Greg Kirczenow

Machine Learning for Yield Curve Feature Extraction: Application to Illiquid Corporate Bonds

Nov 23, 2018

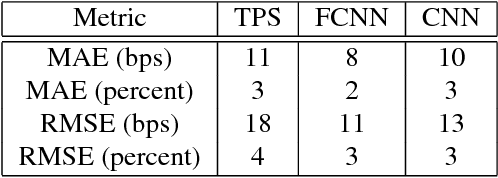

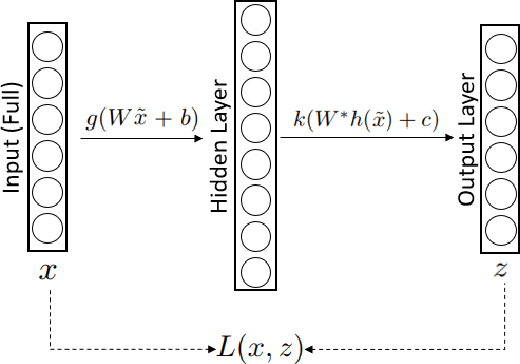

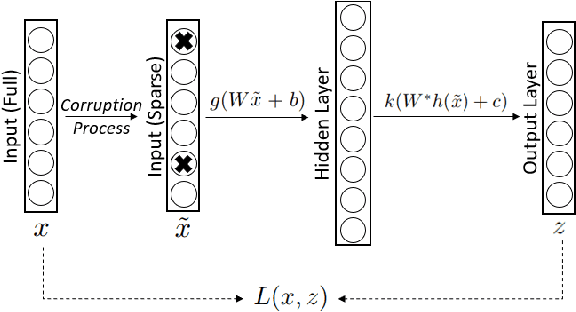

Abstract:This paper studies an application of machine learning in extracting features from the historical market implied corporate bond yields. We consider an example of a hypothetical illiquid fixed income market. After choosing a surrogate liquid market, we apply the Denoising Autoencoder (DAE) algorithm to learn the features of the missing yield parameters from the historical data of the instruments traded in the chosen liquid market. The DAE algorithm is then challenged by two "point-in-time" inpainting algorithms taken from the image processing and computer vision domain. It is observed that, when tested on unobserved rate surfaces, the DAE algorithm exhibits superior performance thanks to the features it has learned from the historical shapes of yield curves.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge