Ali Fathi

Reinforcement Learning for Corporate Bond Trading: A Sell Side Perspective

Jun 18, 2024Abstract:A corporate bond trader in a typical sell side institution such as a bank provides liquidity to the market participants by buying/selling securities and maintaining an inventory. Upon receiving a request for a buy/sell price quote (RFQ), the trader provides a quote by adding a spread over a \textit{prevalent market price}. For illiquid bonds, the market price is harder to observe, and traders often resort to available benchmark bond prices (such as MarketAxess, Bloomberg, etc.). In \cite{Bergault2023ModelingLI}, the concept of \textit{Fair Transfer Price} for an illiquid corporate bond was introduced which is derived from an infinite horizon stochastic optimal control problem (for maximizing the trader's expected P\&L, regularized by the quadratic variation). In this paper, we consider the same optimization objective, however, we approach the estimation of an optimal bid-ask spread quoting strategy in a data driven manner and show that it can be learned using Reinforcement Learning. Furthermore, we perform extensive outcome analysis to examine the reasonableness of the trained agent's behavior.

Adversarial Attacks on Deep Algorithmic Trading Policies

Oct 22, 2020

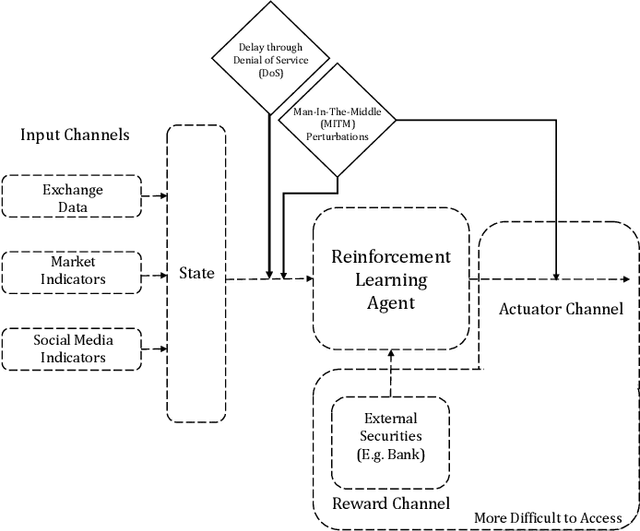

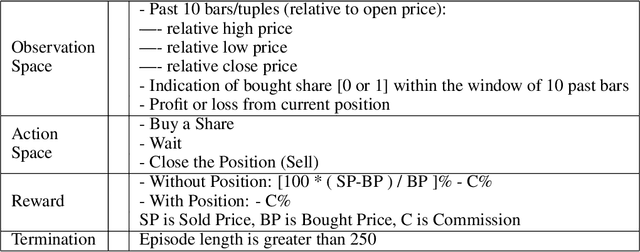

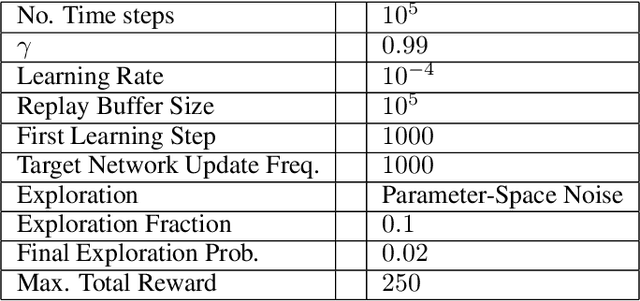

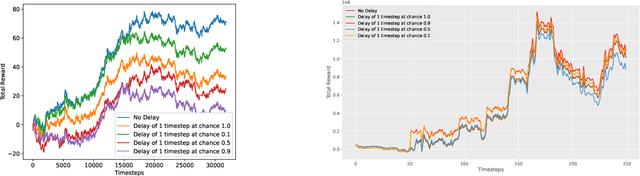

Abstract:Deep Reinforcement Learning (DRL) has become an appealing solution to algorithmic trading such as high frequency trading of stocks and cyptocurrencies. However, DRL have been shown to be susceptible to adversarial attacks. It follows that algorithmic trading DRL agents may also be compromised by such adversarial techniques, leading to policy manipulation. In this paper, we develop a threat model for deep trading policies, and propose two attack techniques for manipulating the performance of such policies at test-time. Furthermore, we demonstrate the effectiveness of the proposed attacks against benchmark and real-world DQN trading agents.

PermuteAttack: Counterfactual Explanation of Machine Learning Credit Scorecards

Aug 28, 2020

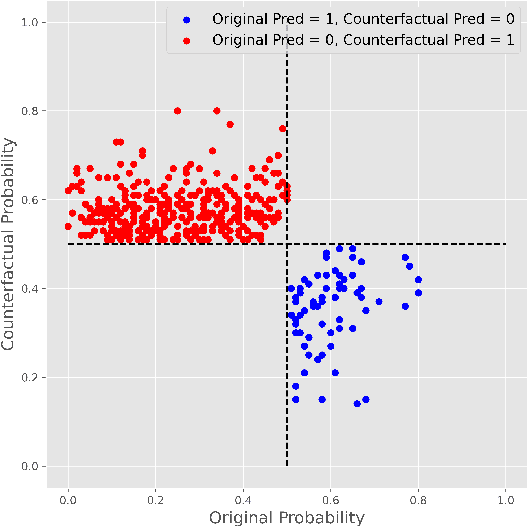

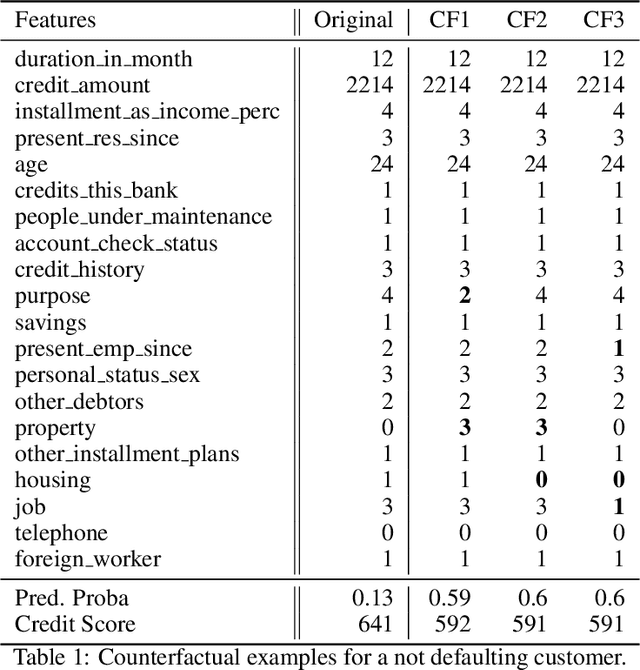

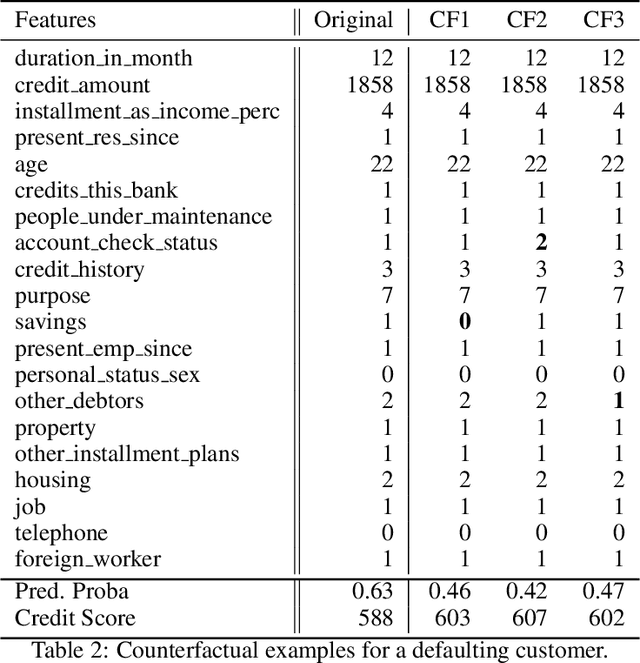

Abstract:This paper is a note on new directions and methodologies for validation and explanation of Machine Learning (ML) models employed for retail credit scoring in finance. Our proposed framework draws motivation from the field of Artificial Intelligence (AI) security and adversarial ML where the need for certifying the performance of the ML algorithms in the face of their overwhelming complexity poses a need for rethinking the traditional notions of model architecture selection, sensitivity analysis and stress testing. Our point of view is that the phenomenon of adversarial perturbations when detached from the AI security domain, has purely algorithmic roots and fall within the scope of model risk assessment. We propose a model criticism and explanation framework based on adversarially generated counterfactual examples for tabular data. A counterfactual example to a given instance in this context is defined as a synthetically generated data point sampled from the estimated data distribution which is treated differently by a model. The counterfactual examples can be used to provide a black-box instance-level explanation of the model behaviour as well as studying the regions in the input space where the model performance deteriorates. Adversarial example generating algorithms are extensively studied in the image and natural language processing (NLP) domains. However, most financial data come in tabular format and naive application of the existing techniques on this class of datasets generates unrealistic samples. In this paper, we propose a counterfactual example generation method capable of handling tabular data including discrete and categorical variables. Our proposed algorithm uses a gradient-free optimization based on genetic algorithms and therefore is applicable to any classification model.

Machine Learning for Yield Curve Feature Extraction: Application to Illiquid Corporate Bonds

Nov 23, 2018

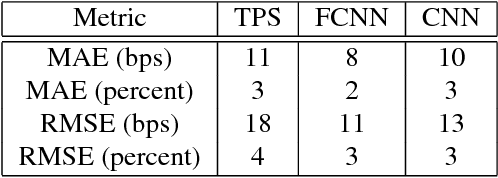

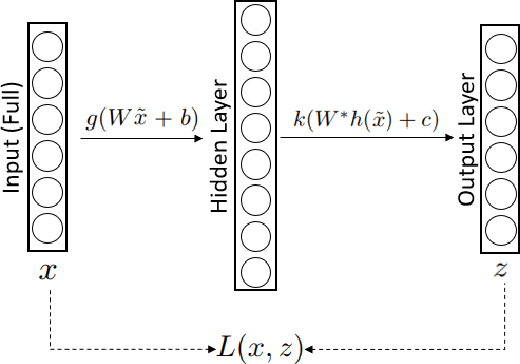

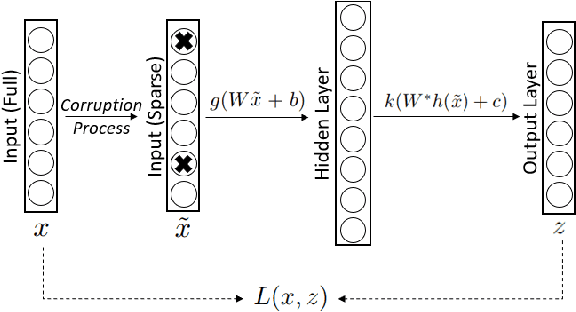

Abstract:This paper studies an application of machine learning in extracting features from the historical market implied corporate bond yields. We consider an example of a hypothetical illiquid fixed income market. After choosing a surrogate liquid market, we apply the Denoising Autoencoder (DAE) algorithm to learn the features of the missing yield parameters from the historical data of the instruments traded in the chosen liquid market. The DAE algorithm is then challenged by two "point-in-time" inpainting algorithms taken from the image processing and computer vision domain. It is observed that, when tested on unobserved rate surfaces, the DAE algorithm exhibits superior performance thanks to the features it has learned from the historical shapes of yield curves.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge