A Framework for Online Investment Algorithms

Paper and Code

Mar 30, 2020

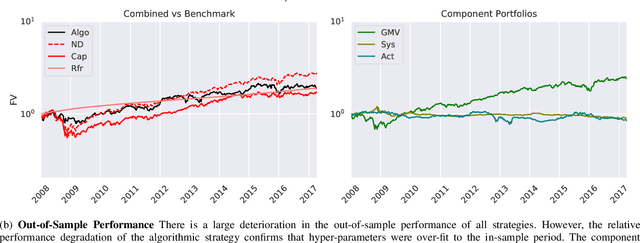

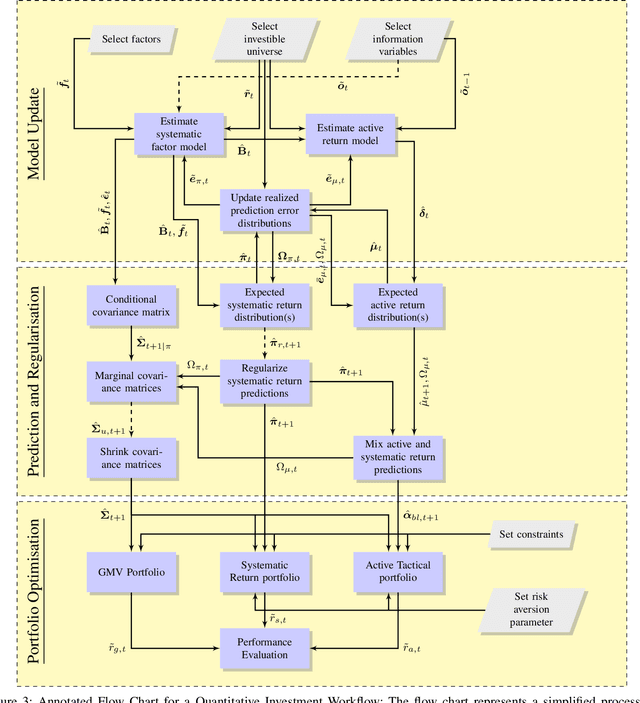

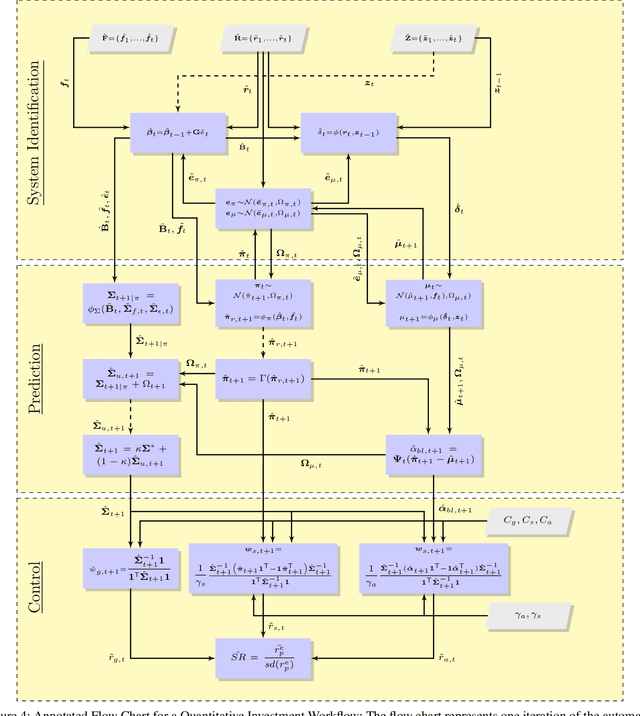

The artificial segmentation of an investment management process into a workflow with silos of offline human operators can restrict silos from collectively and adaptively pursuing a unified optimal investment goal. To meet the investor's objectives, an online algorithm can provide an explicit incremental approach that makes sequential updates as data arrives at the process level. This is in stark contrast to offline (or batch) processes that are focused on making component level decisions prior to process level integration. Here we present and report results for an integrated, and online framework for algorithmic portfolio management. This article provides a workflow that can in-turn be embedded into a process level learning framework. The workflow can be enhanced to refine signal generation and asset-class evolution and definitions. Our results confirm that we can use our framework in conjunction with resampling methods to outperform naive market capitalisation benchmarks while making clear the extent of back-test over-fitting. We consider such an online update framework to be a crucial step towards developing intelligent portfolio selection algorithms that integrate financial theory, investor views, and data analysis with process-level learning.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge