Orthogonal Machine Learning for Demand Estimation: High Dimensional Causal Inference in Dynamic Panels

Paper and Code

Jan 10, 2018

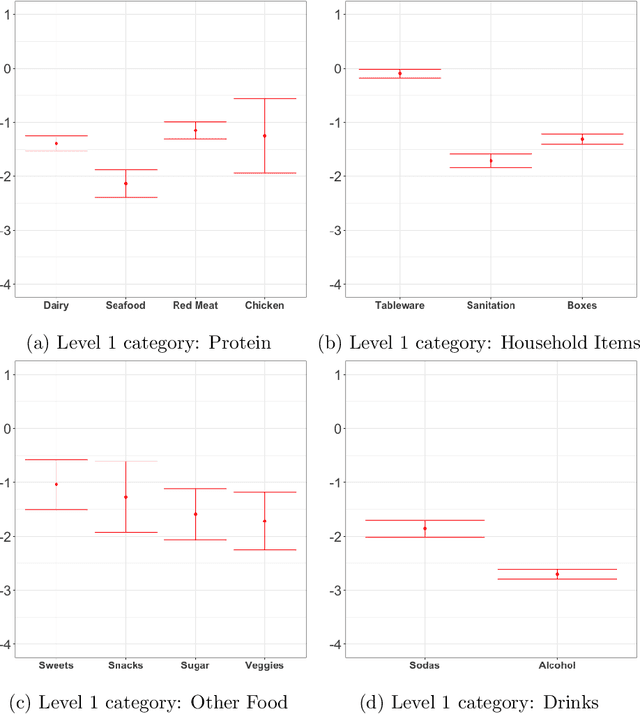

There has been growing interest in how economists can import machine learning tools designed for prediction to accelerate and automate the model selection process, while still retaining desirable inference properties for causal parameters. Focusing on partially linear models, we extend the Double ML framework to allow for (1) a number of treatments that may grow with the sample size and (2) the analysis of panel data under sequentially exogenous errors. Our low-dimensional treatment (LD) regime directly extends the work in [Chernozhukov et al., 2016], by showing that the coefficients from a second stage, ordinary least squares estimator attain root-n convergence and desired coverage even if the dimensionality of treatment is allowed to grow. In a high-dimensional sparse (HDS) regime, we show that second stage LASSO and debiased LASSO have asymptotic properties equivalent to oracle estimators with no upstream error. We argue that these advances make Double ML methods a desirable alternative for practitioners estimating short-term demand elasticities in non-contractual settings.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge