Scalable Bid Landscape Forecasting in Real-time Bidding

Paper and Code

Jan 18, 2020

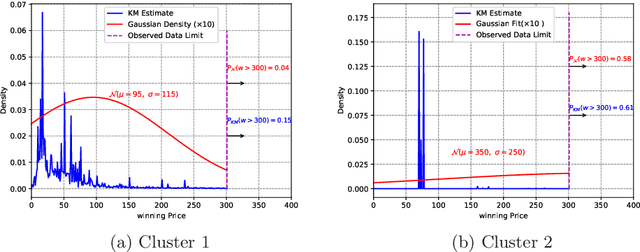

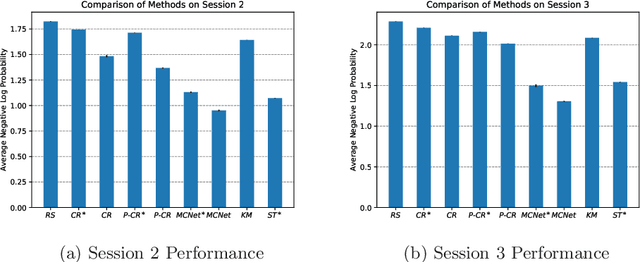

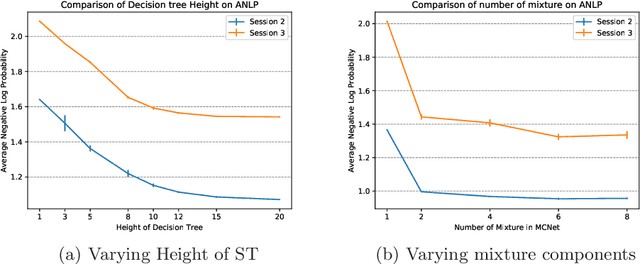

In programmatic advertising, ad slots are usually sold using second-price (SP) auctions in real-time. The highest bidding advertiser wins but pays only the second-highest bid (known as the winning price). In SP, for a single item, the dominant strategy of each bidder is to bid the true value from the bidder's perspective. However, in a practical setting, with budget constraints, bidding the true value is a sub-optimal strategy. Hence, to devise an optimal bidding strategy, it is of utmost importance to learn the winning price distribution accurately. Moreover, a demand-side platform (DSP), which bids on behalf of advertisers, observes the winning price if it wins the auction. For losing auctions, DSPs can only treat its bidding price as the lower bound for the unknown winning price. In literature, typically censored regression is used to model such partially observed data. A common assumption in censored regression is that the winning price is drawn from a fixed variance (homoscedastic) uni-modal distribution (most often Gaussian). However, in reality, these assumptions are often violated. We relax these assumptions and propose a heteroscedastic fully parametric censored regression approach, as well as a mixture density censored network. Our approach not only generalizes censored regression but also provides flexibility to model arbitrarily distributed real-world data. Experimental evaluation on the publicly available dataset for winning price estimation demonstrates the effectiveness of our method. Furthermore, we evaluate our algorithm on one of the largest demand-side platforms and significant improvement has been achieved in comparison with the baseline solutions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge