Andrew Paskaramoorthy

Pareto Driven Surrogate (ParDen-Sur) Assisted Optimisation of Multi-period Portfolio Backtest Simulations

Sep 13, 2022

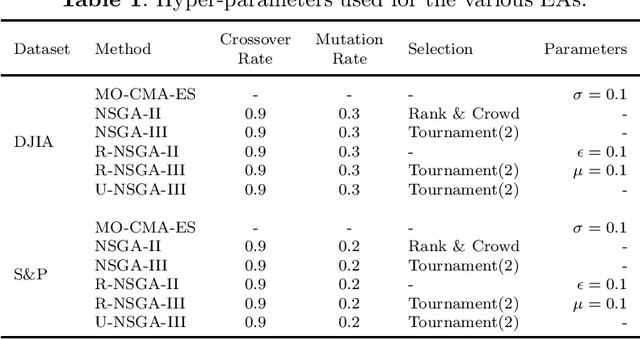

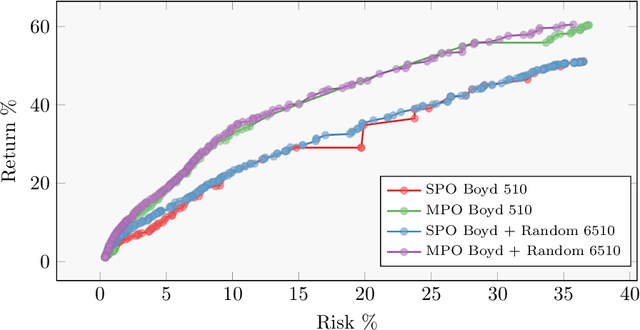

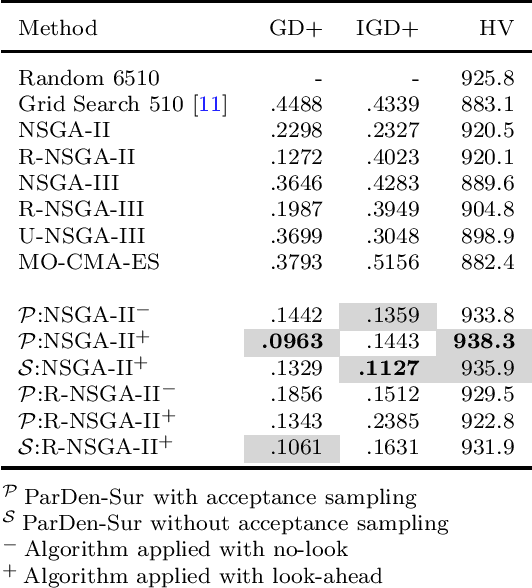

Abstract:Portfolio management is a multi-period multi-objective optimisation problem subject to a wide range of constraints. However, in practice, portfolio management is treated as a single-period problem partly due to the computationally burdensome hyper-parameter search procedure needed to construct a multi-period Pareto frontier. This study presents the \gls{ParDen-Sur} modelling framework to efficiently perform the required hyper-parameter search. \gls{ParDen-Sur} extends previous surrogate frameworks by including a reservoir sampling-based look-ahead mechanism for offspring generation in \glspl{EA} alongside the traditional acceptance sampling scheme. We evaluate this framework against, and in conjunction with, several seminal \gls{MO} \glspl{EA} on two datasets for both the single- and multi-period use cases. Our results show that \gls{ParDen-Sur} can speed up the exploration for optimal hyper-parameters by almost $2\times$ with a statistically significant improvement of the Pareto frontiers, across multiple \glspl{EA}, for both datasets and use cases.

A Framework for Online Investment Algorithms

Mar 30, 2020

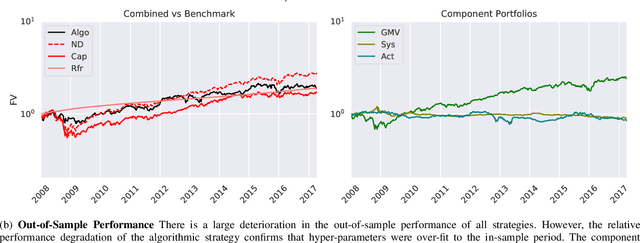

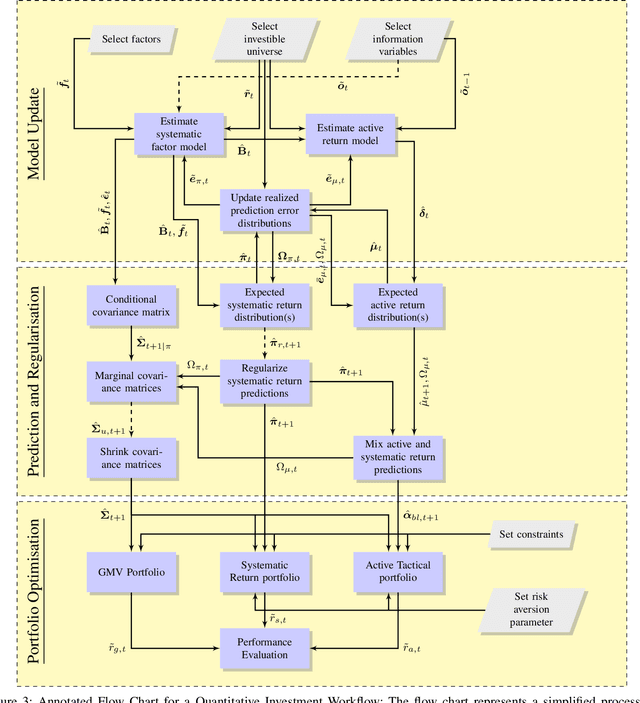

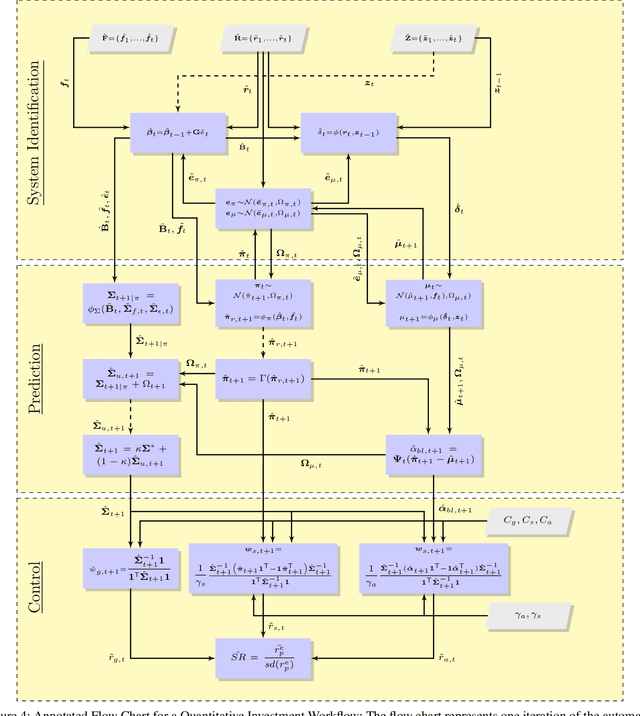

Abstract:The artificial segmentation of an investment management process into a workflow with silos of offline human operators can restrict silos from collectively and adaptively pursuing a unified optimal investment goal. To meet the investor's objectives, an online algorithm can provide an explicit incremental approach that makes sequential updates as data arrives at the process level. This is in stark contrast to offline (or batch) processes that are focused on making component level decisions prior to process level integration. Here we present and report results for an integrated, and online framework for algorithmic portfolio management. This article provides a workflow that can in-turn be embedded into a process level learning framework. The workflow can be enhanced to refine signal generation and asset-class evolution and definitions. Our results confirm that we can use our framework in conjunction with resampling methods to outperform naive market capitalisation benchmarks while making clear the extent of back-test over-fitting. We consider such an online update framework to be a crucial step towards developing intelligent portfolio selection algorithms that integrate financial theory, investor views, and data analysis with process-level learning.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge