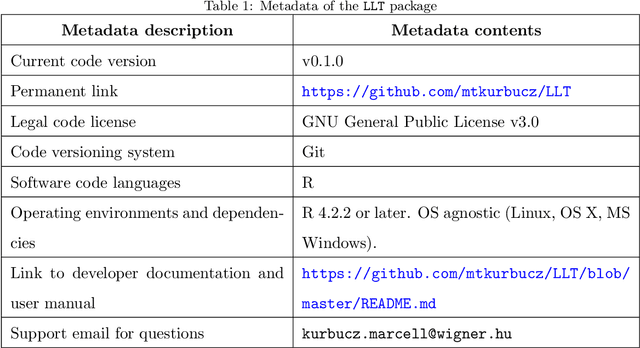

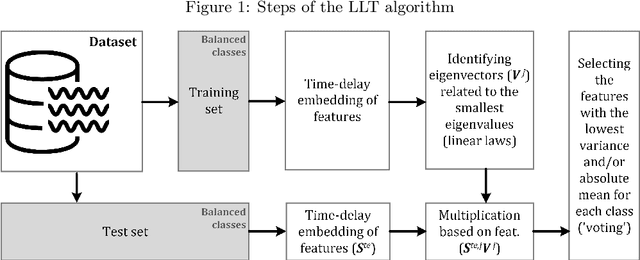

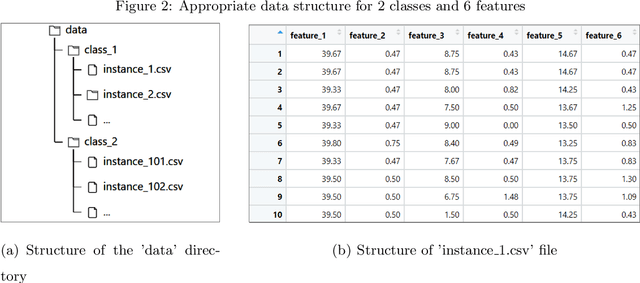

Abstract:The goal of the linear law-based feature space transformation (LLT) algorithm is to assist with the classification of univariate and multivariate time series. The presented R package, called LLT, implements this algorithm in a flexible yet user-friendly way. This package first splits the instances into training and test sets. It then utilizes time-delay embedding and spectral decomposition techniques to identify the governing patterns (called linear laws) of each input sequence (initial feature) within the training set. Finally, it applies the linear laws of the training set to transform the initial features of the test set. These steps are performed by three separate functions called trainTest, trainLaw, and testTrans. Their application requires a predefined data structure; however, for fast calculation, they use only built-in functions. The LLT R package and a sample dataset with the appropriate data structure are publicly available on GitHub.

Predicting the Price Movement of Cryptocurrencies Using Linear Law-based Transformation

Apr 27, 2023Abstract:The aim of this paper is to investigate the effect of a novel method called linear law-based feature space transformation (LLT) on the accuracy of intraday price movement prediction of cryptocurrencies. To do this, the 1-minute interval price data of Bitcoin, Ethereum, Binance Coin, and Ripple between 1 January 2019 and 22 October 2022 were collected from the Binance cryptocurrency exchange. Then, 14-hour nonoverlapping time windows were applied to sample the price data. The classification was based on the first 12 hours, and the two classes were determined based on whether the closing price rose or fell after the next 2 hours. These price data were first transformed with the LLT, then they were classified by traditional machine learning algorithms with 10-fold cross-validation. Based on the results, LLT greatly increased the accuracy for all cryptocurrencies, which emphasizes the potential of the LLT algorithm in predicting price movements.

Linear Laws of Markov Chains with an Application for Anomaly Detection in Bitcoin Prices

Jan 24, 2022

Abstract:The goals of this paper are twofold: (1) to present a new method that is able to find linear laws governing the time evolution of Markov chains and (2) to apply this method for anomaly detection in Bitcoin prices. To accomplish these goals, first, the linear laws of Markov chains are derived by using the time embedding of their (categorical) autocorrelation function. Then, a binary series is generated from the first difference of Bitcoin exchange rate (against the United States Dollar). Finally, the minimum number of parameters describing the linear laws of this series is identified through stepped time windows. Based on the results, linear laws typically became more complex (containing an additional third parameter that indicates hidden Markov property) in two periods: before the crash of cryptocurrency markets inducted by the COVID-19 pandemic (12 March 2020), and before the record-breaking surge in the price of Bitcoin (Q4 2020 - Q1 2021). In addition, the locally high values of this third parameter are often related to short-term price peaks, which suggests price manipulation.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge