Parallel Extraction of Long-term Trends and Short-term Fluctuation Framework for Multivariate Time Series Forecasting

Paper and Code

Sep 07, 2020

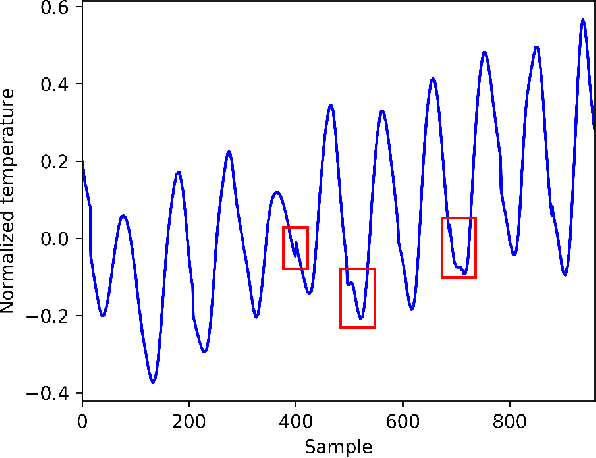

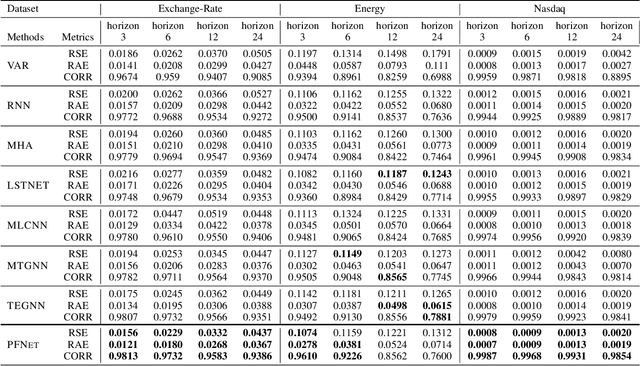

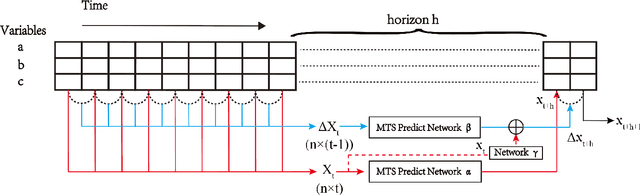

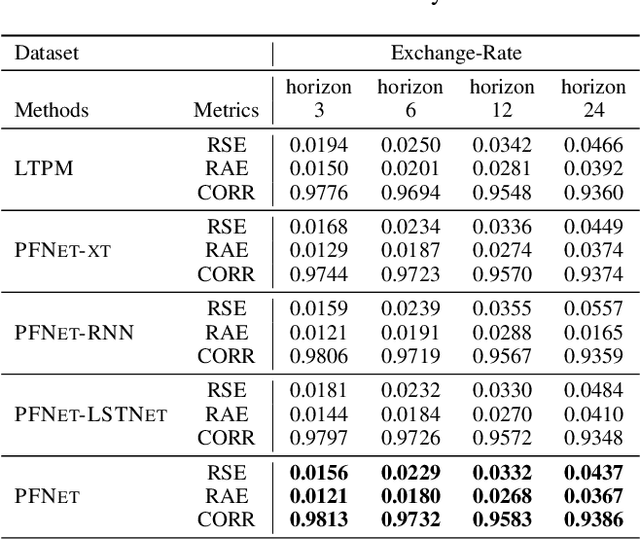

Multivariate time series forecasting is widely used in various fields. Reasonable prediction results can assist people in planning and decision-making, generate benefits and avoid risks. Normally, there are two characteristics of time series, that is, long-term trend and short-term fluctuation. For example, stock prices will have a long-term upward trend with the market, but there may be a small decline in the short term. These two characteristics are often relatively independent of each other. However, the existing prediction methods often do not distinguish between them, which reduces the accuracy of the prediction model. In this paper, a MTS forecasting framework that can capture the long-term trends and short-term fluctuations of time series in parallel is proposed. This method uses the original time series and its first difference to characterize long-term trends and short-term fluctuations. Three prediction sub-networks are constructed to predict long-term trends, short-term fluctuations and the final value to be predicted. In the overall optimization goal, the idea of multi-task learning is used for reference, which is to make the prediction results of long-term trends and short-term fluctuations as close to the real values as possible while requiring to approximate the values to be predicted. In this way, the proposed method uses more supervision information and can more accurately capture the changing trend of the time series, thereby improving the forecasting performance.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge